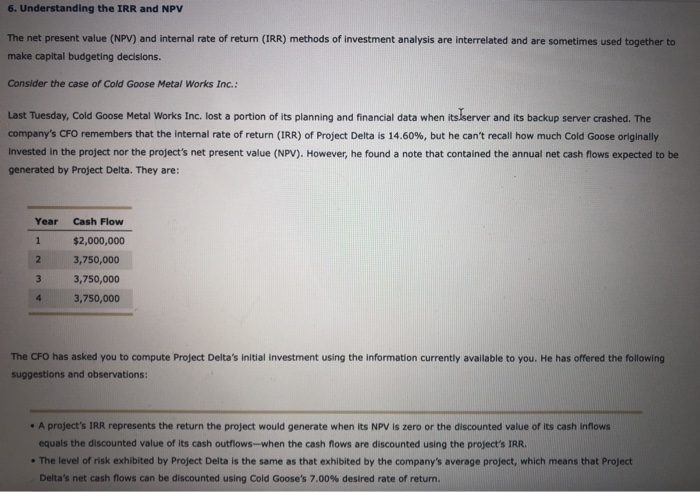

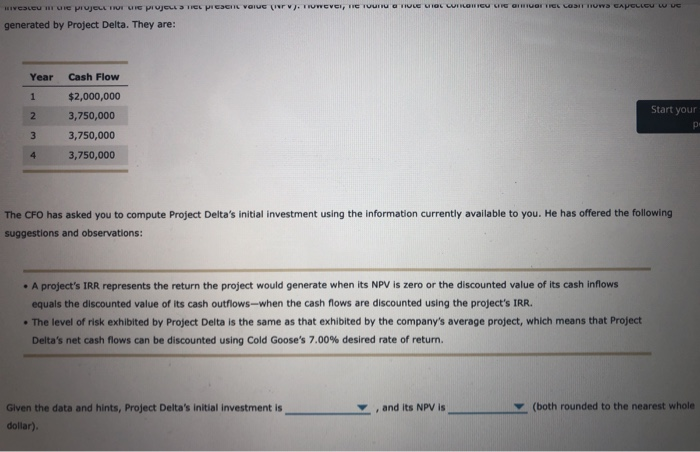

6. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Last Tuesday, Cold Goose Metal Works Inc. lost a portion of its planning and financial data when its server and its backup server crashed. The company's CFO remembers that the internal rate of return (IRR) of Project Delta is 14.60%, but he can't recall how much Cold Goose originally Invested in the project nor the project's net present value (NPV). However, he found a note that contained the annual net cash flows expected to be generated by Project Delta. They are: Year Cash Flow $2,000,000 1 2 3,750,000 3 3,750,000 3,750,000 4 The CFO has asked you to compute Project Delta's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Delta is the same as that exhibited by the company's average project, which means that Project Delta's net cash flows can be discounted using Cold Goose's 7.00% desired rate of return. HIVES DE PUJOL FUE UE PUEL SHIL PIEDEL VOIVEN). Twever, he run a HELIOCELONTOU CHUTE LODHUW CAPELLO W generated by Project Delta. They are: Year Cash Flow 1 Start your 2 $2,000,000 3,750,000 3,750,000 3,750,000 p 3 4 The CFO has asked you to compute Project Delta's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Delta is the same as that exhibited by the company's average project, which means that Project Delta's net cash flows can be discounted using Cold Goose's 7.00% desired rate of return. and its NPV is (both rounded to the nearest whole Given the data and hints, Project Delta's initial investment is dollar)