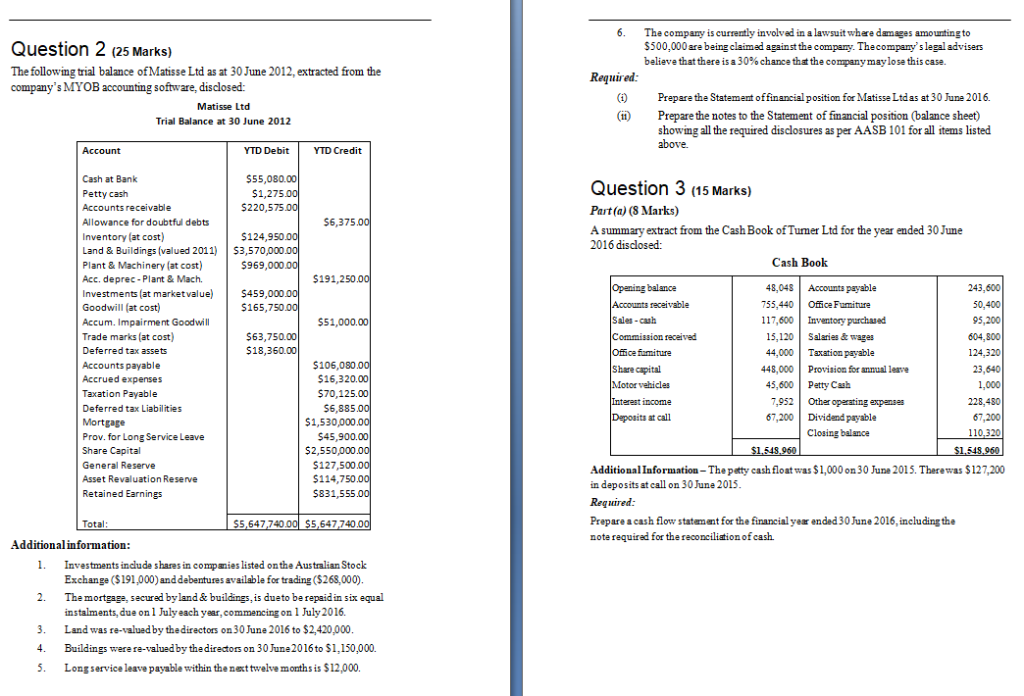

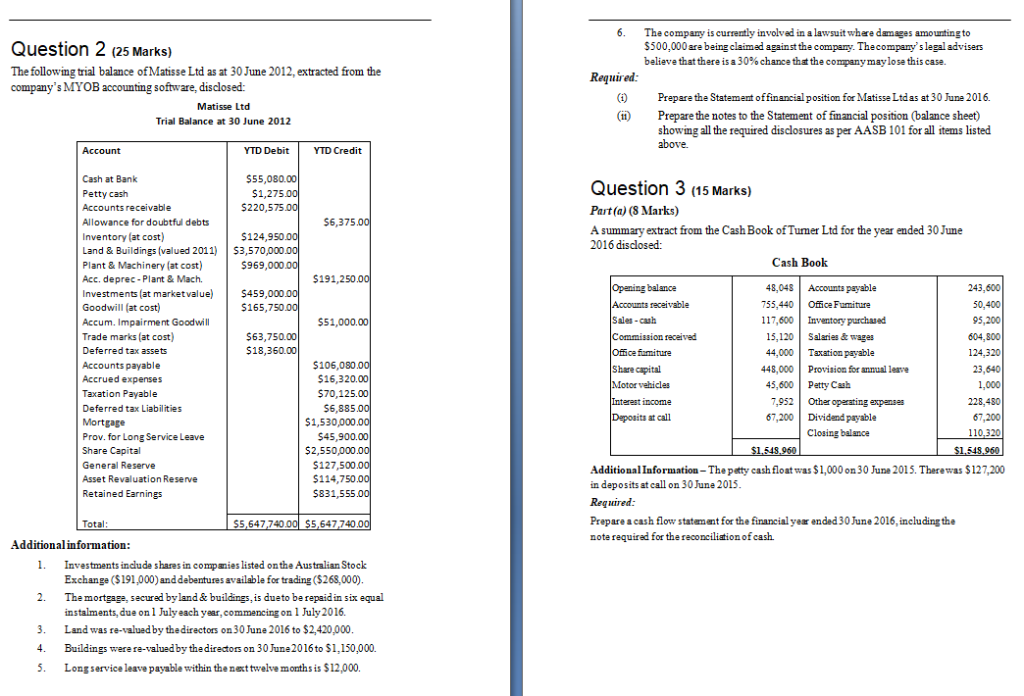

6. The company is currently involvad in a lawsuit whare damages amountingto Question 2 (25 Marks) The following trial balance of Matisse Ltd as at 30 June 2012, extracted from the company's MYOB accounting software, disclosed: 500,000 are being claimad against the company. Thecompany'slegal advisers believe that there is a 30% chance that the company may lose this case. (i) Prepare the Statement offinancial position for Matisse Ltdas at 30 June 2016. ()Prepare the notes to the Statement of financial position (balance sheet) Matisse Ltd Trial Balance at 30 June 2012 showing all the required disclosures as per AASB 101 for all items listed above. Account YTD Debit YTD Credit Cash at Bank Petty cash Accounts receivable Allowance for doubtful debts Inventory (at cost) Land & Buildings (valued 2011) S3,570,000 Plant & Machinery (at cost) Acc. deprec- Plant&Mach Investments (at marketvalue$459,000 Goodwill (at cost) Accum. Impairment Goodwil Trade marks (at cost) Deferred tax assets Accounts payable Accrued expenses Taxation Payable Deferred tax Liabilities Mortgage Prov. for Long Service Leave Share Capital General Reserve Asset Revaluation Reserve Retained Earnings $55,080.00 Question 3 (15 Marks) Part(a) (S Marks) A summary extract from the Cash Book of Tumer Ltd for the year ended 30 June 2016 disclosed: $1,275 $220,575 $124,950 $969,000 $6,375.0 Cash Boolk 191,250 243,600 400 95,200 604,800 124,320 23,640 1,000 228,480 67,200 balance 48,04S Accounts payable $165,750 recaivable 755.440 Office Fumiture Sales-cash 117,600Inventory purchaed 15,120Salaries&wagas 44,000 Taxation payable 48,000Provision for annual leave 45,600 Petty Cash 51,000.00 $63,750.00 $18,360.00 received miture S106,0800 Share capital $16,320.00 570,125.00 vehicles ncom at 7,952 Other operating expanses $6,885.0 1,530,000.0 67,200 Dividend payable $45,900.00 Closing balance $2,550,000 127,500 $114,750.0 $831,555.0 AdditionalInformation-The patty cash float was $1,000on30 June 2015. Therewas $127,20 in deposits atcall on 30June 2015 Required: Prepare a cash flow statement for the financialyear ended 30 June 2016, includingthe note requirad for the reconciliation of cash Total 5,647,740 5,647,740.0 Additional information 1. Investments include shares in compmies listed onthe Australian Stock Exchange ($191,000) anddebentures available for trading ($268,000) Themortgage, secured byland & buildings,is dueto be repaid in six equal instalments,due on1 Julyeach year,commencing on 1 July 2016. Land was re-valued by thedirectors on 30 June 2016 to $2,420,000 Buildings werere-valuedby thedirectors on 30 June2016to $1,150,000. 2. 3. 4. 5. Longservice leave payable within thenettwelvemonths is $12,000