6. Why is there still underutilized manufacturing capacity when the SPx256 is being manufactured? Is the pricing model in fact too aggressive? (answer in 600-700 words)

The case study (23 pages uploaded in order) are as below. Please read through them to be able to answer the above question.

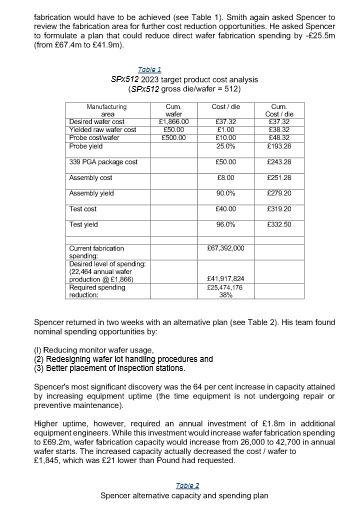

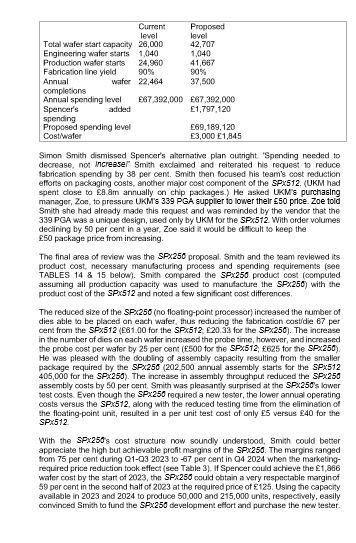

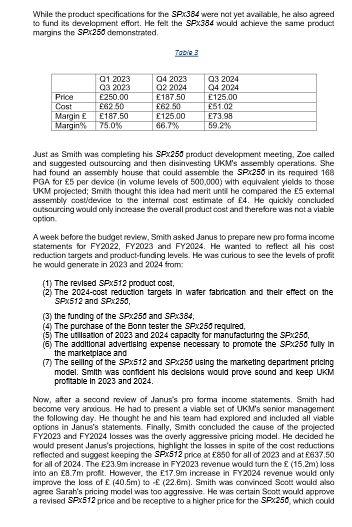

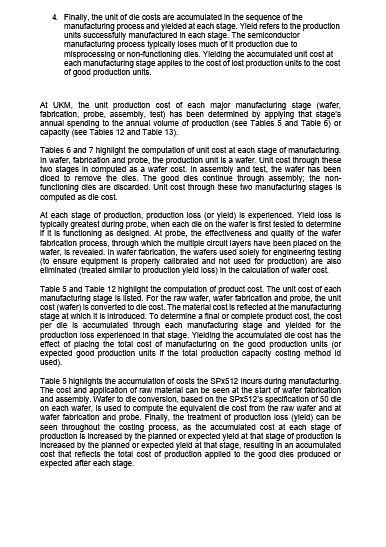

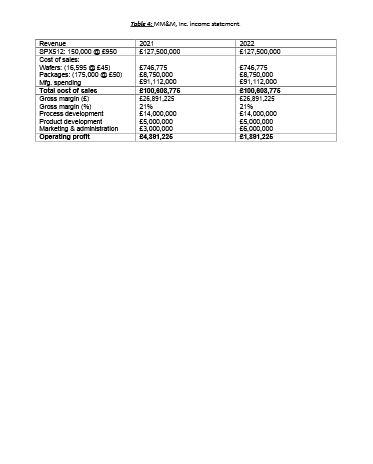

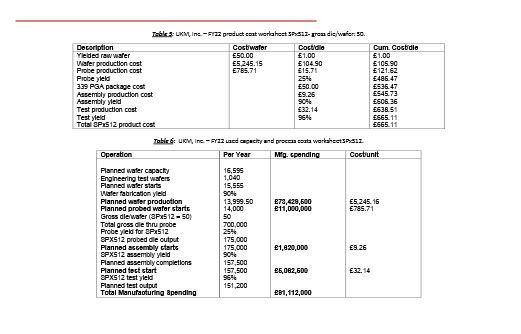

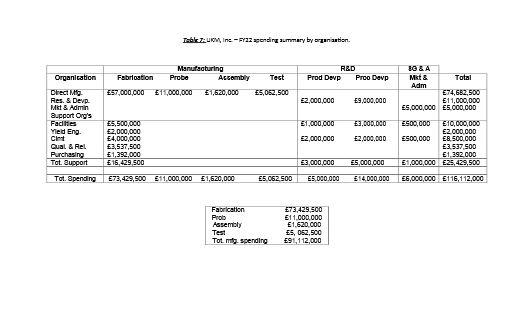

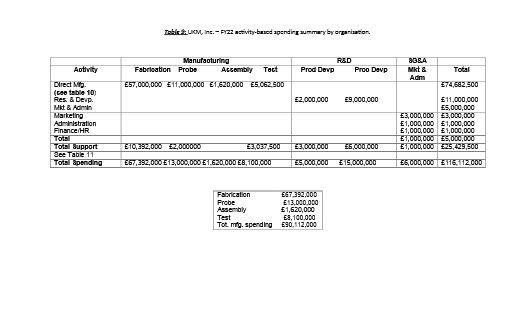

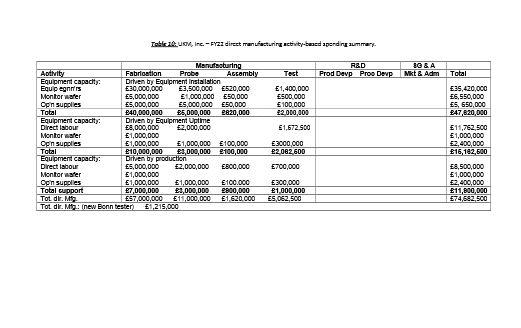

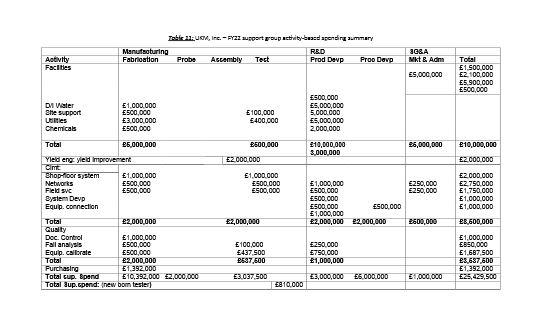

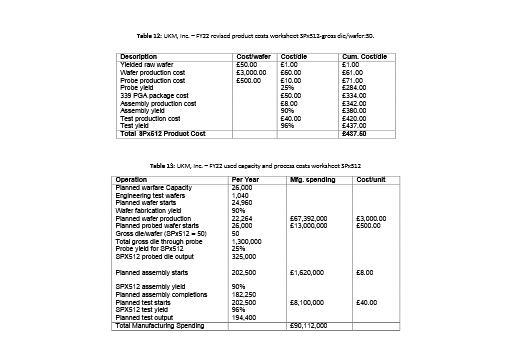

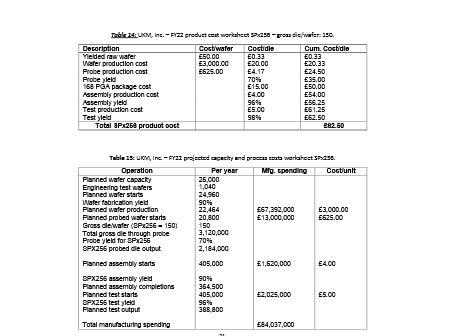

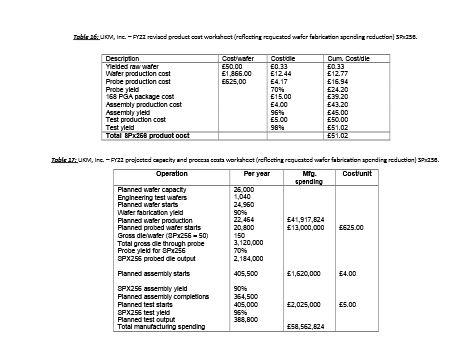

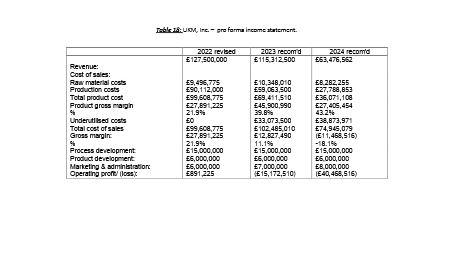

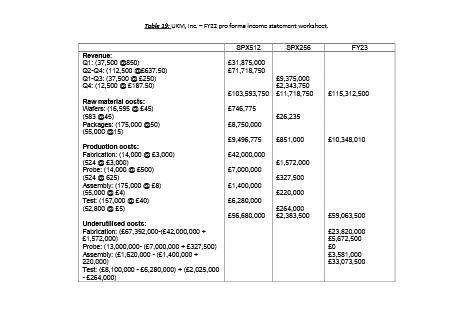

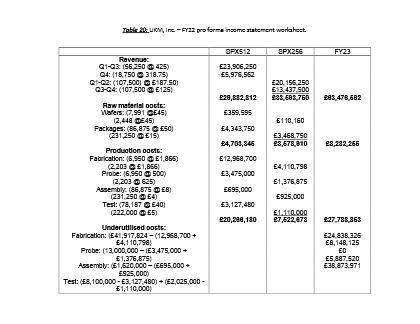

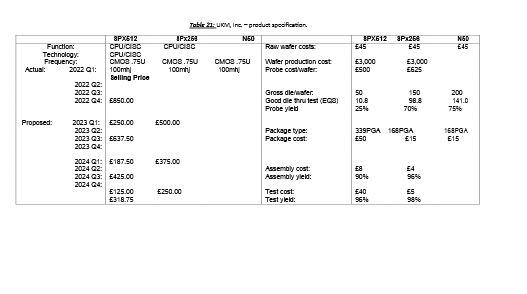

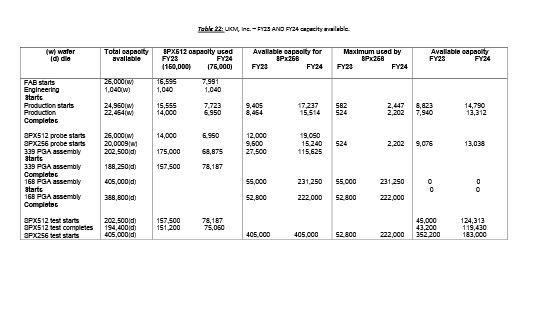

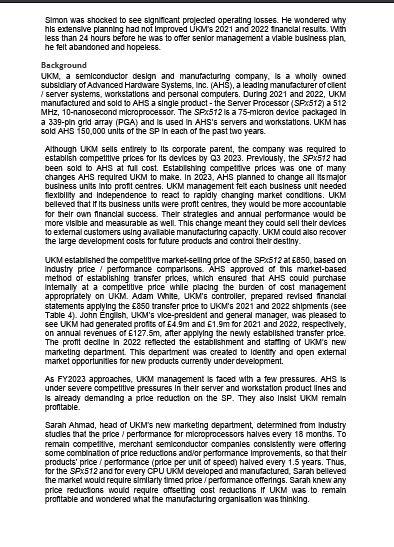

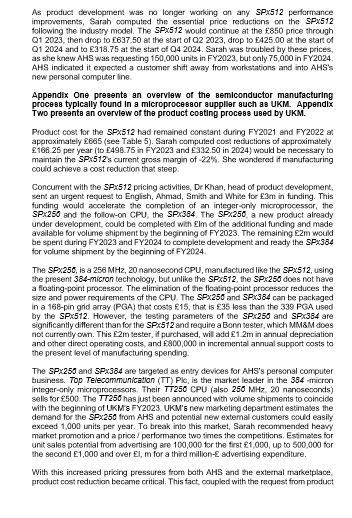

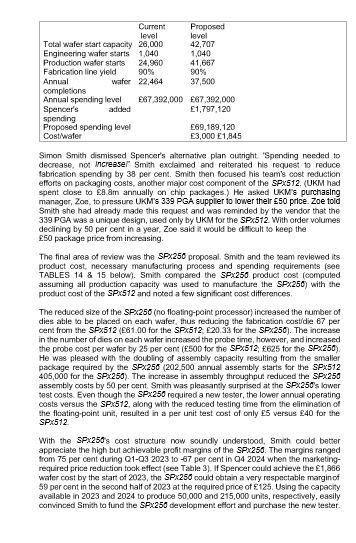

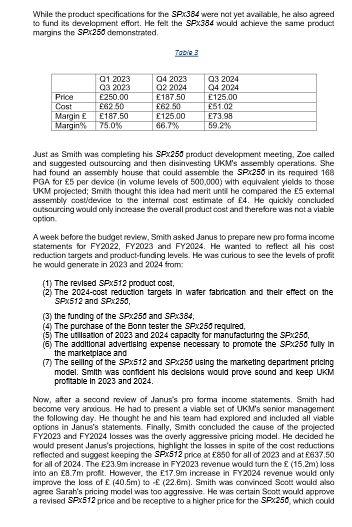

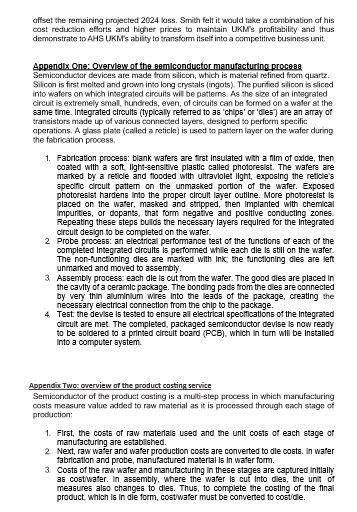

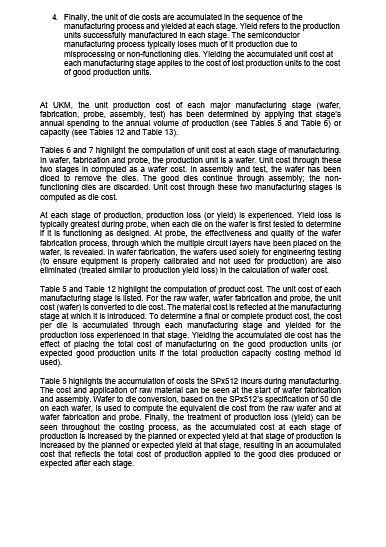

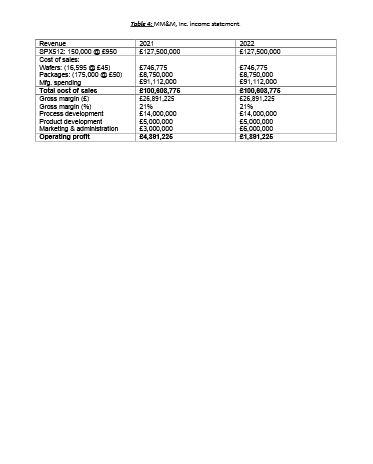

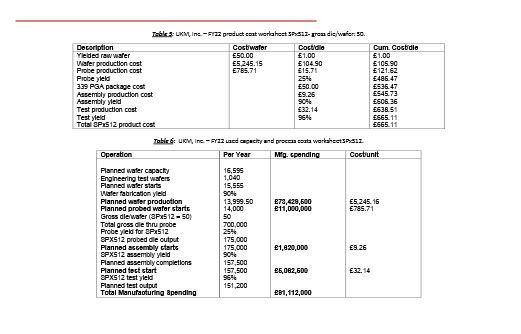

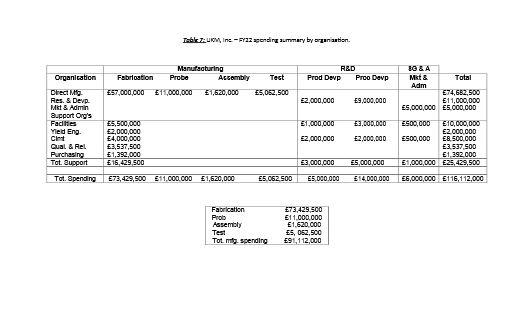

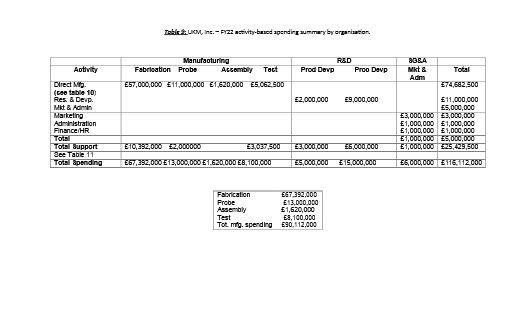

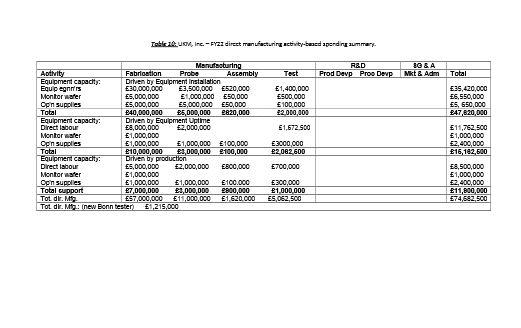

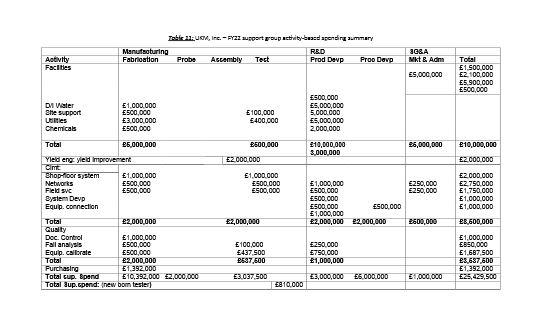

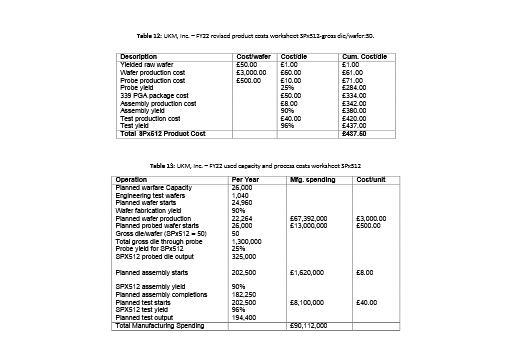

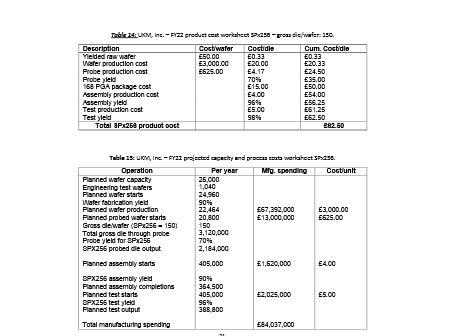

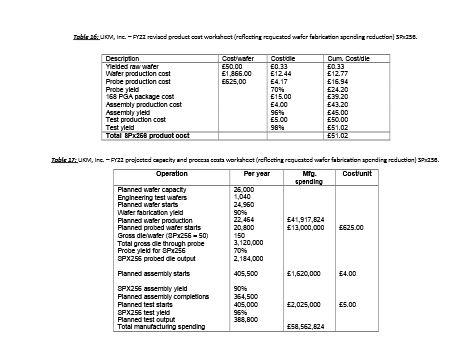

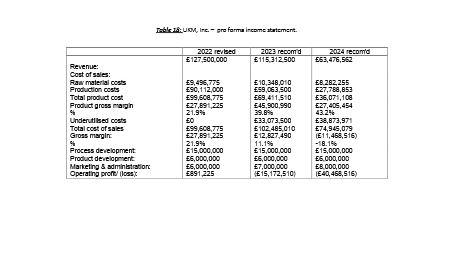

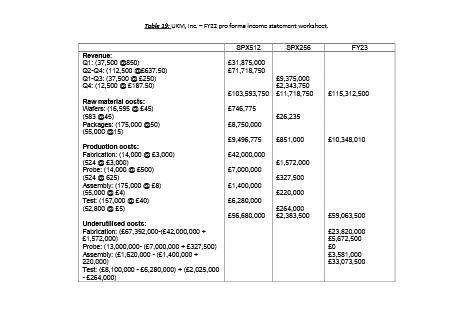

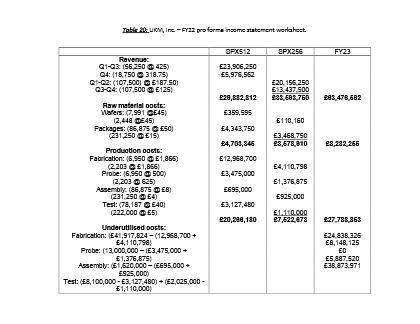

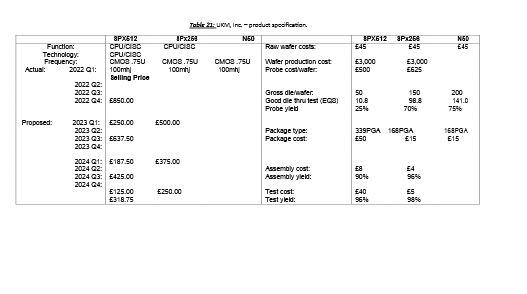

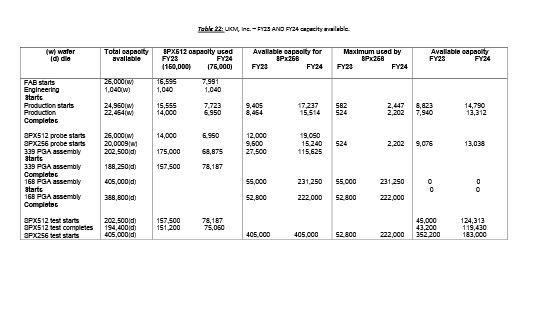

Before the annual year budget review, Simon Smith, UK Manufacturing's (UKM) Director of operations, was confident. While he waited for the latest financial estimates, he thought of the plan he and his staff had methodically prepared, which successfully addressed all the crises this new business unit was facing: developing competitive pricing on an ageing product, developing and marketing new products to external customers against an established market leader, reducing manufacturing costs, improving manufacturing utilisation and improving its slim levels of profitability. When Adam White, UKM's controller, solemnly delivered the requested pro forma income statements, Simon's mood changed dramatically. Instead of sustained profit, Simon was shocked to see slgnificant projected operating losses. He wondered why his extenske planning had not improved UKM's 2021 and 2022 inancial results. With less than 24 hours before he was to offer senior management a valole business plan, he felt abandoned and hopelese. Biackground UKM, a semiconductor design and marufacturing company, is a wholly owined subsidlary of Actvanced Hardware Systems, Inc. (AHS), a leading manufachurer of clent I server systems, workstations and personal compuiers. During 2021 and 2022, UKM manufactured and 501d to AHS a single product - the Server Processor {SP512} a 512 MHz, 10-nanosecond microproces60r. The SPx512 is a 75 -micron devle packaged in a 339-pin grid anay (PGA) and Is used In AHS'E servers and workstations. UKM ha5 sold AHS 150,000 units of the SP In each of the past two years. Although UKM sells entirely to lts corporate parent, the company was reculred to establish compettitie prices for lts devices by Q3 2023. Previously, the SPx512 had been sold to AHS at full cost. Establishing compettive prices was one of many changes AHS recjulred UKM to make. In 2023 , AHS planned to change all lis major business units into profit centres. UKM management felt each busines5 unit needed flexicility and Independence to react to rapldly changing market conditions. UKM belleved that if It business unlts were pront centres, they would be more accountable for their own financlal success. Ther strategles and annual performance would be more vislole and measurable as well. This change meant they could sell thelr devices to external customers using avalable manufacturing capaclty. UKM could also recover the large development costs for tuture products and control their destlny. UKM established the compettive market-sellng price of the SPX512 at B50, based on industry price I perfommance comparisons. AHS approved of this market-based method of establishing transfer prices, which ensured that AHS could purchase Intemally at a compettive price while placing the burden of cost management appropilately on UKM. Adam While, UKM's controller, prepared redsed financial statements applying the 5850 transfer poice to UKM's 2021 and 2022 shlpments (5ee Table 4). John English, UKaM's voe-predident and general manager, was pleased to see UKM had generated profits of 4.9m and E1.9m for 2021 and 2022 , respecthely, on annual revenues of 127.5m, after applying the newty established transfer price. The profit decilne in 2022 reflected the establishment and stafing of LXM's new marketing department. This department was creaded to Identify and open external market opporturitles for new products currenty under development. A5 FY2023 approaches, LKM management l5 faced with a fex pressures. AHS l5 under severe competltive pressures in thelr server and workstation product lines and is already demanding a price reduction on the SP. They also Inslst UKM remain prontable. Sarah Ahmad, head of UKM's new mariceting department, determined from Industry studles that the price / performance for microprocessors halves every 18 month5. To remain competithe, merchant semiconcuctor companies consistently were offering some comblnation of price reductions andior performance improvements, so that their procucts' price f performance (prlce per unit of speed) halved every 1.5 years. Thus, for the SPX 512 and for every CPU UKM developed and manufactured, Sarah belleved the market would require simllarly tlmed price / perfomance offerings. Sarah knew amy price reductons would requlre offsetting cost recuctions if UKM was to remaln prontable and wondered what the manufacturing organisailon was thinking. As product developament was no longer warking an any SPx512 performance improwements, Sarah computnd the essential price redkuctions on the SPX512 following the industry model. The SPX512 would continue at the f850 price through Q1 2023, then drcp to E637.50 at the start of Q22023, drop to E425.00 at the start of Q1 2024 and to 318.75 at the start of 042024 . Sarah was troubled by these prices, as she knaw AHS was requasting 150,000 units in FY2023, but coly 75,000 in FY2024. AHS indicatod it expeched a customer shitt awey from workstations and into AHS's new perschal computer ine. Appendix One presents an overview of the 8emiconductor manufacturing procese typically found in a microprocessor auppller auch as UKM. Appendix Two presente an overvlew of the product costing process used by UKM. Product cost for the SFX512 had remained constant during FY2021 and FY2022 at appraximately 2665 (see Table 5). Sarah campuled coes recuctions of spproximately 166. 