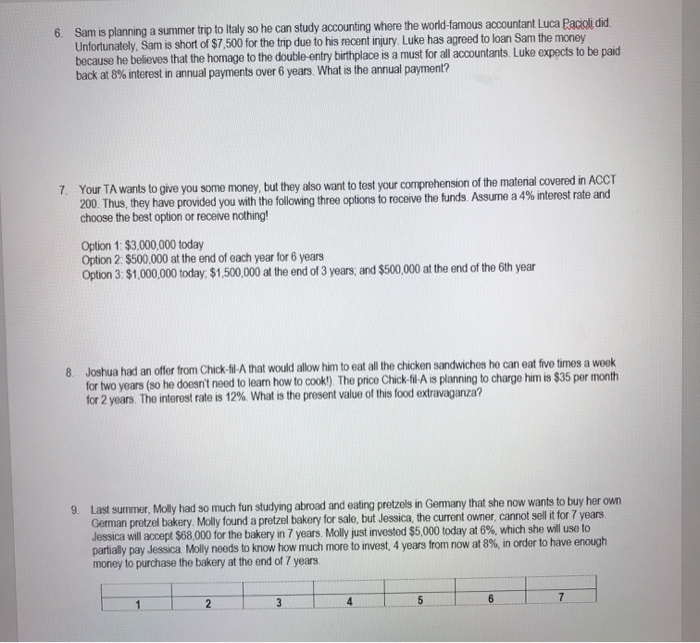

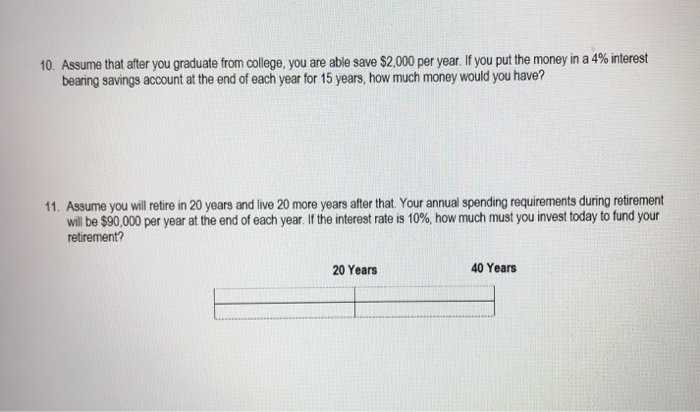

6. Sam is planning a summer trip to Italy so he can study accounting where the world-famous accountant Luca Pacioli did. Unfortunately, Sam is short of $7,500 for the trip due to his recent injury. Luke has agreed to loan Sam the money because he believes that the homage to the double entry birthplace is a must for all accountants. Luke expects to be paid back at 8% interest in annual payments over 6 years. What is the annual payment? 7. Your TA wants to give you some money, but they also want to test your comprehension of the material covered in ACCT 200. Thus, they have provided you with the following three options to recove the funds. Assume a 4% interest rate and choose the best option or receive nothing! Option 1: $3,000,000 today Option 2 $500,000 at the end of each year for 6 years Option 3: $1,000,000 today, $1,500,000 at the end of 3 years, and $500,000 at the end of the 6th year 8 Joshua had an offer from Chick-fil-A that would allow him to eat all the chicken sandwiches he can eat five times a week for two years (so he doesn't need to learn how to cook!). The price Chick-fil-A is planning to charge him is $35 per month for 2 years. The interest rate is 12%. What is the present value of this food extravaganza? 9. Last summer, Molly had so much fun studying abroad and eating pretzels in Germany that she now wants to buy her own German pretzel bakery. Molly found a pretzel bakery for sale, but Jessica, the current owner, cannot sell it for 7 years Jessica will accept $68,000 for the bakery in 7 years. Molly just invested $5,000 today at 6%, which she will use to partially pay Jessica Molly needs to know how much more to invest 4 years from now at 8%, in order to have enough money to purchase the bakery at the end of 7 years 1 7 2 3 4 6 5 10. Assume that after you graduate from college, you are able save $2,000 per year. If you put the money in a 4% interest bearing savings account at the end of each year for 15 years, how much money would you have? 11. Assume you will retire in 20 years and live 20 more years after that. Your annual spending requirements during retirement will be $90,000 per year at the end of each year. If the interest rate is 10%, how much must you invest today to fund your retirement? 20 Years 40 Years