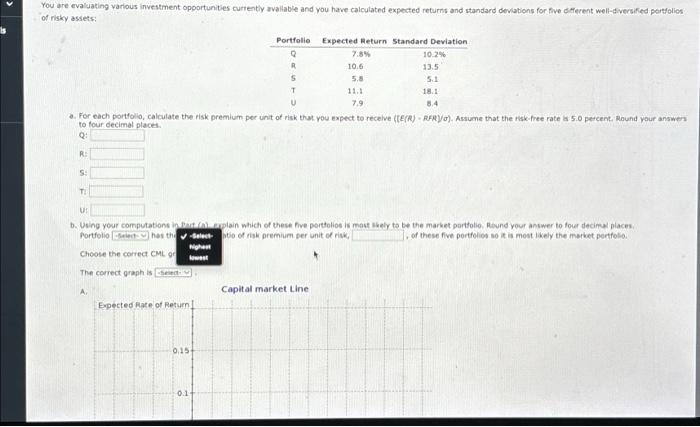

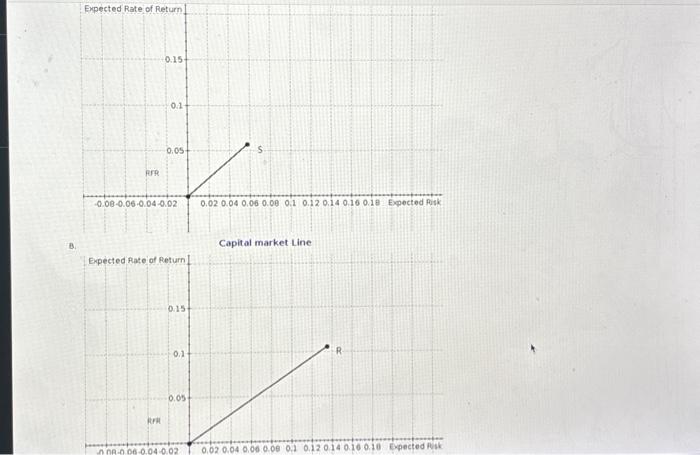

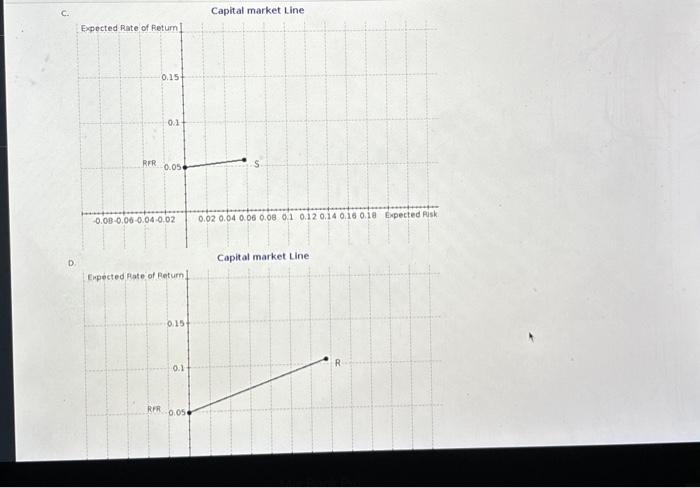

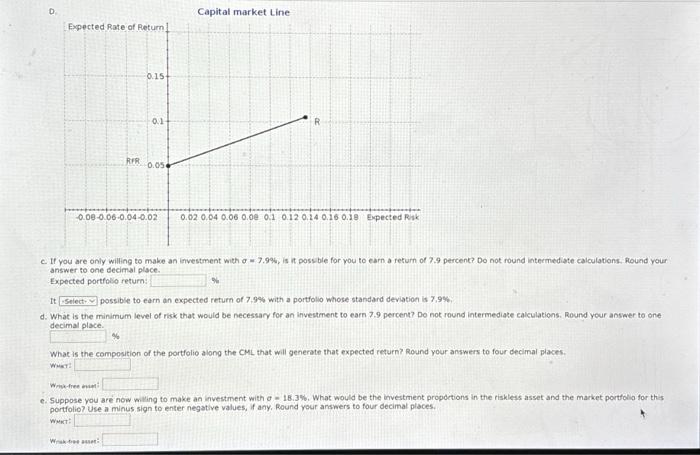

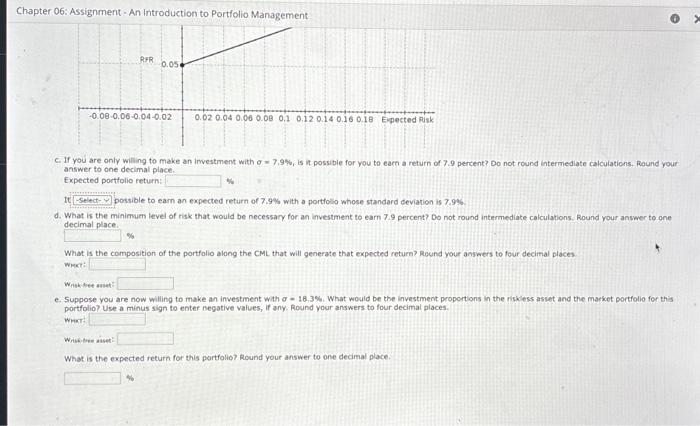

c. Capital market Line D. Capital market Line risky assets: to four decimal places. Q: R: S: T. U: Portfolio has th bo of rak premium per unit of rikk. , of these five portfolion so it is mest ikely the merket pertfolio. Choose the correct cui of The correct graph is A. Capital market Line Chapter 06: Assignment - An introduction to Portfolio Management C. If you are only willing to make an imvestment with =7.9%, is it possible for you to eam a return af 7.9 percent? Do not round intermedlate calculations. Round your answer to one decimal plach. Expected portfolio return: It possible to earn an expected return of 7.9% with a portiolio whose standard deviation is 7.9%6. d. What is the minimum level of risk that would be necessary for an investment to earn 7.9 percent? 00 not round intermediate calculations. Round vour answer to one decimal nlace. What is the combosition of the portfolio along the CML that will generate that expected return? Round your answers to four decimal places. Whet: Wrakiter wet: e. Suppose you are now willing to make an investment with =18.3%. What would be the investment proportions in the rikiless asvet and the market portfolio for this portfolio? Use a minus sign to enter pegative values, if any. Round your answers to four decimal places. Wharr: Wrikterin nust: What is the expected return for this portfolio? Round your answer to one decimal place. B. Copital market Line C. If you are only willing to make an investment with =7.9%, is it possble for you to earn a return of 7.9 percent? Do not round intermediate calculations, flound your answer to one decimal place. Expected portfolio return: It possible to earn an expected return of 7.9% with a portfolio whose standard deviation is 7,9%, d. What is the minimum level of risk that would be necessary for an investment to earn 7.9 percent? Do not round intermediate calculations. Round your answer to one dinimal nlare. What is the composition of the portfolio along the CML that will generate that expected return? Round your answers to four decimal places. wher: Whitree min: e. Suppose you are now wiling to make an investment with =18.3%. What would be the investment propdetions in the rishless asset and the market portfollo for ths portfolio? Use a minus sign to enter negative values, ff any, Round your answers to four decimal places. whrt: Wraktos asupt