Question

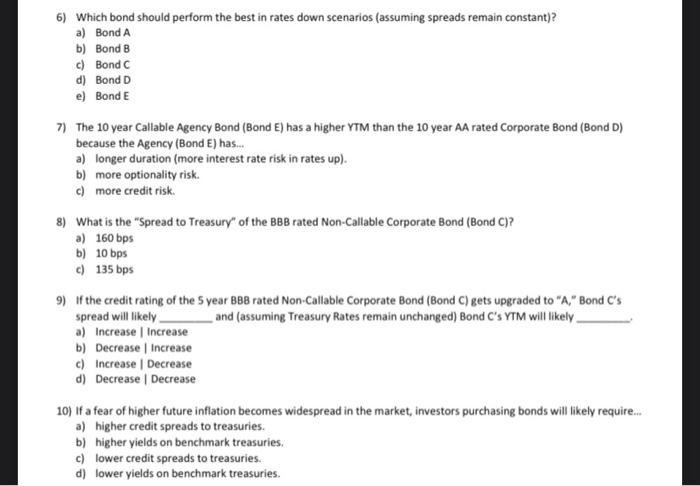

6) Which bond should perform the best in rates down scenarios (assuming spreads remain constant)? a) Bond A b) Bond B c) Bond C d)

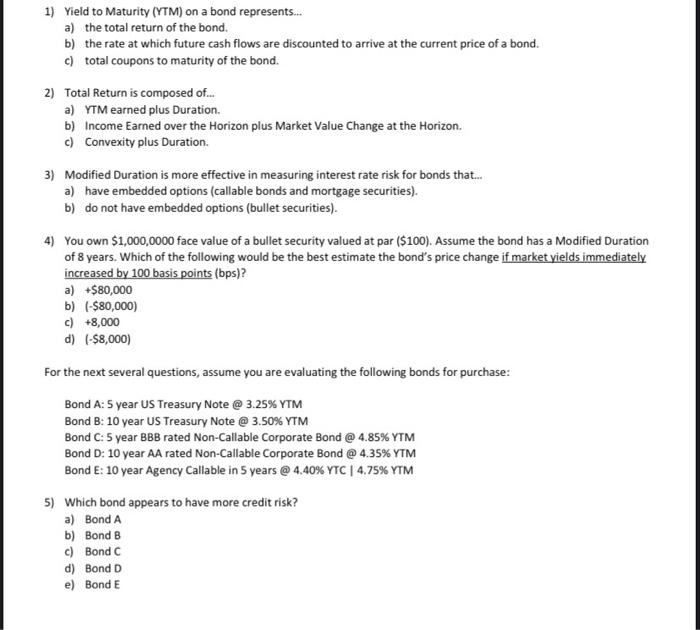

6) Which bond should perform the best in rates down scenarios (assuming spreads remain constant)? a) Bond A b) Bond B c) Bond C d) Bond D e) Bond E 7) The 10 year Callable Agency Bond (Bond E) has a higher YTM than the 10 year AA rated Corporate Bond (Bond D) because the Agency (Bond E) has... a) longer duration (more interest rate risk in rates up). b) more optionality risk. c) more credit risk. 8) What is the "Spread to Treasury" of the BBB rated Non-Callable Corporate Bond (Bond C)? a) 160 bps b) 10 bps c) 135 bps 9) If the credit rating of the 5 year BBB rated Non-Callable Corporate Bond (Bond C) gets upgraded to "A," Bond C's spread will likely and (assuming Treasury Rates remain unchanged) Bond C's YTM will likely a) Increase | Increase b) Decrease Increase c) Increase Decrease d) Decrease | Decrease 10) If a fear of higher future inflation becomes widespread in the market, investors purchasing bonds will likely require... a) higher credit spreads to treasuries. b) higher yields on benchmark treasuries. c) lower credit spreads to treasuries. d) lower yields on benchmark treasuries. 1) Yield to Maturity (YTM) on a bond represents... a) the total return of the bond. b) the rate at which future cash flows are discounted to arrive at the current price of a bond. c) total coupons to maturity of the bond. 2) Total Return is composed of... a) YTM earned plus Duration. b) Income Earned over the Horizon plus Market Value Change at the Horizon. c) Convexity plus Duration. 3) Modified Duration is more effective in measuring interest rate risk for bonds that... a) have embedded options (callable bonds and mortgage securities). b) do not have embedded options (bullet securities). 4) You own $1,000,0000 face value of a bullet security valued at par ($100). Assume the bond has a Modified Duration of 8 years. Which of the following would be the best estimate the bond's price change if market yields immediately increased by 100 basis points (bps)? a) +$80,000 b) (-$80,000) c) +8,000 d) (-$8,000) For the next several questions, assume you are evaluating the following bonds for purchase: Bond A: 5 year US Treasury Note @ 3.25% YTM Bond B: 10 year US Treasury Note @ 3.50% YTM Bond C: 5 year BBB rated Non-Callable Corporate Bond @ 4.85% YTM Bond D: 10 year AA rated Non-Callable Corporate Bond @ 4.35% YTM Bond E: 10 year Agency Callable in 5 years @ 4.40% YTC | 4.75% YTM 5) Which bond appears to have more credit risk? a) Bond A b) Bond B c) Bond C d) Bond D e) Bond E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started