6. Use the same set of information given in the problem above. (a) Use S&P 500 future prices to calculate the implied dividend yield

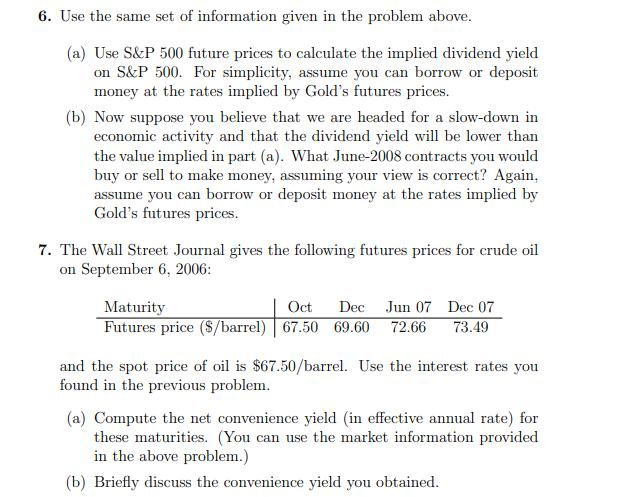

6. Use the same set of information given in the problem above. (a) Use S&P 500 future prices to calculate the implied dividend yield on S&P 500. For simplicity, assume you can borrow or deposit money at the rates implied by Gold's futures prices. (b) Now suppose you believe that we are headed for a slow-down in economic activity and that the dividend yield will be lower than the value implied in part (a). What June-2008 contracts you would buy or sell to make money, assuming your view is correct? Again, assume you can borrow or deposit money at the rates implied by Gold's futures prices. 7. The Wall Street Journal gives the following futures prices for crude oil on September 6, 2006: Maturity Oct Dec Jun 07 Dec 07 Futures price ($/barrel) 67.50 69.60 72.66 73.49 and the spot price of oil is $67.50/barrel. Use the interest rates you found in the previous problem. (a) Compute the net convenience yield (in effective annual rate) for these maturities. (You can use the market information provided in the above problem.) (b) Briefly discuss the convenience yield you obtained.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

6 a To calculate the implied dividend yield on SP 500 using SP 500 futures prices we need to calculate the fair value of the futures contract and then ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started