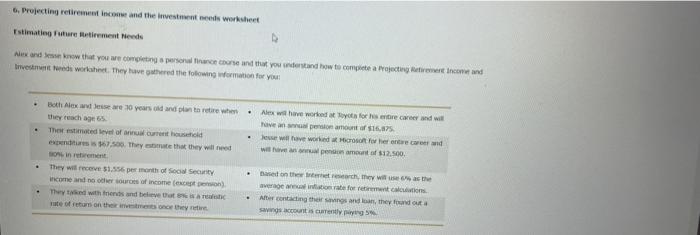

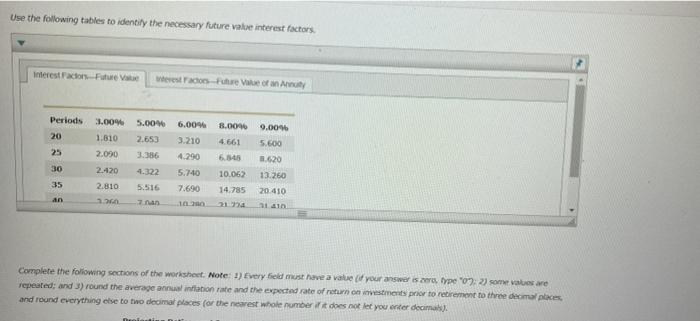

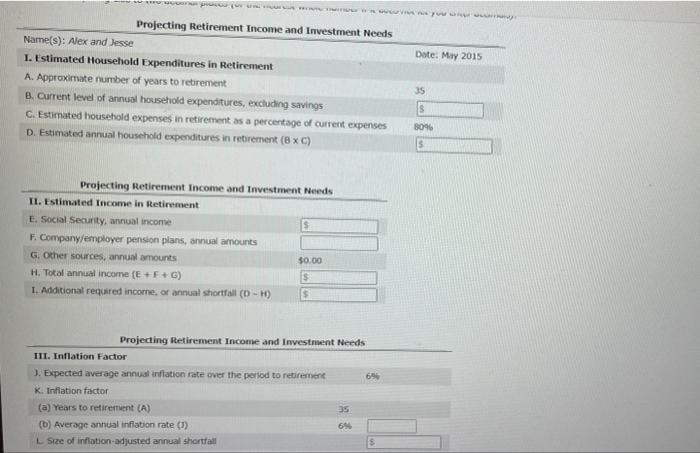

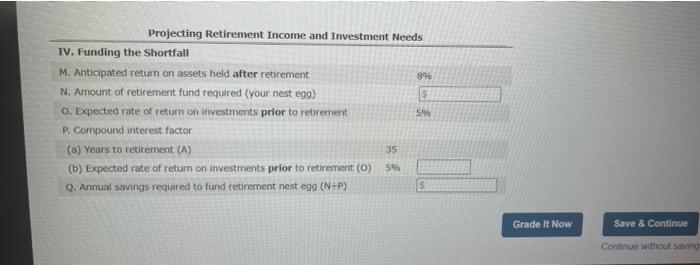

6. Projecting retirement income and the investment needs worksheet stimating Future Retirement Needs Alex and Sew that you are coming personal content that you understand how to come a recoger cand Inventede wortet. They have thered the following formation for you Bath Alex wese we 30 years old and plan to retire when. they reach age 65 The estimated level of current hosted expenditures 167.500. They that they will need in retirement They will receive 51.556 per month of Social Security income and no other source of income (exceto They ted with friends and believe te of reason there they need Alex will have worked for more career and will version amount of $16.7. Je will have worked for her new wil en amount of $12.500. Basest on the Internet, they will as the average ration rate for retirement to After contacting the sings and they found out Sa concurrently Use the following tables to identify the necessary future value interest factors Interest Factor Future Westados-Fre Value of any 5.00 3.009 1.610 8.00 Periods 20 25 9.0096 2.653 2.000 3.386 6.00% 3.210 4.290 5.740 7.690 30 2.420 4.322 4.661 6.54 10.062 14.785 5.600 1.620 13.260 20.410 35 2.810 5.516 an 5 120 7 na Complete the following sections of the worksheet. Note: 1) Every field must have a value your answer is cera, type "07:22) som var repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places and round everything else to two decimal places for the nearest whole number it does not let you enter decimas). Dunia Date: May 2015 Projecting Retirement Income and Investment Needs Name(s): Alex and Jesse 1. Estimated Household Expenditures in Retirement A. Approximate number of years to retirement B. Current level of annual household expenditures, excluding savings C.Estimated household expenses in retrement as a percentage of current expenses D. Estimated annual household expenditures in retirement (BXC) 35 a 8096 Projecting Retirement Income and Investment Needs II. Estimated Income in Retirement E. Social Security, annual income F. Company employer pension plans, annual amounts G. Other sources, annual amounts $0.00 H. Total annual income (E+F+ G) S 1. Additional required income, or annual shortfall (0-10) $ Projecting Retirement Income and Investment Needs III. Inflation Factor J. Expected average annual inflation rate over the period to retirement 6 K. Inflation factor (a) Years to retirement (A) 35 (b) Average annual inflation rate (1) L Size of Inflation-adjusted annual shortfall 996 Projecting Retirement Income and Investment Needs IV. Funding the Shortfall M. Anticipated return on assets held after retirement N. Amount of retirement fund required (your nest ega) O. Expected rate of return on investments prior to retirement 5% P. Compound interest factor (a) Years to retirement (A) (b) Expected rate of retum on investments prior to retirement (0) Q. Annual savings required to fund