Question

6. What is the appropriate annual risk-free rate on a three-year default-free loan under the following conditions? Real interest rate = 3%, first year expected

6. What is the appropriate annual risk-free rate on a three-year default-free loan under the following conditions? Real interest rate = 3%, first year expected inflation is 1.7%, second year expected inflation is 2.2%, third year expected inflation is 1.9%.

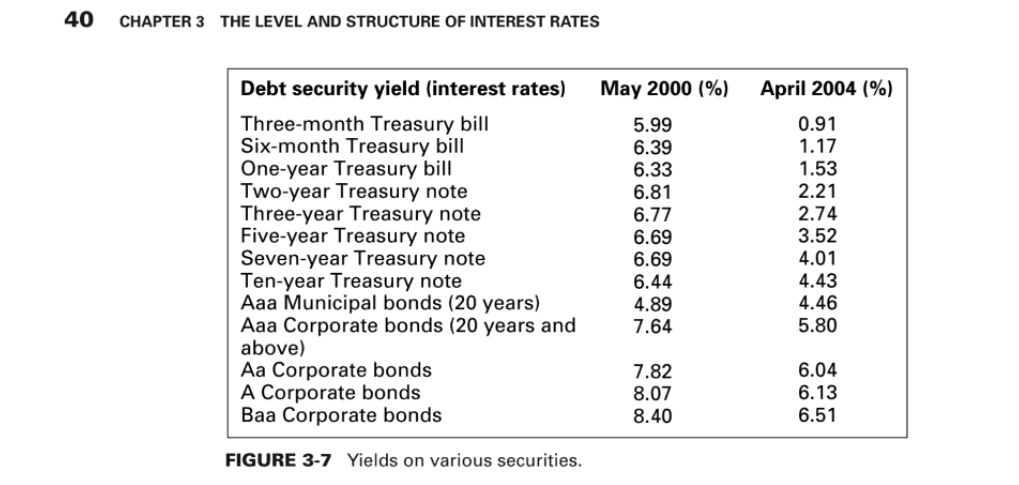

7. Using Equation 3-6 and the data in Figure 3-7 for May 2000, calculate the one-year interest rate expected for year three.

8. Using Equation 3-6 and the data in Figure 3-7 for April 2004, calculate the one-year interest rate expected for year two.

9. In this chapter, we discussed using expectations theory to find expected future interest rates, but we only discussed estimating expected rates covering a one-year period. However, the process can be generalized to estimate future interest rates over multi-year periods. Use the data in Figure 3-7 for April 2004 to estimate the expected annualized interest for a two-year security that starts three years in the future. (Hint: this security spans years four and five and the figure contains current rates for three- and five-year securities.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started