Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. You plan to purchase a new car with a total purchase price of $26,500. You intend to make a down payment of $3,500,

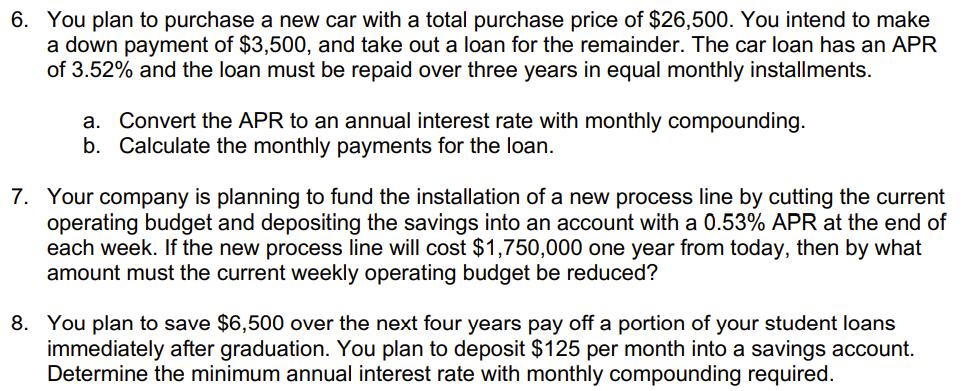

6. You plan to purchase a new car with a total purchase price of $26,500. You intend to make a down payment of $3,500, and take out a loan for the remainder. The car loan has an APR of 3.52% and the loan must be repaid over three years in equal monthly installments. a. Convert the APR to an annual interest rate with monthly compounding. b. Calculate the monthly payments for the loan. 7. Your company is planning to fund the installation of a new process line by cutting the current operating budget and depositing the savings into an account with a 0.53% APR at the end of each week. If the new process line will cost $1,750,000 one year from today, then by what amount must the current weekly operating budget be reduced? 8. You plan to save $6,500 over the next four years pay off a portion of your student loans immediately after graduation. You plan to deposit $125 per month into a savings account. Determine the minimum annual interest rate with monthly compounding required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started