26 per year (io 496.75 in FY 2023 and 332.50 in 2024) would be necessary to maintain the SPx512: current gross mangin of 22%. She wonderod if manufacturing could schisue a cost reduction thet steep. Concurrent with the SP512 pricing sctivities, Dr Khan, head of product development, sent an urgent request to English, Ahmad, Smith and Whise for 3m in funding. This funding would acoelerate the completion of an integer-only microprocessor, the SP250 and the follow-on CPU, the SPX 384 . The SPx250, a new product alresdy under developenent, could be completed wich m of the additional funding and mede avsilable for volume shipment by the begirning of FYZ023. The remsining 2m woukd be spert turing FY2023 and FY2024 to complete developoment and resdy the SPXSB4 for volume shipment by the begirning of FY2024. The SPX250, is a 256MHz,20 nancsecond CPU, manuflactured like the SPX512, using the present 384micron technology, but unlike the SPx512, the SPx250 does not have a flosting-point procassor. The elimination of the flaating-paint processer reduces the size and power roquirements of the CPU. The SPX250 and SPXXB4 can be packaged in a 168-pin grid array (PGA) that cos*s \&15, that is 835 less than the 339 PGA used by the SPX512. However, the testing parameters of the SPX250 and SPX 384 are significsently different than for the SPx512 and require a Eonn vester, which MM8M does not currently own. This E2m taster, if purchased, wil add 1.2m in annual depreciation and other diroct operating costs, and 900,000 in incremental annual support costs to the present lavel of menutacturing spending. The SPx250 and SPx384 are targesed as entry devices for AHS's personil computer businass. Top Telecommunication (TT) Ple, is the market lesder in the 394 -micren integer-only microprocessors. Their TT250 CPU (also 250MHz,20 nancseconds) sells for 500. The T7250 has just been announced with volume shipments to coincide with the beginning of UKM F FY2023. UKM's new marketing department estimases the demend for the SPx 250 from AHS and potential new extemal customers could easily exceed 1,000 units per year. To treak into this market, Sarah recommended heawy market promotion and a prion / perfocmance two times the competitions. Estimases for unit sales potential from advertising are 100,000 tor the frst 1,000, up to 500,000 for the second E1,000 and ower E1, mi for a third milion- sdvertising expenditure. With this increased pricing pressures from bath AHS and the external marketplace, product cost roduxtion became critical. This fact coupled with the requnst from product development for additionsal funding, had John Engish very concerned. He knew it was important to bring out the SPX250 and SPx 364 quickly, but the pricing pressures for their markes entrance and the pricing pressures from A.HS an the SPX512 soemed almost impossible to meet and s.ll 8chieve a proth in FY2023 and 2024 . He knew. however, if he didint maintain a profitable cperation, his tenure would be short. Reducad product costs leading to competitive manufacturing appeared to be the critical factor necessary to sustain UKM's slim profit kevels. English askot Smith, the directoc of operations, to formulate a series of recommendations for develoging and manulacturing an expanded CFU product line in FY2023 and FYZ024. He asked that the recommendatiars be completed by the ancuial two-year budget reviaw, schaduled to cammence in a month. Englsh knew that soon afeer budget review he wouki have to present a crediale business plan to UKM managemere. He worried how hecould develop a viable plan in light of the obstacles. The 5 mith's plan Simon Smith siarted tis preperetion by reviewing the detailed SPx512 product cosi (see TABLES belcw 1,2 and 3). He inmediately assembled a team comprising White fram firance, T.Q. Marcel from quality and Dian Ruby from training. The team, led by Mark Spencer, manager of wafer fabrication, conducted a cost review by activity. Simon, the John Engish, believed sigritcant cost reductions would be necessary to maintein protiablity. He hed recently taken an executive development course in activity-based costing and knew it was a prowen method for beter understanding cost structures and cost drivers, and highligiting non-value-added work. Smith was excitrd, given the sioe of the essignmere and his belief there were both cost reduction opportunities in manufacturing and necsesery improvements in the current standard cost system. He felt the cument standard cost system did not properly capture the complexity of UKME production process. He felt an ABC analysis could provide the insight nacessary to reduce the SFx512 procuct eost by the 166 marketing had roquestod. The team mapped the processes of the entire operation and than reassigned costs % the newly defined activities. The manufacturing support organisations were also better understood. Their key activities were costed, and then each w9s algned to the mianufacturing operation it supported. UKM's AEC team reset the SPx512 product cost in line with the true practical capacity of the manufacturing process. The team saw capecity u:ilisation ase a major driver of product cost. The old product costing methodolagy was bascd on the plarned utilisation of each manutactuning process with underutilised manutacturing costs abeorbed in product costs. The revisod SPx512 product cost was plensing, but not wery surpeising to Smith. it contimed his beliet in the inaccur3cies of the old costing method. The new SPX512 product cost of 2437.50 w98 E227.61 lower than the E665.11 origins cost shown by' the old system. It did not make sense to charge the SPx 512 for the cos:s of rescurces it did not consume. Smith felt he could commit immediataly to Sarah's 2023 product cost roduction request of 168. To achieve the 2024 product cost goal of 332.50, 5mith and his team looked further into the acrity-based coesing results. The ebucy clearly showed that waler fabrication was the largest area of mandfacturing coes. Smith computed that if the SFX512 waseer cost was reduced from the 2023 kevel of 3,000 weafer to 1,986 wafer, the 3 PX 512 total product cost would be lowered by 105, achieving the desired f.332.50. To obtain a water cost of 1,366, spending reductions of +2.25.5m or 38 per cent in water fabrication would have to be schieved (sea Table 1). Smith again asked Spencer to revien the fabrication area for further cost reduction opportunities. He asked Spencer to formulate a plan that could redube direat wafer fabrication spending by 25.5m (from \&.67. 