Question

6. To calculate an estimate of GE based on a comparable P/E ratio, multiply the industry average P/E ratio by GE EPS. 7. Compare the

6. To calculate an estimate of GE based on a comparable P/E ratio, multiply the industry average P/E ratio by GE EPS.

7. Compare the stock prices produced by the two methods to the actual stock price. What recommendation can you make as to whether clients should buy or sell GE stock based on your price estimates?

8. Explain to your boss why the estimate from the two valuation methods differ. Specifically, address the assumptions implicit in the models themselves as well as the assumption you made in preparing your analysis. Why do these estimates differ from the actual stock price of GE?

Here is the link of the soluliton that has been solved. Please do 6, 7, 8

http://www.chegg.com/homework-help/relation-capital-budgeting-discounted-free-cash-flow-model-chapter-10-problem-6DC-solution-9780132747585-exc

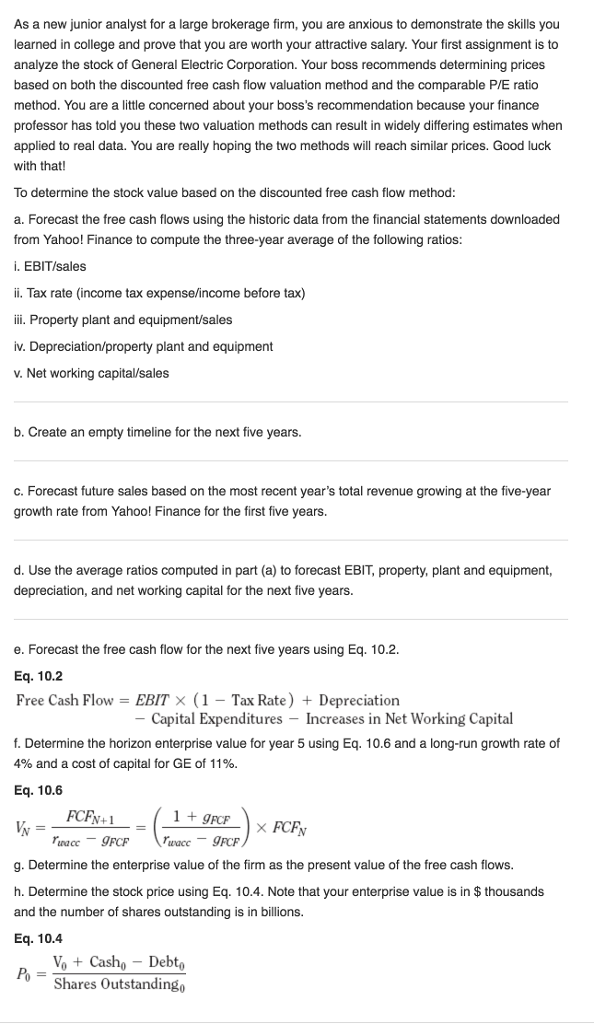

As a new junior analyst for a large brokerage firm, you are anxious to demonstrate the skills you learned in college and prove that you are worth your attractive salary. Your first assignment is to analyze the stock of General Electric Corporation. Your boss recommends determining prices based on both the discounted free cash flow valuation method and the comparable P/E ratio method. You are a little concerned about your boss's recommendation because your finance professor has told you these two valuation methods can result in widely differing estimates when applied to real data. You are really hoping the two methods will reach similar prices. Good luck with that To determine the stock value based on the discounted free cash flow method: a. Forecast the free cash flows using the historic data from the financial statements downloaded from Yahoo! Finance to compute the three-year average of the following ratios: i. EBIT/sales ii. Tax rate (income tax expense/income before tax) ii. Property plant and equipment/sales iv. Depreciation/property plant and equipment v. Net working capital/sales b. Create an empty timeline for the next five years. c. Forecast future sales based on the most recent year's total revenue growing at the five-year growth rate from Yahoo! Finance for the first five years. d. Use the average ratios computed in part (a) to forecast EBIT, property, plant and equipment, depreciation, and net working capital for the next five years e. Forecast the free cash flow for the next five years using Eq. 10.2 Eq. 10.2 Free Cash Flow = EBIT (1-Tax Rate) + Depreciation Capital Expenditures Increases in Net Working Capital f. Determine the horizon enterprise value for year 5 using Eq. 10.6 and a long-run growth rate of 4% and a cost of capital for GE of 11%. Eq. 10.6 X FCF g. Determine the enterprise value of the firm as the present value of the free cash flows. h. Determine the stock price using Eq. 10.4. Note that your enterprise value is in $ thousands and the number of shares outstanding is in billions. Eq. 10.4 Vo Casho Debt, Shares Outstandingo As a new junior analyst for a large brokerage firm, you are anxious to demonstrate the skills you learned in college and prove that you are worth your attractive salary. Your first assignment is to analyze the stock of General Electric Corporation. Your boss recommends determining prices based on both the discounted free cash flow valuation method and the comparable P/E ratio method. You are a little concerned about your boss's recommendation because your finance professor has told you these two valuation methods can result in widely differing estimates when applied to real data. You are really hoping the two methods will reach similar prices. Good luck with that To determine the stock value based on the discounted free cash flow method: a. Forecast the free cash flows using the historic data from the financial statements downloaded from Yahoo! Finance to compute the three-year average of the following ratios: i. EBIT/sales ii. Tax rate (income tax expense/income before tax) ii. Property plant and equipment/sales iv. Depreciation/property plant and equipment v. Net working capital/sales b. Create an empty timeline for the next five years. c. Forecast future sales based on the most recent year's total revenue growing at the five-year growth rate from Yahoo! Finance for the first five years. d. Use the average ratios computed in part (a) to forecast EBIT, property, plant and equipment, depreciation, and net working capital for the next five years e. Forecast the free cash flow for the next five years using Eq. 10.2 Eq. 10.2 Free Cash Flow = EBIT (1-Tax Rate) + Depreciation Capital Expenditures Increases in Net Working Capital f. Determine the horizon enterprise value for year 5 using Eq. 10.6 and a long-run growth rate of 4% and a cost of capital for GE of 11%. Eq. 10.6 X FCF g. Determine the enterprise value of the firm as the present value of the free cash flows. h. Determine the stock price using Eq. 10.4. Note that your enterprise value is in $ thousands and the number of shares outstanding is in billions. Eq. 10.4 Vo Casho Debt, Shares OutstandingoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started