Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Paul lends 8000 to Peter. Peter agrees to pay it back in 10 annual installments at 9% with the first payment due in one

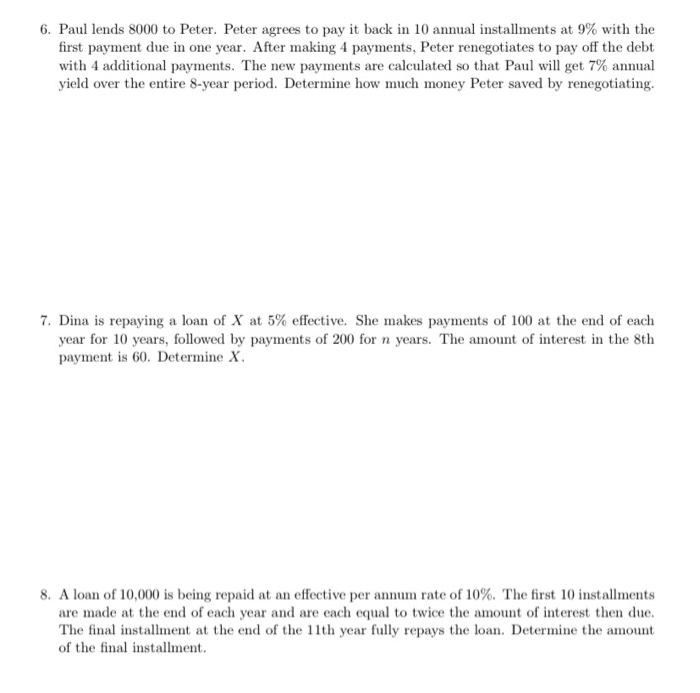

6. Paul lends 8000 to Peter. Peter agrees to pay it back in 10 annual installments at 9% with the first payment due in one year. After making 4 payments, Peter renegotiates to pay off the debt with 4 additional payments. The new payments are calculated so that Paul will get 7% annual yield over the entire 8-year period. Determine how much money Peter saved by renegotiating.

7. Dina is repaying a loan of X at 5% effective. She makes payments of 100 at the end of each year for 10 years, followed by payments of 200 for n years. The amount of interest in the 8th payment is 60. Determine X.

8. A loan of 10,000 is being repaid at an effective per annum rate of 10%. The first 10 installments are made at the end of each year and are each equal to twice the amount of interest then due. The final installment at the end of the 11th year fully repays the loan. Determine the amount of the final installment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started