4m to 41.9m ). Tobice SPX512 2023 iarget product cost analysis {SP512 gross dieiwater =512} Spencer reharned in two weaks with an altemative plan (see Table 2). His team found nominal spending opportunities by: (1) Reducing monitor wafer usage, (2) Redeslgning wafer lot handing procedures and (3) Better placement of Inspection atations. Spencer's most signiticant discovery was the ef4 per cent increase in capacity atteined by increasing equipment uptime (the tme equipment is not undergoing repair or preventive maintenance). Higher uptime, howsucr, required an anneal investmen; of 1.8m in atdicional equipmentengineers. While this irvestment would increase water tabrication spending to 269.2m, waler fabrication capacity would increase from 26,000 w. 42,700 in annual wafer starts. The increased capacity actually decreased the cost i wafer to 1,845, which was 21 lower than Paund had requested. Simon Smith dismissed Spencer's ahernative plan oizright 'Spending necded to decrease, not increaser Smish exclaimed end reiterated his request to reduce fabrication spending by 38 per cent. Smith then focused his team's cost reduction effors on packaging costs, another major cost component of the SPX512. UKM had spent dose to EA.Gmannuallyonchippackages.)HeaskedUKMrpurchasing manager, Zon, to pressure UK'H's 339 PGA suppler to lower thelr E50 prlce. Zoe told Smith she had already made this request and was reminded by the vendor that the 339 PGA was a unique design, vsed only by UKM for the SPx512. With order volumes declining by 50 per cent in a year, Zoe said it would be ditloult to keep the E50 package price from increasing. The final ares of review was the SPx 250 proposal. Smith and the teem reviewed its procuct cost, necessary menulacturing process and spending recuirements (see TABLES 14 \& 15 belowi. Smith compered the SPX250 product cost roomputed assurning all production capacity was used to manufacture the SPX250) with the product cost of the SPX512 and noted a few significant cost differences. The reduced size of the SPx250 (no floating-point processor) ifvcreased the number of dies able to be placed on esch wafer, thus rectucing the fabrication oostidie 67 per cent from the SPX512 {661.00 for the SPX512, 20.33 for the SPX250\}. The increase in the number of dies on each waffer increased the probe time, however, and increased the probe cost per wafer by 25 per cent (f500 tor the SPX.512; f625 tor the SPX.250). He was pleased with the doubling of assembly capacity resulting from the smaller package required by the SPX.250 (202,500 annual assembly starts for the SPX512 405,000 for the SPx250). The increase in assembly throughpus reduced the SPX250 assembly costs by 50 per oent. Smith was plensantly surprised at the SPX250's kower test costs. Even though the SPX250 required a new testar, the lower annual operating costs versus the SPx512, along with the recured testing time from the eliminstion of the floating-point unit, rasulted in a per unit test cost of only E5 versus 40 for the SPx 512 With the SPx250's cost structure now scundly understood, Smith could beter appreciate the high but schievable profit margins of the SP250. The margins ranged from 75 per cent during Q1-Q3 2023 to 67 per cent in Q4 2024 when the marketingrequired price reduction tock effect (see Table 3). If Spencer oauld sctieven the 1,866 wafer cost by the start of 2023 , the SP 250 ocuid obtain a very respectabile margin of 59 per cent in the second half of 2023 at the required pnice of 2125 . Using the capecity avsiable in 2023 and 2024 to produces 50,000 and 215,000 units, respectively, essily convinced Smith to fund the SPX:250 development eflort and purchase the new sester. While the product specilications for the SPx384 were nat yet avaliable, he also agreed to fund its develapment effort. He fell the SPXS84 would achieve the same product. margns the SP*260 demonstrassd. 700183 Just as Smith was comple:ing his SPx250 prockuct development maeting, Zoa called and suggested cutsourcing and then disinvesting LKCM's assembly operations. She had found an assembly house that could asscmbic the SPX250 in its requirod 168 PGA for &5 per devioe (in volume levels of 500,000 ) with equivelent yields to those UKM projected; Smith thought this idea had merit unsi he compared the E5 extemal assembly costldevice to the internal cost estimaste of 4. He quickly concluded autseurcing would only increase the overall product cost and tharefare was nat s viable option. A week before the buidget review, Smith asked Jamus to prepare new pro forms income statements for FY2022, FY2023 and FY2024. He wrated to reflect all his coef reductian targets and product-funcing lavels. He was curious to sae the levels of profit he would generate in 2023 and 2024 from: (1) The revised 3Px512 product cost, (2) The 2024-cost reduction targets in wafer fabrication and their effect on the SPX512 and SPx250, (3) the funding of the SPx.250 and SPx384; (4) The purchase of the Bonn tester the SPx250 requined, (5) The utilsation of 2023 and 2024 capacity for manufacturing the SPx 250 , (6) The adalitional advertibing expense necessary to promote the SPx.250 fully in the marketplace and (7) The selling of the SFx512 and SPx 250 using the marketing departnent pricing model. Smlth was contident his decisions would prove aound and keep UKM protitable in 2023 and 2024. Now, atter a scoond reviow of danus's pro forma income siatements, Smith had become very arojous. He had to present a viable set of UKM's senior managamert. the following day. He thought he and his raam had explored and incloded all viable options in Janus's statements. Finally, Smith concluded the cause of the projected FY2023 and FY2024 loeses was tha averly aggressive pricing model. He decided he would present Janus's projections, highlight the ksses in spite of the cost retuations retiected and suggest