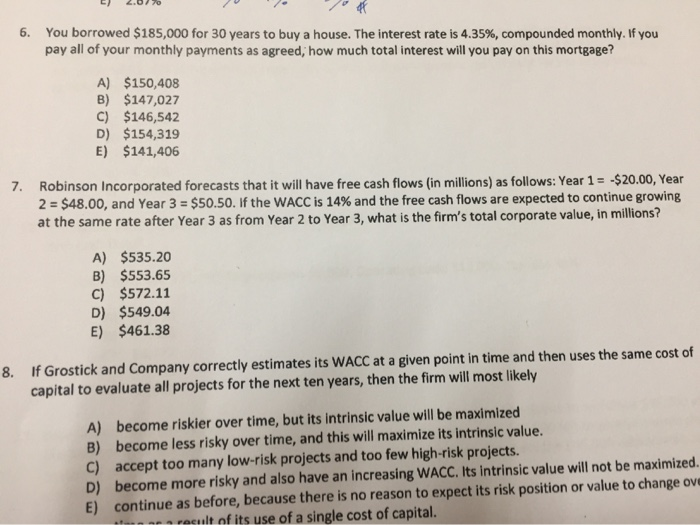

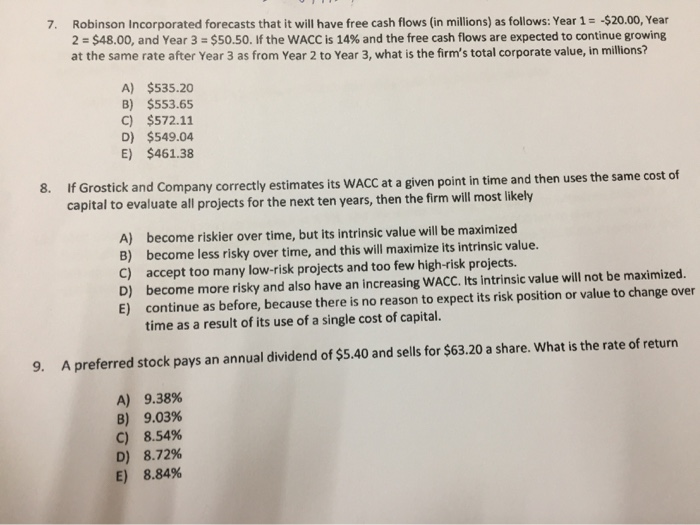

6. You borrowed $185,000 for 30 years to buy a house. The interest rate is 4.35%, compounded monthly. If you pay all of your monthly payments as agreed, how much total interest will you pay on this mortgage? A) $150,408 B) $147,027 C) $146,542 D) $154,319 E) $141,406 7. Robinson Incorporated forecasts that it will have free cash flows (in millions) as follows: Year 1 = $20.00, Year 2 = $48.00, and Year 3 = $50.50. If the WACC is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the firm's total corporate value, in millions? A) $535.20 B) $553.65 C) $572.11 D) $549.04 E) $461.38 8. If Grostick and Company correctly estimates its WACC at a given point in time and then uses the same cost of capital to evaluate all projects for the next ten years, then the firm will most likely A) become riskier over time, but its intrinsic value will be maximized B) become less risky over time, and this will maximize its intrinsic value. C) accept too many low-risk projects and too few high-risk projects. D) become more risky and also have an increasing WACC. Its intrinsic value will not be maximized. E) continue as before, because there is no reason to expect its risk position or value to change ove result of its use of a single cost of capital. 7. Robinson Incorporated forecasts that it will have free cash flows (in millions) as follows: Year 1 = -$20.00, Year 2 = $48.00, and Year 3 = $50.50. If the WACC is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the firm's total corporate value, in millions? A) $535.20 B) $553.65 C) $572.11 D) $549.04 E) $461.38 8. If Grostick and Company correctly estimates its WACC at a given point in time and then uses the same cost of capital to evaluate all projects for the next ten years, then the firm will most likely A) become riskier over time, but its intrinsic value will be maximized B) become less risky over time, and this will maximize its intrinsic value. C) accept too many low-risk projects and too few high-risk projects. D) become more risky and also have an increasing WACC. Its intrinsic value will not be maximized. E) continue as before, because there is no reason to expect its risk position or value to change over time as a result of its use of a single cost of capital. 9. A preferred stock pays an annual dividend of $5.40 and sells for $63.20 a share. What is the rate of return A) 9.38% B) 9.03% C) 8.54% D) 8.72% E) 8.84%