Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 Required Information [The following information applles to the questions displayed below] Demarco and Janine Jackson have been marrled for 20 years and have four

6

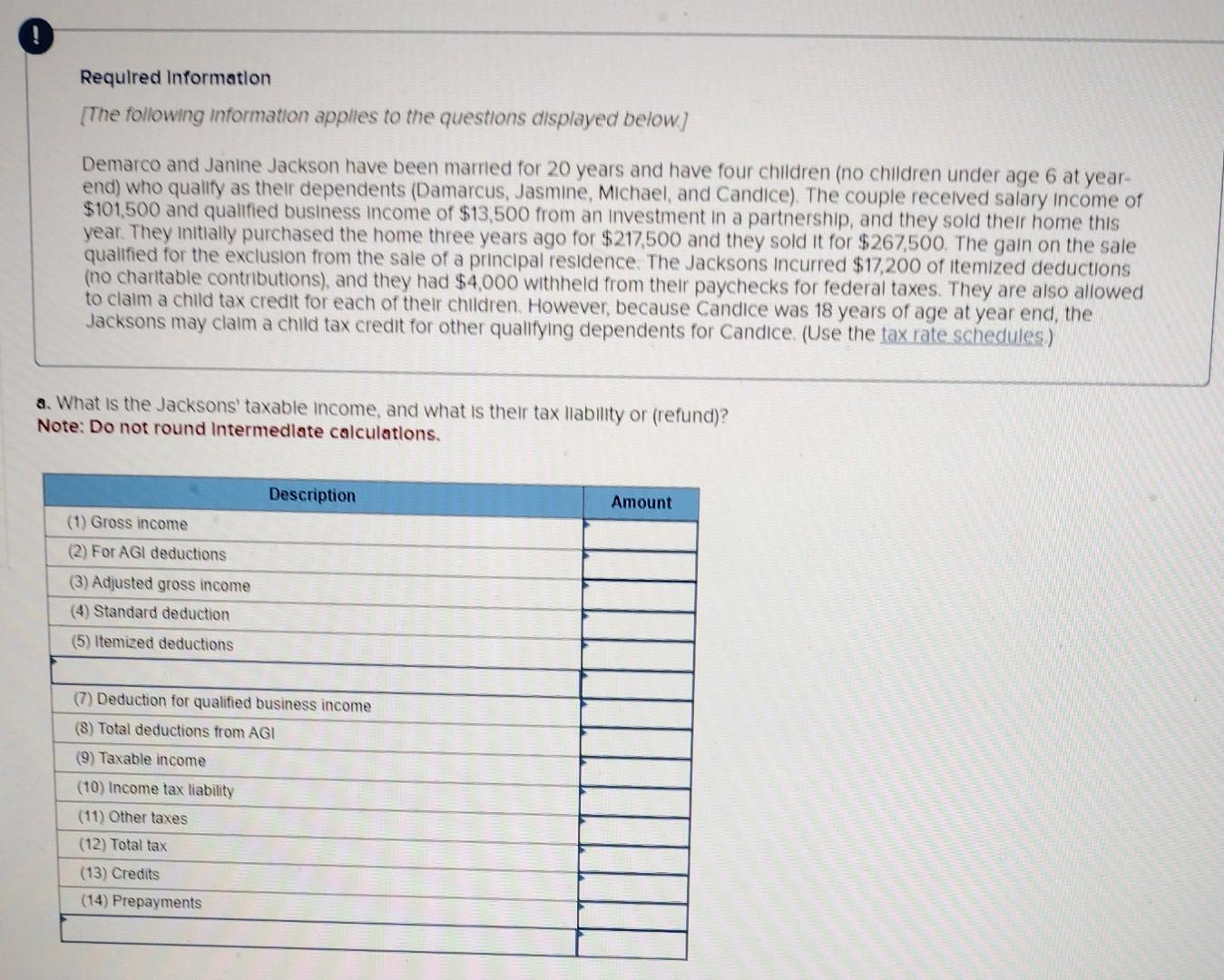

Required Information [The following information applles to the questions displayed below] Demarco and Janine Jackson have been marrled for 20 years and have four children (no children under age 6 at yearend) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple recelved salary income of $101,500 and qualified business income of $13,500 from an investment in a partnership, and they sold their home this year. They initlally purchased the home three years ago for $217,500 and they sold it for $267,500. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $17,200 of Itemized deductions (no charitable contributions), and they had $4,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. (Use the tax rate schedules) a. What is the Jacksons' taxable income, and what is their tax llability or (refund)? Note: Do not round Intermedlate calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started