Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6-01) A debt of 5,000 pesos with interest at 6% payable quarterly will be discharged, interest included, by equal payments at the end of each

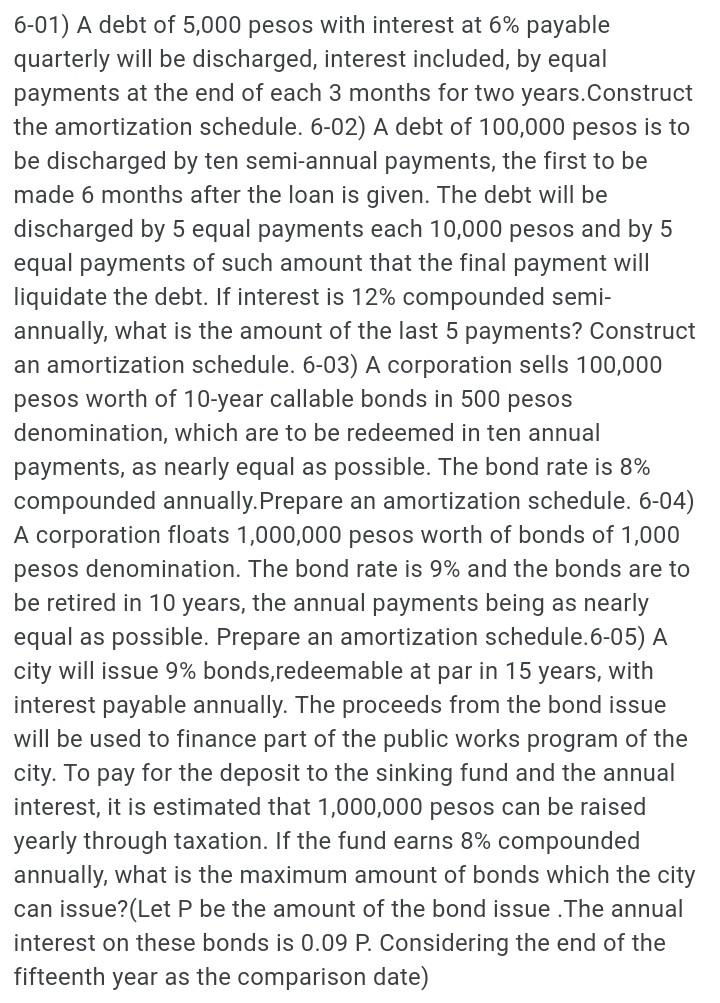

6-01) A debt of 5,000 pesos with interest at 6% payable quarterly will be discharged, interest included, by equal payments at the end of each 3 months for two years.Construct the amortization schedule. 6-02) A debt of 100,000 pesos is to be discharged by ten semi-annual payments, the first to be made 6 months after the loan is given. The debt will be discharged by 5 equal payments each 10,000 pesos and by 5 equal payments of such amount that the final payment will liquidate the debt. If interest is 12% compounded semi- annually, what is the amount of the last 5 payments? Construct an amortization schedule. 6-03) A corporation sells 100,000 pesos worth of 10-year callable bonds in 500 pesos denomination, which are to be redeemed in ten annual payments, as nearly equal as possible. The bond rate is 8% compounded annually.Prepare an amortization schedule. 6-04) A corporation floats 1,000,000 pesos worth of bonds of 1,000 pesos denomination. The bond rate is 9% and the bonds are to be retired in 10 years, the annual payments being as nearly equal as possible. Prepare an amortization schedule. 6-05) A city will issue 9% bonds,redeemable at par in 15 years, with interest payable annually. The proceeds from the bond issue will be used to finance part of the public works program of the city. To pay for the deposit to the sinking fund and the annual interest, it is estimated that 1,000,000 pesos can be raised yearly through taxation. If the fund earns 8% compounded annually, what is the maximum amount of bonds which the city can issue?(Let P be the amount of the bond issue The annual interest on these bonds is 0.09 P. Considering the end of the fifteenth year as the comparison date)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started