Answered step by step

Verified Expert Solution

Question

1 Approved Answer

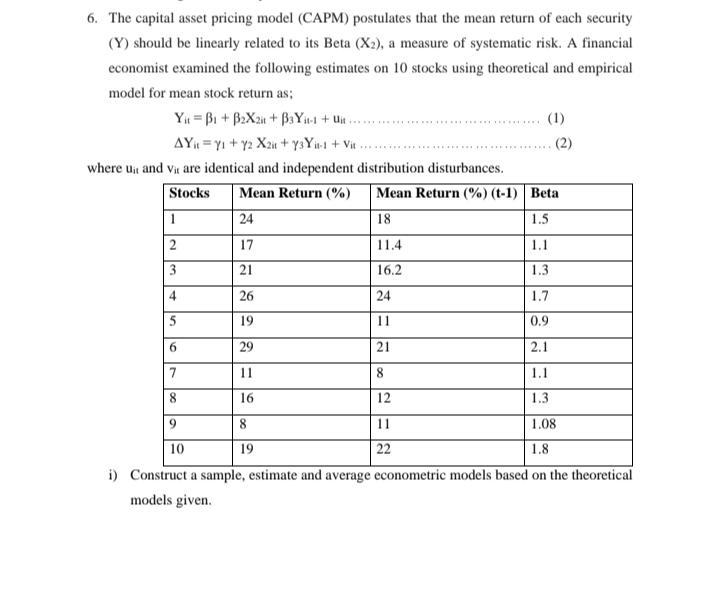

6. The capital asset pricing model (CAPM) postulates that the mean return of each security (Y) should be linearly related to its Beta (X2),

6. The capital asset pricing model (CAPM) postulates that the mean return of each security (Y) should be linearly related to its Beta (X2), a measure of systematic risk. A financial economist examined the following estimates on 10 stocks using theoretical and empirical model for mean stock return as; Yit =B1 + BX2it + B3Yit-1 + Uit AY=Y + y2 X2it + Y3Yin-1 + Vit where uit and vit are identical and independent distribution disturbances. Stocks Mean Return (%) Mean Return (%) (t-1) 24 18 17 11.4 21 16.2 26 24 19 11 29 21 11 8 16 12 11 22 1 2 3 4 5 6 7 8 9 10 8 19 (1) (2) Beta 1.5 1.1 1.3 1.7 0.9 2.1 1.1 1.3 1.08 1.8 i) Construct a sample, estimate and average econometric models based on the theoretical models given. ii) What is the implication of Y-1 in both models? iii) What does model (2) imply in this case? Explain the y in the model. iv) Compute and test the expect least square estimates of models; B. B2 and B. Interpret your answers in each case. v) Compute the AY, and explain what it implies with respect to Y, 72, and Y3. vi) Determine the RSS, R, and Adjusted R? Explain your answers in each case. vii) Why do we include stochastic error term in the econometric model? What does it represent in our case here? Is there any difference in u, and vie State the hypothesis and test the significance of the Beta (X2) and Yit-1. viii) ix) Construct and interpret a 95% confidence interval for all B

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started