Question: 6. When reporting on financial statements prepared on the basis of income tax accounting, the auditor should include in the report a paragraph that a.

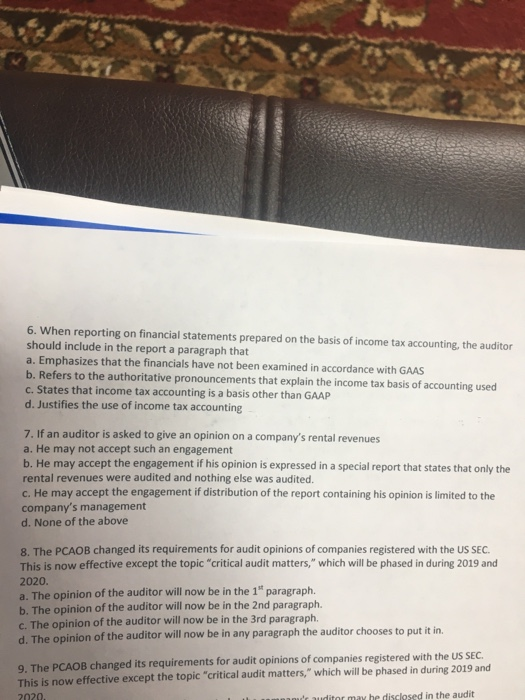

6. When reporting on financial statements prepared on the basis of income tax accounting, the auditor should include in the report a paragraph that a. Emphasizes that the financials have not been examined in accordance with GAAS b. Refers to the authoritative pronouncements that explain the income tax basis of accounting used c. States that income tax accounting is a basis other than GAAP d. Justifies the use of income tax accounting 7. If an auditor is asked to give an opinion on a company's rental revenues a. He may not accept such an engagement b. He may accept the engagement if his opinion is expressed in a special report that states that only the rental revenues were audited and nothing else was audited. c. He may accept the engagement if distribution of the report containing his opinion is limited to the company's management d. None of the above 8. The PCAOB changed its requirements for audit opinions of companies registered with the US SEC. This is now effective except the topic "critical audit matters," which will be phased in during 2019 and 2020 a. The opinion of the auditor will now be in the 1 " paragraph. b. The opinion of the auditor will now be in the 2nd paragraph. c. The opinion of the auditor will now be in the 3rd paragraph. The opinion of the auditor will now be in any paragraph the auditor chooses to put it in. d. 9. The PCAOB changed its requirements for audit opinions of companies registered with the US SEC This is now effective except the topic "critical audit matters," which will be phased in during 2019 and 2020 uditor may he disclased in the audit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts