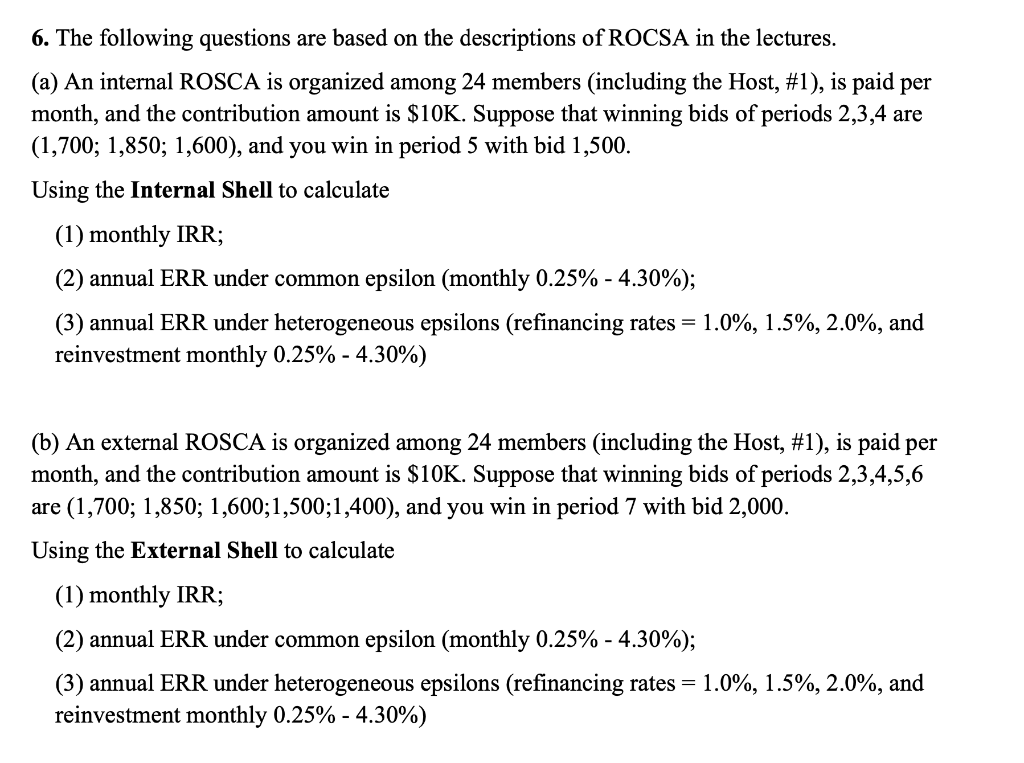

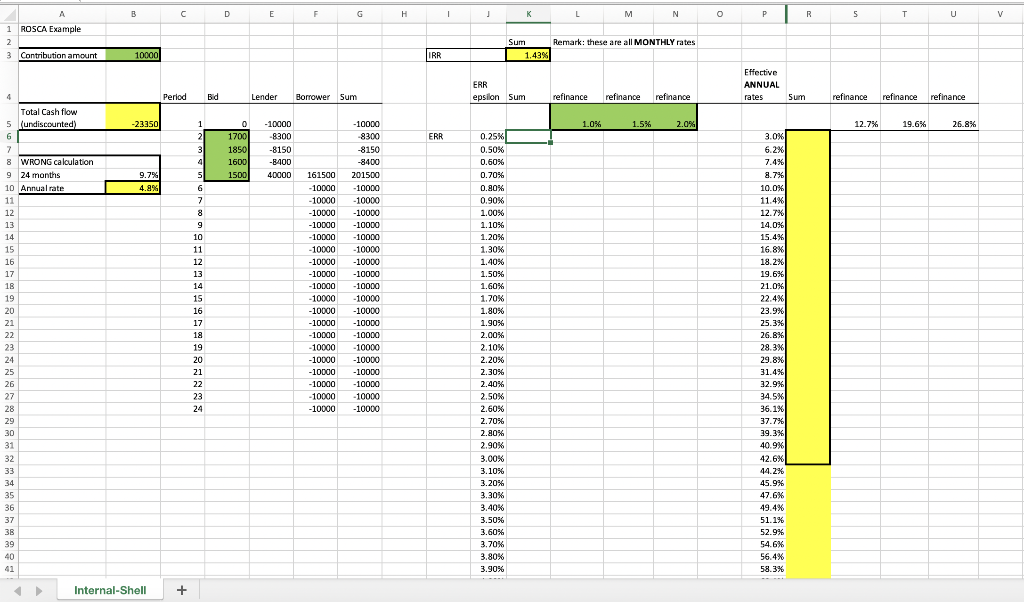

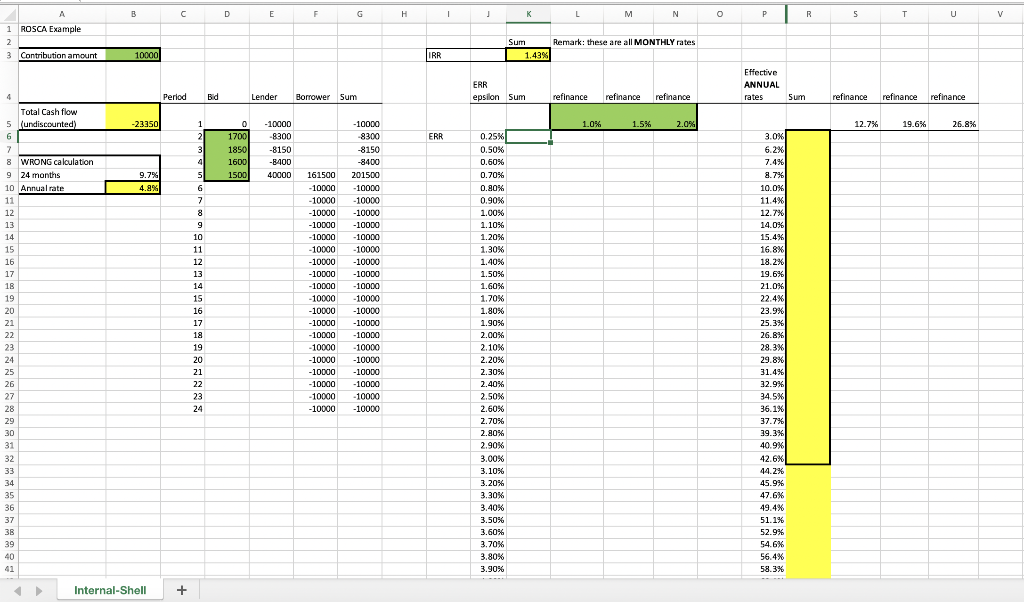

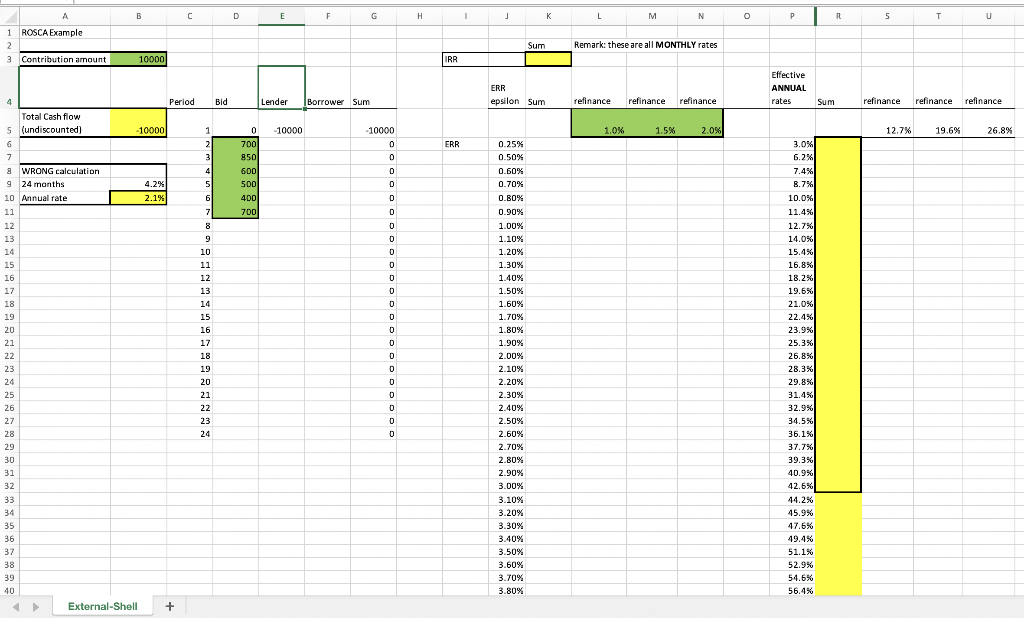

6. The following questions are based on the descriptions of ROCSA in the lectures. (a) An internal ROSCA is organized among 24 members (including the Host, #1), is paid per month, and the contribution amount is $10K. Suppose that winning bids of periods 2,3,4 are (1,700; 1,850; 1,600), and you win in period 5 with bid 1,500. Using the Internal Shell to calculate (1) monthly IRR; (2) annual ERR under common epsilon (monthly 0.25% - 4.30%); (3) annual ERR under heterogeneous epsilons (refinancing rates = 1.0%, 1.5%, 2.0%, and reinvestment monthly 0.25% - 4.30%) - (b) An external ROSCA is organized among 24 members (including the Host, #1), is paid per month, and the contribution amount is $10K. Suppose that winning bids of periods 2,3,4,5,6 are (1,700; 1,850; 1,600;1,500;1,400), and you win in period 7 with bid 2,000. Using the External Shell to calculate (1) monthly IRR; (2) annual ERR under common epsilon (monthly 0.25% - 4.30%); (3) annual ERR under heterogeneous epsilons (refinancing rates = 1.0%, 1.5%, 2.0%, and reinvestment monthly 0.25% - 4.30%) A B C D E F G H 1 ] K L M N 0 P R 5 T U U V 1 ROSCA Example 2 3 Contribution amount Sum Remark: these are all MONTHLY rates 1.43% 10000 IRR ERR epsilon Sum Effective ANNUAL rates Period Bid Lender Borrower Sum refinance refinance refinance Sum refinance refinance refinance -23350 1.0% % 1.5% 2.0% 12.7% 19.6% 26.8% ERR 4 Total Cash flow 5 (undiscounted) 6 7 8 WRONG calculation 9 24 months 10 Annual rate 11 12 13 14 15 0 1700 1850 1600 1500 1 2 3 4 5 6. 