heeping the SPX512 price an f850 for all of 2023 and at 5637.50 for all or 2024. The E23.9m incresse in Fr2023 revenue would turn the Z(15.2m) loss impeove the lass of ( 40.5m) to (22.6m). Smith was convinced Scot would also agree Sarah's pricing model was too aggressive. He wes certain Scote would epprove a revised SPx512 price and be receptive to a higher price tor the SPX250, which could offset the remairing projected 2024 lass. Smith felt it would take a combination of his cost rectuction effarts and higher prices to maintain UKRS's profitabiility and thus demonstrate to AHS UKM's abiity to transform itself into a competitive business isit. Appendls One: Oyervlew of the eemlconductor manufacturing procese Semicanductor devices are made from slicon, which is material refined from quartz. Silicon is first meited and grown into kng crysials (ingots). The purified silicon is sliced into wafers on which integated circuits will be pertems. As the size of en integrated circut is extremely small, hundreds, even, of circuits can be formed on a waler at the same time. Integrated clrcults (typically referred to 38 'chips' or 'dles') are an anray of transistors made tp of various connected layers, designed to perform specific operations. A glass plats (calied a reticie) is issod to pattern layer on the wafer during the fabrication process. 1. Fabrication process: blank wafers are first Insulated wht a film of oxide, then coated with a sott. light-sensitive plastic called photoreslat. The wafers are marked by a retcle and flocded with ultraviolet llght, exposing the retcole's specific circult pattern on the unmasked portion of the wafer. Exposed photoreslat hardens into the proper clrcult layer outilne. More photoresist is placed on the wafer, masked and stripped, then Implanted with chemical Impurities, or dopants, that form negative and posltive conducting zone6. Repeating these ateps bulds the necessary layers required for the Integrated carcult design to be completed on the wafer. 2 Probe process: an electrical performance test of the functions of each of the completed Integrated circultis is performed whlle each dle ls atill on the waferThe non-functioning dles are marked with Ink, the tunctioning dles are left unmarked and moved to assembly. 3 Assembly process: each dle is cut from the wafer. The good dles are placed in the cavity of a ceramlc package. The bonding pads from the dies are connected by very thin aluminium wres Into the leads of the pacicage, creating the necessary electrical connection from the chip to the package. 4. Test. the devise is tested to ensure all electrical specilloations of the Integrated circult are met. The completed, packaged semiconductor devise is now ready to be soldered to a printed circult board (FCB), which in turn will be Installed Into a computer aystem. Appendix Two: overview of the product costing servise Semiconductor of the product costing is a multi-ttep process in which marnfacturing costs meneure value added to raw material as it is processed through each siage of producticn: 1. Frat, the costs of raw materials used and the unit costs of each atage of manufacturing are established. 2 Next, raw wafer and wafer production costs are converted to dle costis. In wafer fabrication and probe, manufactured material is in wafer form. 3 Costs of the raw wafer and manulacturing in these stages are captured initizlly a6 costiwafer. In assembly, where the wafer ls cut Into dles, the unit of measures also changes to dies. Thus, to complete the costing of the final product. Which is in die form, cost'wafer must be converted to costide. 4. Finally, the unit of dle costs are accumulated in the sequence of the manufacturing process and ylelded at each stage. Yeld refers to the production units successfully manufactured in each stage. The semiconductor manufacturing process typically loses much of it production due to misprocessing or non-functioning dles. Ylelding the accumulated unit cost at each manufacturing stage applies to the cost of lost production units to the cost of good production units. At UKM, the unit procuction cost of each major manufacturing stage (wafer, fabrication, probe, assembly, test) has been determined by applying that stage's annual spending to the annual wolume of production (5ee Tables 5 and Table 6) or capachty (see Tables 12 and Table 13). Tables 6 and 7 highilght the computation of unit cost at each stage of manufacturing. In wafer, fabrication and probe, the production unit is a wafer. Unit cosi through these two stages in computed a5 a wafer cost. In assembly and test, the wafer ha5 been diced to remove the cles. The good cles contlnue through assembly; the nonfunctioning cles are clscarcled. Unit cost through these two manufacturing stages is computed as dle cost. At each stage of production, production loss (or yleid) 15 experlenced. Yleld loss 15 typlcally greatest curing probe, when each cle on the wafer is first tested to determine If it is functioning as designed. At probe, the effectiveness and quality of the wafer fabrication process, through which the multiple clrcult layers have been placed on the wafer, is revealed. In wafer fabrication, the wafers used solely for engineering testing (to ensure equipment I5 properly callbrated and not used for proctuction) are also elminated (treated similar to production yleid los5) in the calculation of wafer cost. Table 5 and Table 12 highilght the computation of product cost. The unit cost of each manufacturing stage is listed. For the raw wafer, wafer fabrication and probe, the unit cost (wafer') is converted to dle cost. The material cost is refected at the manutacturing stage at which it is introduced. To determine a final or complete product cost, the cost per cle is accumulated through each manulacturing atage and ylelded for the production loss experlenced in that slage. Ylelding the accumulated dle cost has the effect of placing the total cost of manufacturing on the good production units (or expected good production units if the total procuction capacity costing method Id ubed) Table 5 highilights the accumulation of costs the SPx512 Incurs during manufacturing. The cost and application of raw materiai can be seen at the start of wafer fabrication and assembly. Wafer to cle conversion, based on the SPx512's specification of 50 de on each wafer, Is used to compute the equlvalent de cost from the raw water and at wafer fabrication and probe. Finaly, the treatment of production loss (ylekd) can be seen throughout the costing process, as the