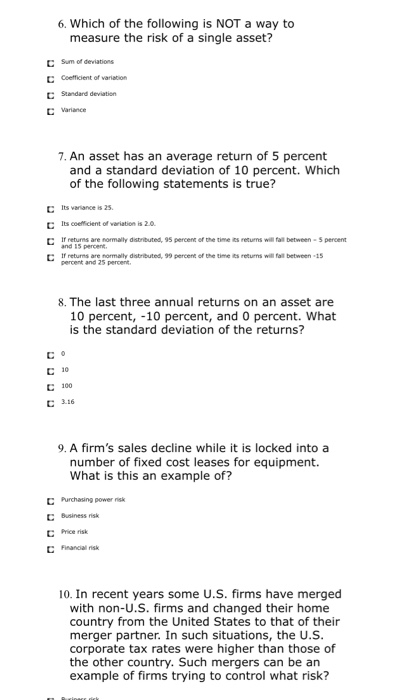

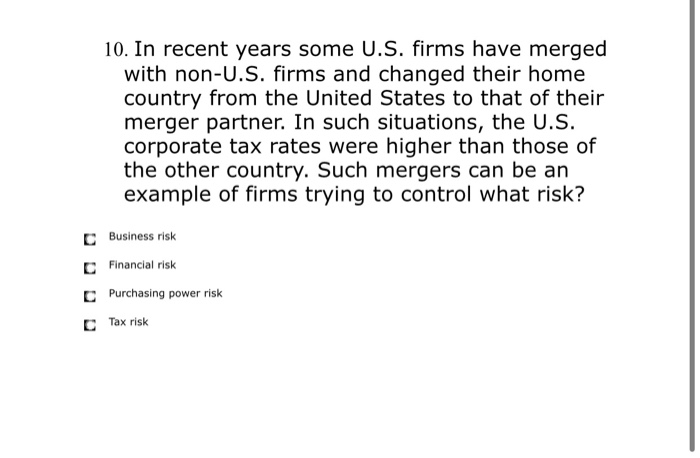

6. Which of the following is NOT a way to measure the risk of a single asset? Sum of deviations Coefficient of variation Standard deviation Variance r 7. An asset has an average return of 5 percent and a standard deviation of 10 percent. Which of the following statements is true? C its variance is 25 Its coefficient of variation is 2.0 L and 15 percent if returns are normally distributed, 95 percent of the time to returns will all between - 5 percent If returns are normally distributed, 90 percent of the time to returns will fall between 15 percent and 25 percent 8. The last three annual returns on an asset are 10 percent, -10 percent, and 0 percent. What is the standard deviation of the returns? C10 C100 9. A firm's sales decline while it is locked into a number of fixed cost leases for equipment. What is this an example of? C C C Purchasing power risk Business risk Price risk Financial risk 10. In recent years some U.S. firms have merged with non-U.S. firms and changed their home country from the United States to that of their merger partner. In such situations, the U.S. corporate tax rates were higher than those of the other country. Such mergers can be an example of firms trying to control what risk? 10. In recent years some U.S. firms have merged with non-U.S. firms and changed their home country from the United States to that of their merger partner. In such situations, the U.S. corporate tax rates were higher than those of the other country. Such mergers can be an example of firms trying to control what risk? C Business risk C Financial risk C Purchasing power risk Tax risk 6. Which of the following is NOT a way to measure the risk of a single asset? Sum of deviations Coefficient of variation Standard deviation Variance r 7. An asset has an average return of 5 percent and a standard deviation of 10 percent. Which of the following statements is true? C its variance is 25 Its coefficient of variation is 2.0 L and 15 percent if returns are normally distributed, 95 percent of the time to returns will all between - 5 percent If returns are normally distributed, 90 percent of the time to returns will fall between 15 percent and 25 percent 8. The last three annual returns on an asset are 10 percent, -10 percent, and 0 percent. What is the standard deviation of the returns? C10 C100 9. A firm's sales decline while it is locked into a number of fixed cost leases for equipment. What is this an example of? C C C Purchasing power risk Business risk Price risk Financial risk 10. In recent years some U.S. firms have merged with non-U.S. firms and changed their home country from the United States to that of their merger partner. In such situations, the U.S. corporate tax rates were higher than those of the other country. Such mergers can be an example of firms trying to control what risk? 10. In recent years some U.S. firms have merged with non-U.S. firms and changed their home country from the United States to that of their merger partner. In such situations, the U.S. corporate tax rates were higher than those of the other country. Such mergers can be an example of firms trying to control what risk? C Business risk C Financial risk C Purchasing power risk Tax risk