7 8 8 9 10 -10000 -8300 -8150 -8400 40000 9.7% 4.9% 16 11 12 13 14 15 16 17 18 19 161500 -10000 -10000 -10000 -10000 -10000 - 10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -8300 -8150 -8400 201500 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 0.25% % 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 1.10% 1.20% 1.30% 1.40% 1.50% 1.60% 1.70% 1.80% 1.90% 2.00% 2.10% 2.20% 2.30% 2.40% 2.50% 2.60% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 3.90% 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 39 40 41 3.0% 6.2% 7.4% % 8.7% 10.0% 11.4% 12.7% 14.0% 15.4% % 16.8% % 18.2% 19.6% 21.0% 22.4% 23.9% 25.3% 26.8% 28.3% 29.8% 31.4% 32.9% 34.5% 36.1% 37.7% 39.3% 40.9% 42.6% 44.2% 45.9% 47.6% 49.4% 51.1% % 52.9% 54.6% 56.4% 58.3% 20 21 22 23 24 Internal-Shell + Contribution amount 1 RR 4 Period Ble Sun otal cash flow (undiscounte 10000 12.7% 19.6% 26.8% ERR 24 months Annual rate 10. XXXXXXXXXXXX Oo - - - 4 4 4 4 4 1 4 4 Nii XXXX Oo HHH AN UN External-Shell + + 6. The following questions are based on the descriptions of ROCSA in the lectures. (a) An internal ROSCA is organized among 24 members (including the Host, #1), is paid per month, and the contribution amount is $10K. Suppose that winning bids of periods 2,3,4 are (1,700; 1,850; 1,600), and you win in period 5 with bid 1,500. Using the Internal Shell to calculate (1) monthly IRR; (2) annual ERR under common epsilon (monthly 0.25% - 4.30%); (3) annual ERR under heterogeneous epsilons (refinancing rates = 1.0%, 1.5%, 2.0%, and reinvestment monthly 0.25% - 4.30%) - (b) An external ROSCA is organized among 24 members (including the Host, #1), is paid per month, and the contribution amount is $10K. Suppose that winning bids of periods 2,3,4,5,6 are (1,700; 1,850; 1,600;1,500;1,400), and