accumulated cost at each stage of procuction is Increased by the planned or expected yleld at that stage of procuction is increased by the planned or expected ylekd at that stage, resulting in an accumulated cost that reflects the total cost of proctuction appled to the good dles produced or expected after each stage. Tobic 4: NMMN, Ine, ircame atutement. Table Ti u10M, Ine - FYZZ ascnaing aLmmary by argan antion. \begin{tabular}{|lr|} \hline Fabrication & 657,392,000 \\ Frobe & E13,000,000 \\ Assembly & 1,620,000 \\ Test & Es,100,000 \\ Tot meg. sperdlng & E90, 112,000 \\ \hline \end{tabular} Tuble 19: LXM, ine- F1Z2 uved enpwity and procen cata warlahest SPyS1I Dable.T8:UNW, ire. - gra farmu incame atatement. Tobis 20k, UWM, Ine - FYZI pro forme inesme atabement weriahect. Iobic adb. UWW, Ine - Fi2I pro forme ineame itatement werlahest Tokir 21-.uWM, Ine, -gratus apedifatian. Table 22: UOM, ine- - F123 AND FY24 engacity mainble. Before the annual year budget review, Simon Smith, UK Manufacturing's (UKM) Director of operations, was confident. While he waited for the latest financial estimates, he thought of the plan he and his staff had methodically prepared, which successfully addressed all the crises this new business unit was facing: developing competitive pricing on an ageing product, developing and marketing new products to external customers against an established market leader, reducing manufacturing costs, improving manufacturing utilisation and improving its slim levels of profitability. When Adam White, UKM's controller, solemnly delivered the requested pro forma income statements, Simon's mood changed dramatically. Instead of sustained profit, Simon was shocked to see slgnificant projected operating losses. He wondered why his extenske planning had not improved UKM's 2021 and 2022 inancial results. With less than 24 hours before he was to offer senior management a valole business plan, he felt abandoned and hopelese. Biackground UKM, a semiconductor design and marufacturing company, is a wholly owined subsidlary of Actvanced Hardware Systems, Inc. (AHS), a leading manufachurer of clent I server systems, workstations and personal compuiers. During 2021 and 2022, UKM manufactured and 501d to AHS a single product - the Server Processor {SP512} a 512 MHz, 10-nanosecond microproces60r. The SPx512 is a 75 -micron devle packaged in a 339-pin grid anay (PGA) and Is used In AHS'E servers and workstations. UKM ha5 sold AHS 150,000 units of the SP In each of the past two years. Although UKM sells entirely to lts corporate parent, the company was reculred to establish compettitie prices for lts devices by Q3 2023. Previously, the SPx512 had been sold to AHS at full cost. Establishing compettive prices was one of many changes AHS recjulred UKM to make. In 2023 , AHS planned to change all lis major business units into profit centres. UKM management felt each busines5 unit needed flexicility and Independence to react to rapldly changing market conditions. UKM belleved that if It business unlts were pront centres, they would be more accountable for their own financlal success. Ther strategles and annual performance would be more vislole and measurable as well. This change meant they could sell thelr devices to external customers using avalable manufacturing capaclty. UKM could also recover the large development costs for tuture products and control their destlny. UKM established the compettive market-sellng price of the SPX512 at B50, based on industry price I perfommance comparisons. AHS approved of this market-based method of establishing transfer prices, which ensured that AHS could purchase Intemally at a compettive price while placing the burden of cost management appropilately on UKM. Adam While, UKM's controller, prepared redsed financial statements applying the 5850 transfer poice to UKM's 2021 and 2022 shlpments (5ee Table 4). John English, UKaM's voe-predident and general manager, was pleased to see UKM had generated profits of 4.9m and E1.9m for 2021 and 2022 , respecthely, on annual revenues of 127.5m, after applying the newty established transfer price. The profit decilne in 2022 reflected the establishment and stafing of LXM's new marketing department. This department was creaded to Identify and open external market opporturitles for new products currenty under development. A5 FY2023 approaches, LKM management l5 faced with a fex pressures. AHS l5 under severe competltive pressures in thelr server and workstation product lines and is already demanding a price reduction on the SP. They also Inslst UKM remain prontable. Sarah Ahmad, head of UKM's new mariceting department, determined from Industry studles that the price / performance for microprocessors halves every 18 month5. To remain competithe, merchant semiconcuctor companies consistently were offering some comblnation of price reductions andior performance improvements, so that their procucts' price f performance (prlce per unit of speed) halved every 1.5 years. Thus, for the SPX 512 and for every CPU UKM developed and manufactured, Sarah belleved the market would require simllarly tlmed price / perfomance offerings. Sarah knew amy price reductons would requlre offsetting cost recuctions if UKM was to remaln prontable and wondered what the manufacturing organisailon was thinking. As product developament was no longer warking an any SPx512 performance improwements, Sarah computnd the essential price redkuctions on the SPX512 following the industry model. The SPX512 would continue at the f850 price through Q1 2023, then drcp to E637.50 at the start of Q22023, drop to E425.00 at the start of Q1 2024 and to 318.75 at the start of 042024 . Sarah was troubled by these prices, as she knaw AHS was requasting 150,000 units in FY2023, but coly 75,000 in FY2024. AHS indicatod it expeched a customer shitt awey from workstations and into AHS's new perschal computer ine. Appendix One presents an overview of the 8emiconductor manufacturing procese typically found in a microprocessor auppller auch as UKM. Appendix Two presente an overvlew of the product costing process used by UKM. Product cost for the SFX512 had remained constant during FY2021 and FY2022 at appraximately 2665 (see Table 5). Sarah campuled coes recuctions of spproximately 166. 