Answered step by step

Verified Expert Solution

Question

1 Approved Answer

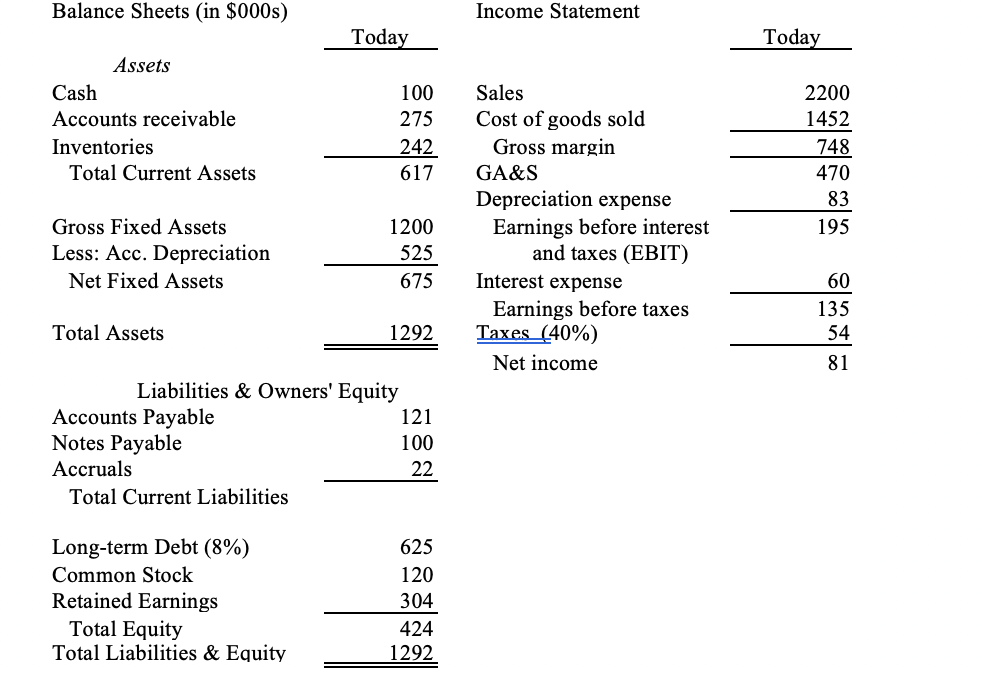

6. The financial statements for The English Leather Company are reproduced below. You are given the following information about the coming year. Prepare Pro Forma

6. The financial statements for The English Leather Company are reproduced below. You are given the following information about the coming year. Prepare Pro Forma statements for the company for next year.

- Sales are expected to increase by 10% and COGS will be 65% of sales

- GA&S will remain at the same level and the cash level will remain the same.

- Depreciation expense will be $91,000 and the company will add $170,000 of new assets and dispose of (sell) assets with book values of $30,000. The selling price of the sold assets will be equal to book value and therefore, there will be no tax effects.

- The tax rate will be 40%

- The company paid $500,000 in dividends in 2010 and will pay the same dividend next year.

- AR will be reduced to 35 days worth of sales. Inventory management improvements will reduce inventories to 55 days of COGS. Accounts payable will remain at 30 days of COGS. The company uses a 360 day year in its calculations.

- Accruals will be 1% of sales

- The company is not allowed to borrow any more by way of long-term debt. Instead, any additional borrowing will come out of notes payable. The interest rate on long-term debt is 8%, while the interest rate on notes payable is 10%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started