you win in period 7 with bid 2,000. Using the External Shell to calculate (1) monthly IRR; (2) annual ERR under common epsilon (monthly 0.25% - 4.30%); (3) annual ERR under heterogeneous epsilons (refinancing rates = 1.0%, 1.5%, 2.0%, and reinvestment monthly 0.25% - 4.30%) A B C D E F G H 1 ] K L M N 0 P R 5 T U U V 1 ROSCA Example 2 3 Contribution amount Sum Remark: these are all MONTHLY rates 1.43% 10000 IRR ERR epsilon Sum Effective ANNUAL rates Period Bid Lender Borrower Sum refinance refinance refinance Sum refinance refinance refinance -23350 1.0% % 1.5% 2.0% 12.7% 19.6% 26.8% ERR 4 Total Cash flow 5 (undiscounted) 6 7 8 WRONG calculation 9 24 months 10 Annual rate 11 12 13 14 15 0 1700 1850 1600 1500 1 2 3 4 5 6. 7 8 8 9 10 -10000 -8300 -8150 -8400 40000 9.7% 4.9% 16 11 12 13 14 15 16 17 18 19 161500 -10000 -10000 -10000 -10000 -10000 - 10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -8300 -8150 -8400 201500 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 -10000 0.25% % 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 1.10% 1.20% 1.30% 1.40% 1.50% 1.60% 1.70% 1.80% 1.90% 2.00% 2.10% 2.20% 2.30% 2.40% 2.50% 2.60% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 3.90% 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 39 40 41 3.0% 6.2% 7.4% % 8.7% 10.0% 11.4% 12.7% 14.0% 15.4% % 16.8% % 18.2% 19.6% 21.0% 22.4% 23.9% 25.3% 26.8% 28.3% 29.8% 31.4% 32.9% 34.5% 36.1% 37.7% 39.3% 40.9% 42.6% 44.2% 45.9% 47.6% 49.4% 51.1% % 52.9% 54.6% 56.4% 58.3% 20 21 22 23 24 Internal-Shell + Contribution amount 1 RR 4 Period Ble Sun otal cash flow (undiscounte 10000 12.7% 19.6% 26.8% ERR 24 months Annual rate 10. XXXXXXXXXXXX Oo - - - 4 4 4 4 4 1 4 4 Nii XXXX Oo HHH AN UN External-Shell + +