26 per year (io 496.75 in FY 2023 and 332.50 in 2024) would be necessary to maintain the SPx512: current gross mangin of 22%. She wonderod if manufacturing could schisue a cost reduction thet steep. Concurrent with the SP512 pricing sctivities, Dr Khan, head of product development, sent an urgent request to English, Ahmad, Smith and Whise for 3m in funding. This funding would acoelerate the completion of an integer-only microprocessor, the SP250 and the follow-on CPU, the SPX 384 . The SPx250, a new product alresdy under developenent, could be completed wich m of the additional funding and mede avsilable for volume shipment by the begirning of FYZ023. The remsining 2m woukd be spert turing FY2023 and FY2024 to complete developoment and resdy the SPXSB4 for volume shipment by the begirning of FY2024. The SPX250, is a 256MHz,20 nancsecond CPU, manuflactured like the SPX512, using the present 384micron technology, but unlike the SPx512, the SPx250 does not have a flosting-point procassor. The elimination of the flaating-paint processer reduces the size and power roquirements of the CPU. The SPX250 and SPXXB4 can be packaged in a 168-pin grid array (PGA) that cos*s \&15, that is 835 less than the 339 PGA used by the SPX512. However, the testing parameters of the SPX250 and SPX 384 are significsently different than for the SPx512 and require a Eonn vester, which MM8M does not currently own. This E2m taster, if purchased, wil add 1.2m in annual depreciation and other diroct operating costs, and 900,000 in incremental annual support costs to the present lavel of menutacturing spending. The SPx250 and SPx384 are targesed as entry devices for AHS's personil computer businass. Top Telecommunication (TT) Ple, is the market lesder in the 394 -micren integer-only microprocessors. Their TT250 CPU (also 250MHz,20 nancseconds) sells for 500. The T7250 has just been announced with volume shipments to coincide with the beginning of UKM F FY2023. UKM's new marketing department estimases the demend for the SPx 250 from AHS and potential new extemal customers could easily exceed 1,000 units per year. To treak into this market, Sarah recommended heawy market promotion and a prion / perfocmance two times the competitions. Estimases for unit sales potential from advertising are 100,000 tor the frst 1,000, up to 500,000 for the second E1,000 and ower E1, mi for a third milion- sdvertising expenditure. With this increased pricing pressures from bath AHS and the external marketplace, product cost roduxtion became critical. This fact coupled with the requnst from product development for additionsal funding, had John Engish very concerned. He knew it was important to bring out the SPX250 and SPx 364 quickly, but the pricing pressures for their markes entrance and the pricing pressures from A.HS an the SPX512 soemed almost impossible to meet and s.ll 8chieve a proth in FY2023 and 2024 . He knew. however, if he didint maintain a profitable cperation, his tenure would be short. Reducad product costs leading to competitive manufacturing appeared to be the critical factor necessary to sustain UKM's slim profit kevels. English askot Smith, the directoc of operations, to formulate a series of recommendations for develoging and manulacturing an expanded CFU product line in FY2023 and FYZ024. He asked that the recommendatiars be completed by the ancuial two-year budget reviaw, schaduled to cammence in a month. Englsh knew that soon afeer budget review he wouki have to present a crediale business plan to UKM managemere. He worried how hecould develop a viable plan in light of the obstacles. The 5 mith's plan Simon Smith siarted tis preperetion by reviewing the detailed SPx512 product cosi (see TABLES belcw 1,2 and 3). He inmediately assembled a team comprising White fram firance, T.Q. Marcel from quality and Dian Ruby from training. The team, led by Mark Spencer, manager of wafer fabrication, conducted a cost review by activity. Simon, the John Engish, believed sigritcant cost reductions would be necessary to maintein protiablity. He hed recently taken an executive development course in activity-based costing and knew it was a prowen method for beter understanding cost structures and cost drivers, and highligiting non-value-added work. Smith was excitrd, given the sioe of the essignmere and his belief there were both cost reduction opportunities in manufacturing and necsesery improvements in the current standard cost system. He felt the cument standard cost system did not properly capture the complexity of UKME production process. He felt an ABC analysis could provide the insight nacessary to reduce the SFx512 procuct eost by the 166 marketing had roquestod. The team mapped the processes of the entire operation and than reassigned costs % the newly defined activities. The manufacturing support organisations were also better understood. Their key activities were costed, and then each w9s algned to the mianufacturing operation it supported. UKM's AEC team reset the SPx512 product cost in line with the true practical capacity of the manufacturing process. The team saw capecity u:ilisation ase a major driver of product cost. The old product costing methodolagy was bascd on the plarned utilisation of each manutactuning process with underutilised manutacturing costs abeorbed in product costs. The revisod SPx512 product cost was plensing, but not wery surpeising to Smith. it contimed his beliet in the inaccur3cies of the old costing method. The new SPX512 product cost of 2437.50 w98 E227.61 lower than the E665.11 origins cost shown by' the old system. It did not make sense to charge the SPx 512 for the cos:s of rescurces it did not consume. Smith felt he could commit immediataly to Sarah's 2023 product cost roduction request of 168. To achieve the 2024 product cost goal of 332.50, 5mith and his team looked further into the acrity-based coesing results. The ebucy clearly showed that waler fabrication was the largest area of mandfacturing coes. Smith computed that if the SFX512 waseer cost was reduced from the 2023 kevel of 3,000 weafer to 1,986 wafer, the 3 PX 512 total product cost would be lowered by 105, achieving the desired f.332.50. To obtain a water cost of 1,366, spending reductions of +2.25.5m or 38 per cent in water fabrication would have to be schieved (sea Table 1). Smith again asked Spencer to revien the fabrication area for further cost reduction opportunities. He asked Spencer to formulate a plan that could redube direat wafer fabrication spending by 25.5m (from \&.67. 