Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Use the following Adjusted Trial Balance and Statement of Retained Earnings to prepare the CLASSIFIED BALANCE SHEET for Good Luck Company for December 31,

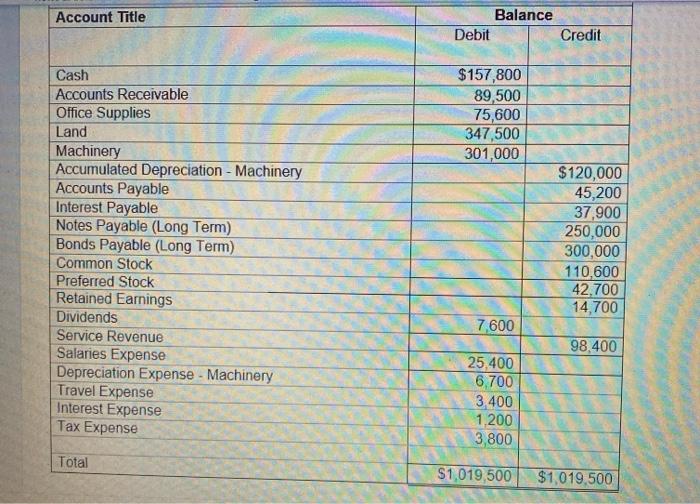

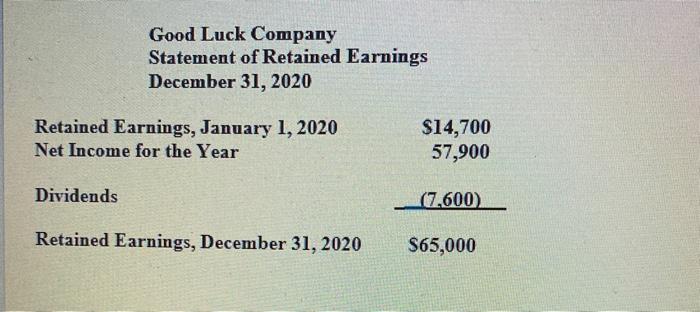

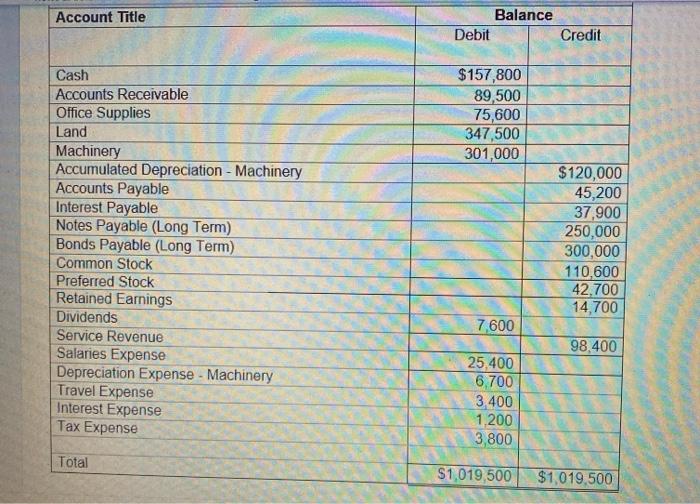

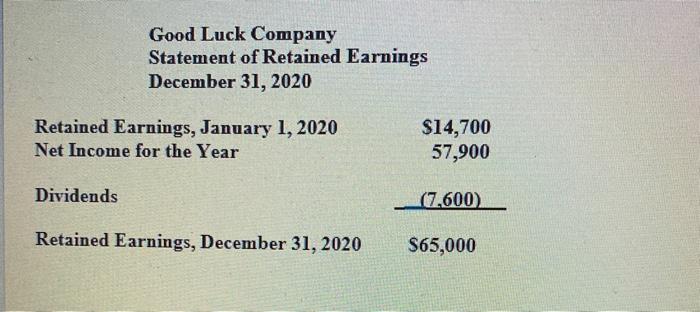

6. Use the following Adjusted Trial Balance and Statement of Retained Earnings to prepare the CLASSIFIED BALANCE SHEET for Good Luck Company for December 31, 2020. 30 points Account Title Balance Debit Credit $157,800 89,500 75,600 347,500 301,000 Cash Accounts Receivable Office Supplies Land Machinery Accumulated Depreciation - Machinery Accounts Payable Interest Payable Notes Payable (Long Term) Bonds Payable (Long Term) Common Stock Preferred Stock Retained Earnings Dividends Service Revenue Salaries Expense Depreciation Expense - Machinery Travel Expense Interest Expense Tax Expense $120,000 45,200 37,900 250,000 300,000 110,600 42,700 14,700 7,600 98,400 25,400 6.700 3.400 1.200 3,800 Total $1,019,500 $1,019,500 Good Luck Company Statement of Retained Earnings December 31, 2020 Retained Earnings, January 1, 2020 Net Income for the Year $14,700 57,900 Dividends (7,600 Retained Earnings, December 31, 2020 S65,000 Good Luck Balance Sheet December 31, 2020 Assets

6. Use the following Adjusted Trial Balance and Statement of Retained Earnings to prepare the CLASSIFIED BALANCE SHEET for Good Luck Company for December 31, 2020. 30 points Account Title Balance Debit Credit $157,800 89,500 75,600 347,500 301,000 Cash Accounts Receivable Office Supplies Land Machinery Accumulated Depreciation - Machinery Accounts Payable Interest Payable Notes Payable (Long Term) Bonds Payable (Long Term) Common Stock Preferred Stock Retained Earnings Dividends Service Revenue Salaries Expense Depreciation Expense - Machinery Travel Expense Interest Expense Tax Expense $120,000 45,200 37,900 250,000 300,000 110,600 42,700 14,700 7,600 98,400 25,400 6.700 3.400 1.200 3,800 Total $1,019,500 $1,019,500 Good Luck Company Statement of Retained Earnings December 31, 2020 Retained Earnings, January 1, 2020 Net Income for the Year $14,700 57,900 Dividends (7,600 Retained Earnings, December 31, 2020 S65,000 Good Luck Balance Sheet December 31, 2020 Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started