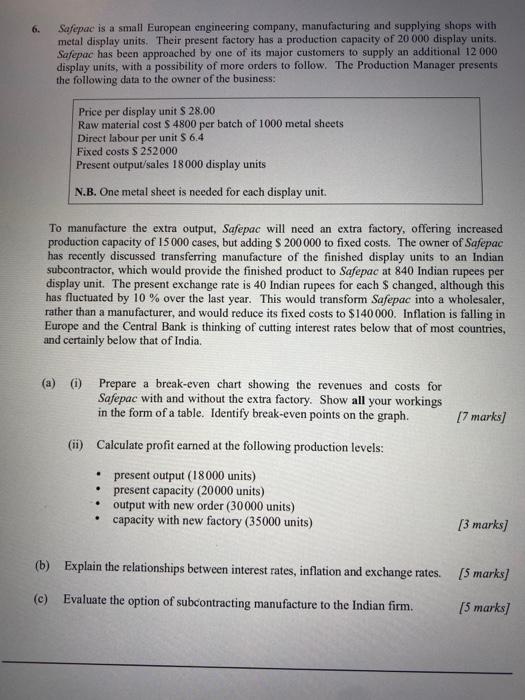

6. Safepac is a small European engineering company, manufacturing and supplying shops with metal display units. Their present factory has a production capacity of 20 000 display units. Safepac has been approached by one of its major customers to supply an additional 12 000 display units, with a possibility of more orders to follow. The Production Manager presents the following data to the owner of the business: Price per display unit S 28.00 Raw material cost $ 4800 per batch of 1000 metal sheets Direct labour per unit S 6.4 Fixed costs $ 252000 Present output/sales 18000 display units N.B.One metal sheet is needed for each display unit. To manufacture the extra output, Safepac will need an extra factory, offering increased production capacity of 15 000 cases, but adding $ 200 000 to fixed costs. The owner of Safepac has recently discussed transferring manufacture of the finished display units to an Indian subcontractor, which would provide the finished product to Safepac at 840 Indian rupees per display unit. The present exchange rate is 40 Indian rupees for each $ changed, although this has fluctuated by 10 % over the last year. This would transform Safepac into a wholesaler, rather than a manufacturer, and would reduce its fixed costs to $140 000. Inflation is falling in Europe and the Central Bank is thinking of cutting interest rates below that of most countries, and certainly below that of India. (a) () Prepare a break-even chart showing the revenues and costs for Safepac with and without the extra factory. Show all your workings in the form of a table. Identify break-even points on the graph. [7 marks] . (ii) Calculate profit earned at the following production levels: present output (18000 units) present capacity (20000 units) output with new order (30000 units) capacity with new factory (35000 units) [3 marks] (b) Explain the relationships between interest rates, inflation and exchange rates. (5 marks] (c) Evaluate the option of subcontracting manufacture to the Indian firm. [5 marks] 6. Safepac is a small European engineering company, manufacturing and supplying shops with metal display units. Their present factory has a production capacity of 20 000 display units. Safepac has been approached by one of its major customers to supply an additional 12 000 display units, with a possibility of more orders to follow. The Production Manager presents the following data to the owner of the business: Price per display unit S 28.00 Raw material cost $ 4800 per batch of 1000 metal sheets Direct labour per unit S 6.4 Fixed costs $ 252000 Present output/sales 18000 display units N.B.One metal sheet is needed for each display unit. To manufacture the extra output, Safepac will need an extra factory, offering increased production capacity of 15 000 cases, but adding $ 200 000 to fixed costs. The owner of Safepac has recently discussed transferring manufacture of the finished display units to an Indian subcontractor, which would provide the finished product to Safepac at 840 Indian rupees per display unit. The present exchange rate is 40 Indian rupees for each $ changed, although this has fluctuated by 10 % over the last year. This would transform Safepac into a wholesaler, rather than a manufacturer, and would reduce its fixed costs to $140 000. Inflation is falling in Europe and the Central Bank is thinking of cutting interest rates below that of most countries, and certainly below that of India. (a) () Prepare a break-even chart showing the revenues and costs for Safepac with and without the extra factory. Show all your workings in the form of a table. Identify break-even points on the graph. [7 marks] . (ii) Calculate profit earned at the following production levels: present output (18000 units) present capacity (20000 units) output with new order (30000 units) capacity with new factory (35000 units) [3 marks] (b) Explain the relationships between interest rates, inflation and exchange rates. (5 marks] (c) Evaluate the option of subcontracting manufacture to the Indian firm. [5 marks]