4m to 41.9m ). Tobice SPX512 2023 iarget product cost analysis {SP512 gross dieiwater =512} Spencer reharned in two weaks with an altemative plan (see Table 2). His team found nominal spending opportunities by: (1) Reducing monitor wafer usage, (2) Redeslgning wafer lot handing procedures and (3) Better placement of Inspection atations. Spencer's most signiticant discovery was the ef4 per cent increase in capacity atteined by increasing equipment uptime (the tme equipment is not undergoing repair or preventive maintenance). Higher uptime, howsucr, required an anneal investmen; of 1.8m in atdicional equipmentengineers. While this irvestment would increase water tabrication spending to 269.2m, waler fabrication capacity would increase from 26,000 w. 42,700 in annual wafer starts. The increased capacity actually decreased the cost i wafer to 1,845, which was 21 lower than Paund had requested. Simon Smith dismissed Spencer's ahernative plan oizright 'Spending necded to decrease, not increaser Smish exclaimed end reiterated his request to reduce fabrication spending by 38 per cent. Smith then focused his team's cost reduction effors on packaging costs, another major cost component of the SPX512. UKM had spent dose to EA.Gmannuallyonchippackages.)HeaskedUKMrpurchasing manager, Zon, to pressure UK'H's 339 PGA suppler to lower thelr E50 prlce. Zoe told Smith she had already made this request and was reminded by the vendor that the 339 PGA was a unique design, vsed only by UKM for the SPx512. With order volumes declining by 50 per cent in a year, Zoe said it would be ditloult to keep the E50 package price from increasing. The final ares of review was the SPx 250 proposal. Smith and the teem reviewed its procuct cost, necessary menulacturing process and spending recuirements (see TABLES 14 \& 15 belowi. Smith compered the SPX250 product cost roomputed assurning all production capacity was used to manufacture the SPX250) with the product cost of the SPX512 and noted a few significant cost differences. The reduced size of the SPx250 (no floating-point processor) ifvcreased the number of dies able to be placed on esch wafer, thus rectucing the fabrication oostidie 67 per cent from the SPX512 {661.00 for the SPX512, 20.33 for the SPX250\}. The increase in the number of dies on each waffer increased the probe time, however, and increased the probe cost per wafer by 25 per cent (f500 tor the SPX.512; f625 tor the SPX.250). He was pleased with the doubling of assembly capacity resulting from the smaller package required by the SPX.250 (202,500 annual assembly starts for the SPX512 405,000 for the SPx250). The increase in assembly throughpus reduced the SPX250 assembly costs by 50 per oent. Smith was plensantly surprised at the SPX250's kower test costs. Even though the SPX250 required a new testar, the lower annual operating costs versus the SPx512, along with the recured testing time from the eliminstion of the floating-point unit, rasulted in a per unit test cost of only E5 versus 40 for the SPx 512 With the SPx250's cost structure now scundly understood, Smith could beter appreciate the high but schievable profit margins of the SP250. The margins ranged from 75 per cent during Q1-Q3 2023 to 67 per cent in Q4 2024 when the marketingrequired price reduction tock effect (see Table 3). If Spencer oauld sctieven the 1,866 wafer cost by the start of 2023 , the SP 250 ocuid obtain a very respectabile margin of 59 per cent in the second half of 2023 at the required pnice of 2125 . Using the capecity avsiable in 2023 and 2024 to produces 50,000 and 215,000 units, respectively, essily convinced Smith to fund the SPX:250 development eflort and purchase the new sester. While the product specilications for the SPx384 were nat yet avaliable, he also agreed to fund its develapment effort. He fell the SPXS84 would achieve the same product. margns the SP*260 demonstrassd. 700183 Just as Smith was comple:ing his SPx250 prockuct development maeting, Zoa called and suggested cutsourcing and then disinvesting LKCM's assembly operations. She had found an assembly house that could asscmbic the SPX250 in its requirod 168 PGA for &5 per devioe (in volume levels of 500,000 ) with equivelent yields to those UKM projected; Smith thought this idea had merit unsi he compared the E5 extemal assembly costldevice to the internal cost estimaste of 4. He quickly concluded autseurcing would only increase the overall product cost and tharefare was nat s viable option. A week before the buidget review, Smith asked Jamus to prepare new pro forms income statements for FY2022, FY2023 and FY2024. He wrated to reflect all his coef reductian targets and product-funcing lavels. He was curious to sae the levels of profit he would generate in 2023 and 2024 from: (1) The revised 3Px512 product cost, (2) The 2024-cost reduction targets in wafer fabrication and their effect on the SPX512 and SPx250, (3) the funding of the SPx.250 and SPx384; (4) The purchase of the Bonn tester the SPx250 requined, (5) The utilsation of 2023 and 2024 capacity for manufacturing the SPx 250 , (6) The adalitional advertibing expense necessary to promote the SPx.250 fully in the marketplace and (7) The selling of the SFx512 and SPx 250 using the marketing departnent pricing model. Smlth was contident his decisions would prove aound and keep UKM protitable in 2023 and 2024. Now, atter a scoond reviow of danus's pro forma income siatements, Smith had become very arojous. He had to present a viable set of UKM's senior managamert. the following day. He thought he and his raam had explored and incloded all viable options in Janus's statements. Finally, Smith concluded the cause of the projected FY2023 and FY2024 loeses was tha averly aggressive pricing model. He decided he would present Janus's projections, highlight the ksses in spite of the cost retuations retiected and suggest heeping the SPX512 price an f850 for all of 2023 and at 5637.50 for all or 2024. The E23.9m incresse in Fr2023 revenue would turn the Z(15.2m) loss impeove the lass of ( 40.5m) to (22.6m). Smith was convinced Scot would also agree Sarah's pricing model was too aggressive. He wes certain Scote would epprove a revised SPx512 price and be receptive to a higher price tor the SPX250, which could offset the remairing projected 2024 lass. Smith felt it would take a combination of his cost rectuction effarts and higher prices to maintain UKRS's profitabiility and thus demonstrate to AHS UKM's abiity to transform itself into a competitive business isit. Appendls One: Oyervlew of the eemlconductor manufacturing procese Semicanductor devices are made from slicon, which is material refined from quartz. Silicon is first meited and grown into kng crysials (ingots). The purified silicon is sliced into wafers on which integated circuits will be pertems. As the size of en integrated circut is extremely small, hundreds, even, of circuits can be formed on a waler at the same time. Integrated clrcults (typically referred to 38 'chips' or 'dles') are an anray of transistors made tp of various connected layers, designed to perform specific operations. A glass plats (calied a reticie) is issod to pattern layer on the wafer during the fabrication process. 