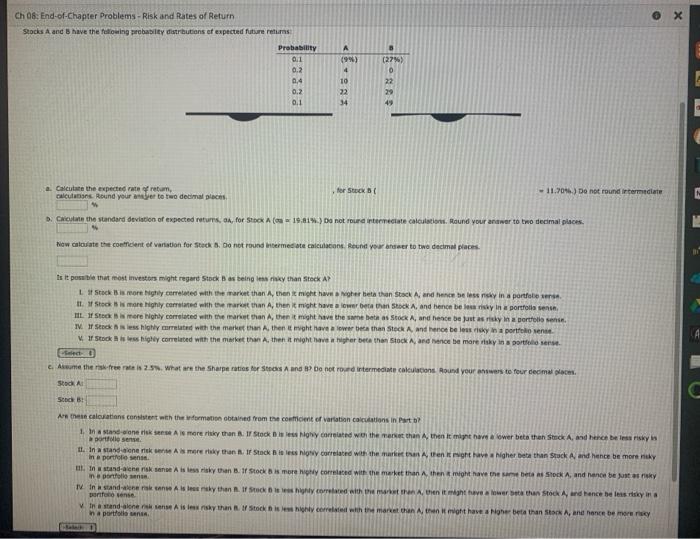

6 X Ch 08: End-of-Chapter Problems - Risk and Rates of Return Stocks A and have the following probability distributions of expected future returns Probability 0.1 0.2 A (9%) 4 (27) 0 22 29 49 10 22 34 0.2 0.1 a. Calculate the expected rate ofretum calcung Round your to two decimal places for Stock - 11.704) Do not round intermediate . Coat the standard deviation of expected returns. A for SORA (19.014.) Do not our termediate calculation. Round your anwer to two decimal places. how calculate the content of variation for Stock Do not round hermediate calculacions en weer to two decimal places Is it possible that most investors might regard Stock Bos being sky than Stock AP L Stock is more highly correlated with the market than then might have her beathan Stack and brisk in a portfeber I. Stockmore highly corrented with them than A, then it might have a lower than stock A, and hence beyin portfotissent HL Stock is more Nighly correlated with the market than A, then it might have the same het as Stock A, and hence be just as risky in a portfolio sen. I. I Stock is highly related with the market, then it might have a lower than Stock A, and hence belo visky in portfolio sense Stock is less highly correlated with the market than A, then it might have her beathan Stock and be more risky in order Et c. Assume the more reis 2.51. What are the Sharpe ratios for stress 1 und 17 do not round intermediate clousons Round your answers to four decimal oom. SA SB A escalations consistent with the formatie obtained from the content of variation calculations in Part ? 1. Indonese A more risk then. I Stock Dil Nighy are won the more than then im wower bets the A, and hence benisky porte sense 1. Instandenen Ameriky thua. If Stock is less hoy correlated with the market trenght Have Nigher beathan Stack and hence be more nuk in portreti in and acneriske A is tes risky than B. Stock is more comiated with the market than Athens might have the beta Stock A, and hence beste sky in ponton TV Instandenen is ky than . If Stacked highly correlated with then it might have were the stock and hence be less skin portfondense in a standalones sense A is less than I Stock is highly correls with the market than that might have a ghebeta than Se A, and hence be more a porta