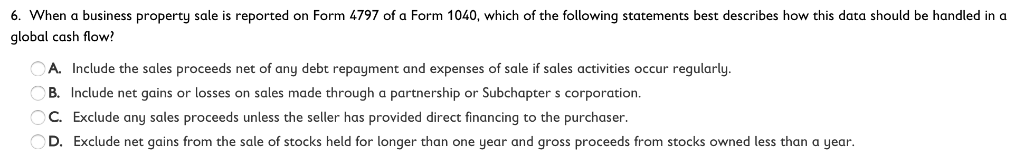

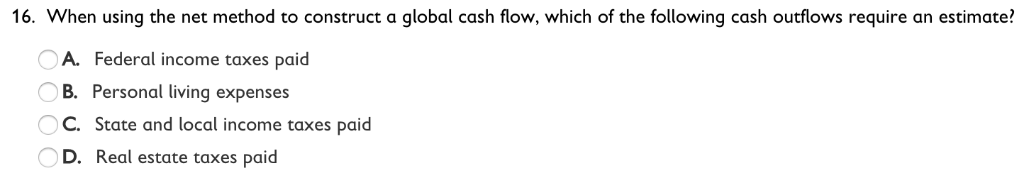

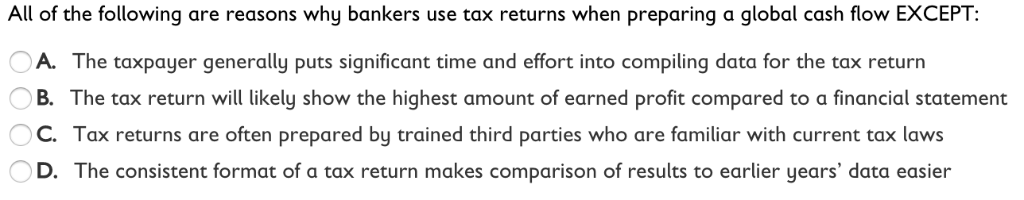

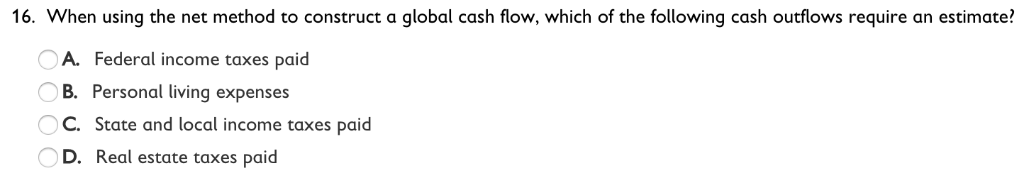

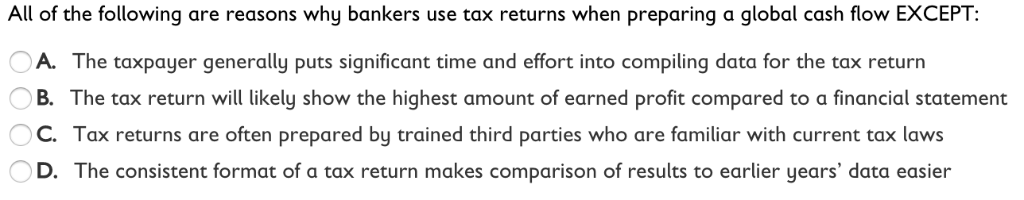

6. When a business property sale is reported on Form 4797 of a Form 1040, which of the following statements best describes how this data should be handled in a global cash flow? A. Include the sales proceeds net of any debt repayment and expenses of sale if sales activities occur regularly B. Include net gains or losses on sales made through a partnership or Subchapter s corporation C. Exclude any sales proceeds unless the seller has provided direct financing to the purchaser D. Exclude net gains from the sale of stocks held for longer than one year and gross proceeds from stocks owned less than a year 16. When using the net method to construct a global cash flow, which of the following cash outflows require an estimate? A. Federal income taxes paid B. Personal tiving expenses C. State and local income taxes paid D. Real estate taxes paid All of the following are reasons why bankers use tax returns when preparing a global cash flow EXCEPT: A. The taxpayer generally puts significant time and effort into compiling data for the tax return B. The tax return will likely show the highest amount of earned profit compared to a financial statement C. Tax returns are often prepared by trained third parties who are familiar with current tax laws D. The consistent format of a tax return makes comparison of results to earlier years' data easier 6. When a business property sale is reported on Form 4797 of a Form 1040, which of the following statements best describes how this data should be handled in a global cash flow? A. Include the sales proceeds net of any debt repayment and expenses of sale if sales activities occur regularly B. Include net gains or losses on sales made through a partnership or Subchapter s corporation C. Exclude any sales proceeds unless the seller has provided direct financing to the purchaser D. Exclude net gains from the sale of stocks held for longer than one year and gross proceeds from stocks owned less than a year 16. When using the net method to construct a global cash flow, which of the following cash outflows require an estimate? A. Federal income taxes paid B. Personal tiving expenses C. State and local income taxes paid D. Real estate taxes paid All of the following are reasons why bankers use tax returns when preparing a global cash flow EXCEPT: A. The taxpayer generally puts significant time and effort into compiling data for the tax return B. The tax return will likely show the highest amount of earned profit compared to a financial statement C. Tax returns are often prepared by trained third parties who are familiar with current tax laws D. The consistent format of a tax return makes comparison of results to earlier years' data easier