1. Fabrication process: blank wafers are first Insulated wht a film of oxide, then coated with a sott. light-sensitive plastic called photoreslat. The wafers are marked by a retcle and flocded with ultraviolet llght, exposing the retcole's specific circult pattern on the unmasked portion of the wafer. Exposed photoreslat hardens into the proper clrcult layer outilne. More photoresist is placed on the wafer, masked and stripped, then Implanted with chemical Impurities, or dopants, that form negative and posltive conducting zone6. Repeating these ateps bulds the necessary layers required for the Integrated carcult design to be completed on the wafer. 2 Probe process: an electrical performance test of the functions of each of the completed Integrated circultis is performed whlle each dle ls atill on the waferThe non-functioning dles are marked with Ink, the tunctioning dles are left unmarked and moved to assembly. 3 Assembly process: each dle is cut from the wafer. The good dles are placed in the cavity of a ceramlc package. The bonding pads from the dies are connected by very thin aluminium wres Into the leads of the pacicage, creating the necessary electrical connection from the chip to the package. 4. Test. the devise is tested to ensure all electrical specilloations of the Integrated circult are met. The completed, packaged semiconductor devise is now ready to be soldered to a printed circult board (FCB), which in turn will be Installed Into a computer aystem. Appendix Two: overview of the product costing servise Semiconductor of the product costing is a multi-ttep process in which marnfacturing costs meneure value added to raw material as it is processed through each siage of producticn: 1. Frat, the costs of raw materials used and the unit costs of each atage of manufacturing are established. 2 Next, raw wafer and wafer production costs are converted to dle costis. In wafer fabrication and probe, manufactured material is in wafer form. 3 Costs of the raw wafer and manulacturing in these stages are captured initizlly a6 costiwafer. In assembly, where the wafer ls cut Into dles, the unit of measures also changes to dies. Thus, to complete the costing of the final product. Which is in die form, cost'wafer must be converted to costide. 4. Finally, the unit of dle costs are accumulated in the sequence of the manufacturing process and ylelded at each stage. Yeld refers to the production units successfully manufactured in each stage. The semiconductor manufacturing process typically loses much of it production due to misprocessing or non-functioning dles. Ylelding the accumulated unit cost at each manufacturing stage applies to the cost of lost production units to the cost of good production units. At UKM, the unit procuction cost of each major manufacturing stage (wafer, fabrication, probe, assembly, test) has been determined by applying that stage's annual spending to the annual wolume of production (5ee Tables 5 and Table 6) or capachty (see Tables 12 and Table 13). Tables 6 and 7 highilght the computation of unit cost at each stage of manufacturing. In wafer, fabrication and probe, the production unit is a wafer. Unit cosi through these two stages in computed a5 a wafer cost. In assembly and test, the wafer ha5 been diced to remove the cles. The good cles contlnue through assembly; the nonfunctioning cles are clscarcled. Unit cost through these two manufacturing stages is computed as dle cost. At each stage of production, production loss (or yleid) 15 experlenced. Yleld loss 15 typlcally greatest curing probe, when each cle on the wafer is first tested to determine If it is functioning as designed. At probe, the effectiveness and quality of the wafer fabrication process, through which the multiple clrcult layers have been placed on the wafer, is revealed. In wafer fabrication, the wafers used solely for engineering testing (to ensure equipment I5 properly callbrated and not used for proctuction) are also elminated (treated similar to production yleid los5) in the calculation of wafer cost. Table 5 and Table 12 highilght the computation of product cost. The unit cost of each manufacturing stage is listed. For the raw wafer, wafer fabrication and probe, the unit cost (wafer') is converted to dle cost. The material cost is refected at the manutacturing stage at which it is introduced. To determine a final or complete product cost, the cost per cle is accumulated through each manulacturing atage and ylelded for the production loss experlenced in that slage. Ylelding the accumulated dle cost has the effect of placing the total cost of manufacturing on the good production units (or expected good production units if the total procuction capacity costing method Id ubed) Table 5 highilights the accumulation of costs the SPx512 Incurs during manufacturing. The cost and application of raw materiai can be seen at the start of wafer fabrication and assembly. Wafer to cle conversion, based on the SPx512's specification of 50 de on each wafer, Is used to compute the equlvalent de cost from the raw water and at wafer fabrication and probe. Finaly, the treatment of production loss (ylekd) can be seen throughout the costing process, as the accumulated cost at each stage of procuction is Increased by the planned or expected yleld at that stage of procuction is increased by the planned or expected ylekd at that stage, resulting in an accumulated cost that reflects the total cost of proctuction appled to the good dles produced or expected after each stage. Tobic 4: NMMN, Ine, ircame atutement. Table Ti u10M, Ine - FYZZ ascnaing aLmmary by argan antion. \begin{tabular}{|lr|} \hline Fabrication & 657,392,000 \\ Frobe & E13,000,000 \\ Assembly & 1,620,000 \\ Test & Es,100,000 \\ Tot meg. sperdlng & E90, 112,000 \\ \hline \end{tabular} Tuble 19: LXM, ine- F1Z2 uved enpwity and procen cata warlahest SPyS1I Dable.T8:UNW, ire. - gra farmu incame atatement. Tobis 20k, UWM, Ine - FYZI pro forme inesme atabement weriahect. Iobic adb. UWW, Ine - Fi2I pro forme ineame itatement werlahest Tokir 21-.uWM, Ine, -gratus apedifatian. Table 22: UOM, ine- - F123 AND FY24 engacity mainble