retirement nest ega (N+P) LT 35 59 Grade It Now Save & Continue Continue without saving 6. Projecting retirement income and the investment needs worksheet stimating Future Retirement Needs Alex and Sew that you are coming personal content that you understand how to come a recoger cand Inventede wortet. They have thered the following formation for you Bath Alex wese we 30 years old and plan to retire when. they reach age 65 The estimated level of current hosted expenditures 167.500. They that they will need in retirement They will receive 51.556 per month of Social Security income and no other source of income (exceto They ted with friends and believe te of reason there they need Alex will have worked for more career and will version amount of $16.7. Je will have worked for her new wil en amount of $12.500. Basest on the Internet, they will as the average ration rate for retirement to After contacting the sings and they found out Sa concurrently Use the following tables to identify the necessary future value interest factors Interest Factor Future Westados-Fre Value of any 5.00 3.009 1.610 8.00 Periods 20 25 9.0096 2.653 2.000 3.386 6.00% 3.210 4.290 5.740 7.690 30 2.420 4.322 4.661 6.54 10.062 14.785 5.600 1.620 13.260 20.410 35 2.810 5.516 an 5 120 7 na Complete the following sections of the worksheet. Note: 1) Every field must have a value your answer is cera, type "07:22) som var repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places and round everything else to two decimal places for the nearest whole number it does not let you enter decimas). Dunia Date: May 2015 Projecting Retirement Income and Investment Needs Name(s): Alex and Jesse 1. Estimated Household Expenditures in Retirement A. Approximate number of years to retirement B. Current level of annual household expenditures, excluding savings C.Estimated household expenses in retrement as a percentage of current expenses D. Estimated annual household expenditures in retirement (BXC) 35 a 8096 Projecting Retirement Income and Investment Needs II. Estimated Income in Retirement E. Social Security, annual income F. Company employer pension plans, annual amounts G. Other sources, annual amounts $0.00 H. Total annual income (E+F+ G) S 1. Additional required income, or annual shortfall (0-10) $ Projecting Retirement Income and Investment Needs III. Inflation Factor J. Expected average annual inflation rate over the period to retirement 6 K. Inflation factor (a) Years to retirement (A) 35 (b) Average annual inflation rate (1) L Size of Inflation-adjusted annual shortfall 996 Projecting Retirement Income and Investment Needs IV. Funding the Shortfall M. Anticipated return on assets held after retirement N. Amount of retirement fund required (your nest ega) O. Expected rate of return on investments prior to retirement 5% P. Compound interest factor (a) Years to retirement (A) (b) Expected rate of retum on investments prior to retirement (0) Q. Annual savings required to fund retirement nest ega (N+P) LT 35 59 Grade It Now Save & Continue Continue without saving