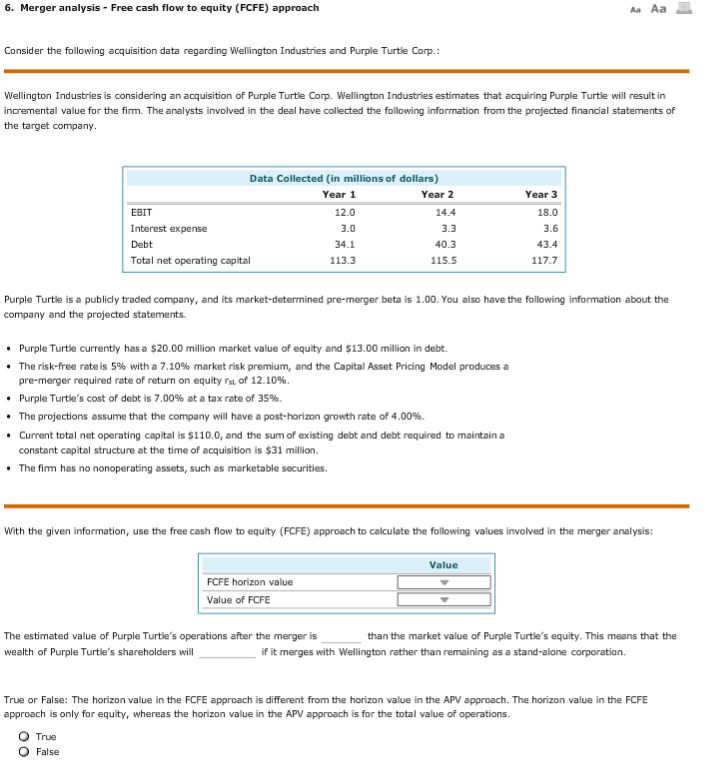

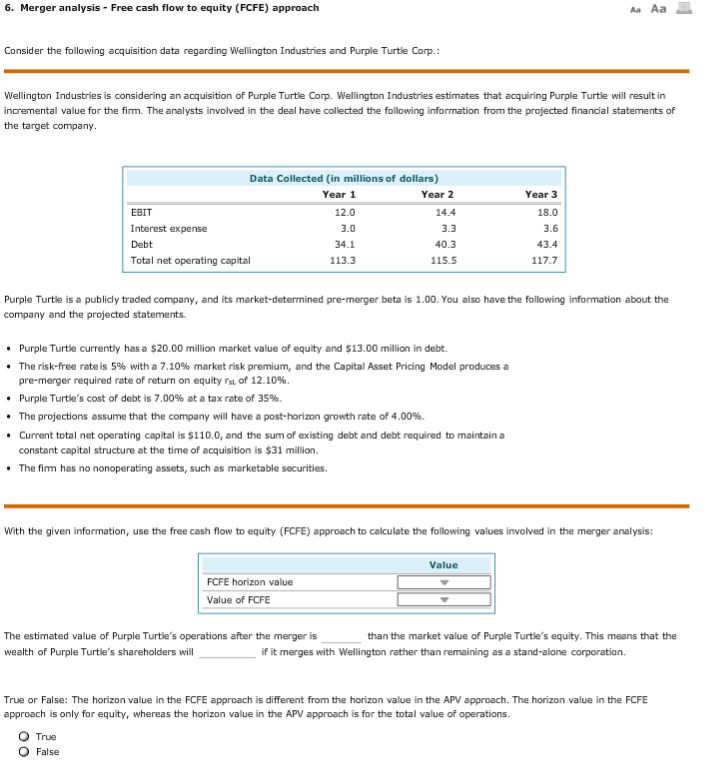

6. Merger analysis Free cash flow to equity (FCFE) approach Aa Aa Consider the following acquisition data regarding Wellington Industries and Purple Turtie Corp.: Wellington Industries is considering an acquisition of Purple Turtle Corp. Wellington Industries estimates that acquiring Purple Turtle will re sult in incremental value for the fim. The analysts involved in the deal have collected the following information from the projected financial statements of the target company Data Collected (in millions of dollars) Year 2 Year 1 Year 3 EBIT 12.0 14.4 18.0 Interest expense 3.0 3.3 3.6 34.1 40.3 43.4 Debt Total net operating capital 113.3 115.5 117.7 Purple Turtle is a publidy traded company, and its market-determined pre-merger beta is 1.00. You also have the following information about the company and the projected statements. Purple Turtle currently has a $20.00 million market value of equity and $13.00 million in debt. The risk-free rate is 5% with a 7.10 % market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity rat of 12.10 % . Purple Turtle's cost of debt is 7.00% at a tax rate of 35% The projections assume that the company will have a post-horizon growth rate of 4.00% Current total net operating capital is $110.0, and the sum of existing debt and debt required to maintain a constant capital structure at the time of acquisition is $31 million The firm has no nonoperating assets, such as marketable securities With the given information, use the free cash flow to equity (FCFE) approach to calculate the following values involved in the merger analysis: Value FCFE horizon value Value of FCFE The estimated value of Purple Turtle's operations after the merger is than the market value of Purple Turtle's equity. This means that the if it merges with Wellington rather than remaining as a stand-alone corporation. wealth of Purple Turtle's shareholders will True or False: The horizon value in the FCFE approach is different from the horizon value in the APV approach. The horizon value in the FCFE approach is only for equity, whereas the horizon value in the APV approach is for the total value of operations O True O False