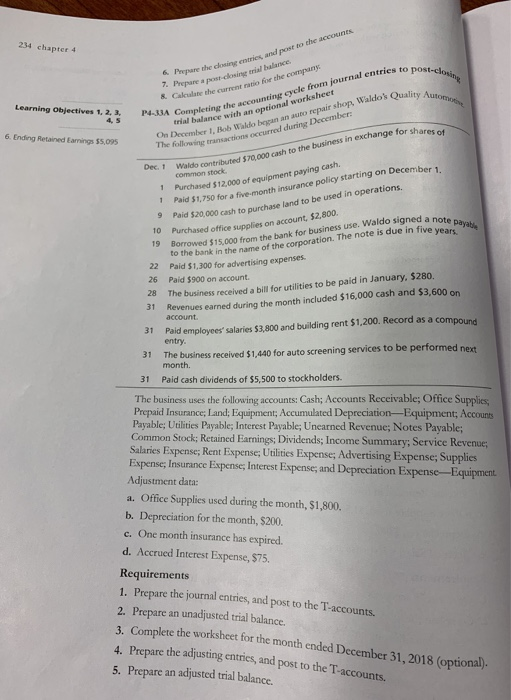

6 Prepare the closing eneries, and post to the accounts 7. Prepare a post-closing trial balance. 8 Caloulate the current ratio for the company 234 chapter 4 post-closing trial balance with an optional worksheet On December 1, Bob Waldo began an auto repair shop, Waldo's Quality Automoiv Learning Objectives 1, 2, 3, P4-33A Completing the accounting cycle from journal entries to 4, 5 6. Ending Retained Eamings $5,095 The following transactions occurred during December Waldo contributed $70,000 cash to the business in exchange for shares of Dec. 1 Purchased $12.000 of equipment paying cash. Paid $1,750 for a five-month insurance policy starting on December 1. common stock Paid $20,000 cash to purchase land to be used in operations. Purchased office supplies on account, $2,800 Borrowed $15,000 from the bank for business use. Waldo signed a note payable 10 19 to the bank in the name of the corporation. The note is due in five years. Paid $1,300 for advertising expenses. 22 26 The business received a bill for utilities to be paid in January, $280. Revenues earned during the month included $16,000 cash and $3,600 on Paid $900 on account 28 31 account Paid employees' salaries $3,800 and building rent $1,200. Record as a compound entry. 31 The business received $1,440 for auto screening services to be performed nePyt month. 31 31 Paid cash dividends of $5,500 to stockholders. The business uses the following accounts: Cash; Accounts Receivable; Office Supplies Prepaid Insurance; Land; Equipment; Accumulated Depreciation-Equipment; Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Payable; Common Stock; Retained Earnings; Dividends; Income Summary; Service Revenue Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense; Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense-Equipment Adjustment data: a. Office Supplies used during the month, $1,800. b. Depreciation for the month, $200 c. One month insurance has expired. d. Accrued Interest Expense, $75 Requirements 1, Prepare the journal entries, and post to the T-accounts. 2. Prepare an unadjusted trial balance, 3. Complete the worksheet for the month ended December 31, 2018 (optional). 4. Prepare the adjusting entries, and post to the T-accounts. 5. Prepare an adjusted trial balance. 6. Prepare the income statement, the statement of retained earnings, and the classi- fied balance sheet in report form. 7. Prepare the closing entries, and post to the T-accounts 8. Prepare a post-closing trial balance