Answered step by step

Verified Expert Solution

Question

1 Approved Answer

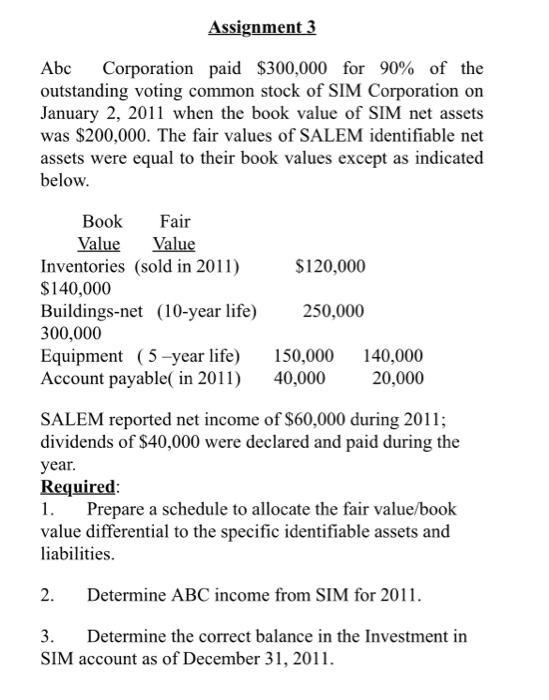

Assignment 3 Abc Corporation paid $300,000 for 90% of the outstanding voting common stock of SIM Corporation on January 2, 2011 when the book

Assignment 3 Abc Corporation paid $300,000 for 90% of the outstanding voting common stock of SIM Corporation on January 2, 2011 when the book value of SIM net assets was $200,000. The fair values of SALEM identifiable net assets were equal to their book values except as indicated below. Book Value Fair Value Inventories (sold in 2011) $140,000 Buildings-net (10-year life) $120,000 250,000 300,000 Equipment (5-year life) Account payable( in 2011) 40,000 2. 150,000 140,000 20,000 SALEM reported net income of $60,000 during 2011; dividends of $40,000 were declared and paid during the year. Required: 1. Prepare a schedule to allocate the fair value/book value differential to the specific identifiable assets and liabilities. Determine ABC income from SIM for 2011. 3. Determine the correct balance in the Investment in SIM account as of December 31, 2011.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 I Statement shows of Identifiable assets Liabilities Particulars 1 Inventories 2 B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started