Answered step by step

Verified Expert Solution

Question

1 Approved Answer

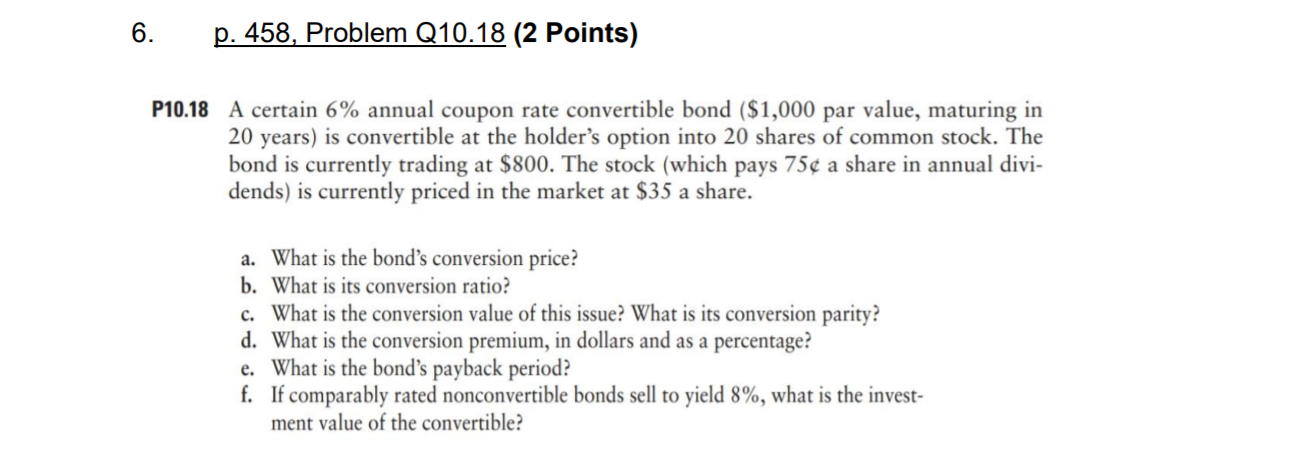

6. p. 458, Problem Q10.18 (2 Points) P10.18 A certain 6% annual coupon rate convertible bond ($1,000 par value, maturing in 20 years) is

6. p. 458, Problem Q10.18 (2 Points) P10.18 A certain 6% annual coupon rate convertible bond ($1,000 par value, maturing in 20 years) is convertible at the holder's option into 20 shares of common stock. The bond is currently trading at $800. The stock (which pays 75 a share in annual divi- dends) is currently priced in the market at $35 a share. a. What is the bond's conversion price? b. What is its conversion ratio? c. What is the conversion value of this issue? What is its conversion parity? d. What is the conversion premium, in dollars and as a percentage? e. What is the bond's payback period? f. If comparably rated nonconvertible bonds sell to yield 8%, what is the invest- ment value of the convertible?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started