Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. The purchase of a new house is the one form of a. household spending that is not counted as part of investment in

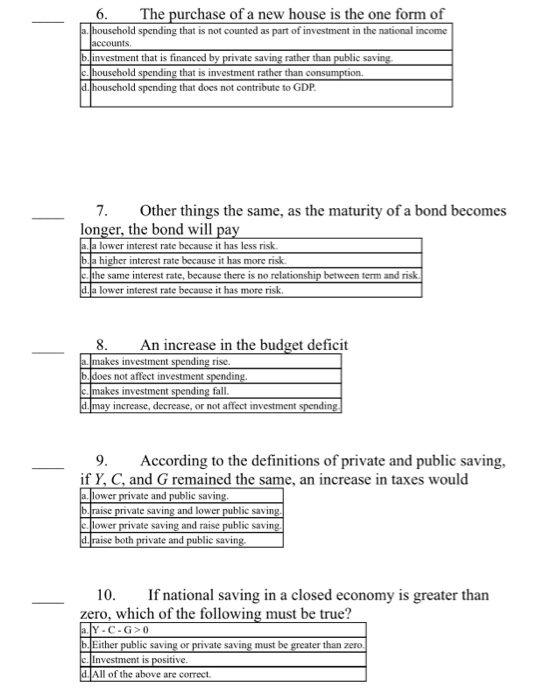

6. The purchase of a new house is the one form of a. household spending that is not counted as part of investment in the national income accounts. b. investment that is financed by private saving rather than public saving. c. household spending that is investment rather than consumption. d. household spending that does not contribute to GDP. 7. Other things the same, as the maturity of a bond becomes longer, the bond will pay a. a lower interest rate because it has less risk. b. a higher interest rate because it has more risk. c. the same interest rate, because there is no relationship between term and risk. d. a lower interest rate because it has more risk. 8. An increase in the budget deficit a. makes investment spending rise. b.does not affect investment spending. c. makes investment spending fall. d. may increase, decrease, or not affect investment spending. 9. According to the definitions of private and public saving, if Y, C, and G remained the same, an increase in taxes would a. lower private and public saving. b. raise private saving and lower public saving. e lower private saving and raise public saving. d. raise both private and public saving. 10. If national saving in a closed economy is greater than zero, which of the following must be true? a.Y-C-G>0 b. Either public saving or private saving must be greater than zero. c. Investment is positive. d. All of the above are correct.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 D Household spending that is investment rather than consumption Government current expenditures include consumption expenditures plus spending on social benefits and other transfers interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started