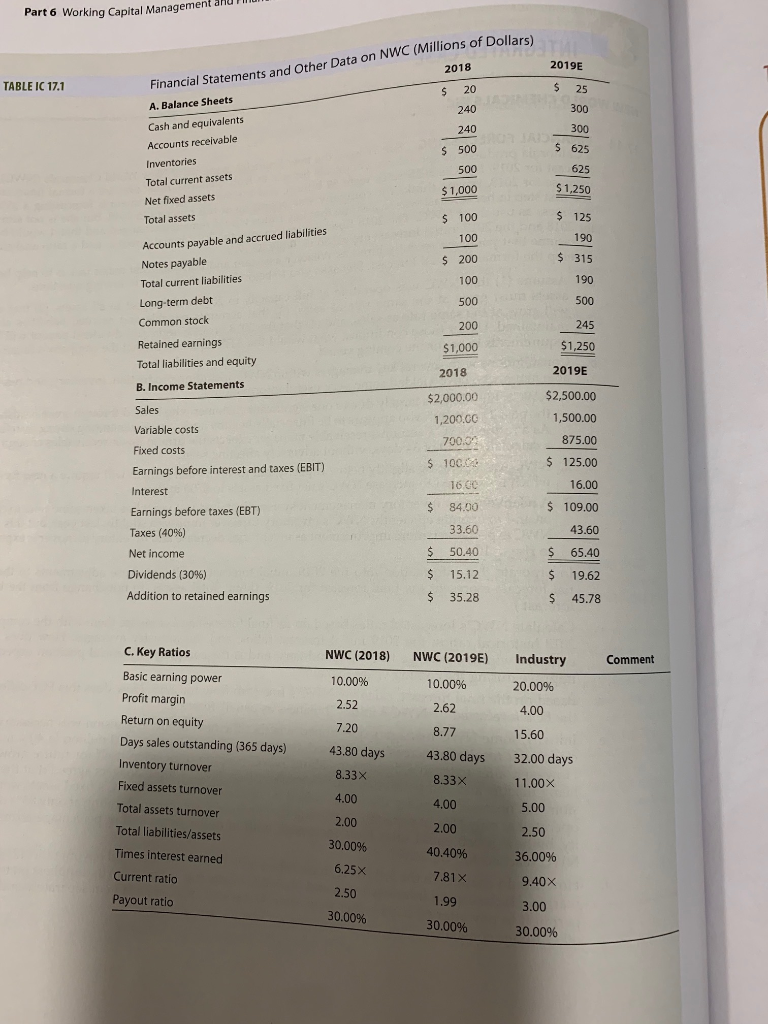

615 Chapter 17 Financial Planning and Forecasting INTEGRATED CASE NEW WORLD CHEMICALS INC FINANCI a Califor FORECASTING forecast for 2010cer of specializoilson, the new finanial manager of New World Chemicals (NWC), increase for 2019. wile The first step in her forecas s the company was o for 2018 as usual" at NWC Thassume that key ratios would remain unchanged and that it would be Assume that nitial forecast develop the formal financial forecast. She asks you to begin by answering the 17-16 C's 2018 sales were eis for use in fruit orchards, must prepare a formal financial and the marketing department is forecasting a 25%a inancial statements, the 2019 initial forecast, and a ratio analysis ere recently hired lable IC 17.1. to help her t and that your firs wing questions: task Assume (1) that NWC was operating at full y in 2018 with respect to all assets, () o assets must w at the same rate as sales, will grow at the maintained. Under the requirements to be for the coming year? rate as sales, and (4) that the 2018 profit margin and dividend payout will be onditions, what would the AFN equation predict the company's financial Consultations with several key managers within NWC, including production, inventory, and receiv- able managers, have yielded some very useful information. b 1. NWC's high DSO is largely due to one significant customer who battled through some hardships the past 2 years but who a As a result, NWC's accouars to be financially healthy again and is generating strong cash flow. a calculated DSO of 34 days without manager expects the firm to lower receivables enough for 2 NWC was operating slightly below capacity, but its forecasted growth will require a new facility, which is expected to increase NWC's net fixed assets to $700 million. 3. A relatively new adversely affecting sales. ventory management system (installed last year) has taken some time to catch on and to operate efficiently. NWC's inventory turnover improved slightly last year, but this year WC expects even more improvement as inventories decrease and inventory turnover to rise to 10x. s expected ancerporate that information into the 2019 initial forecast results, as these adjustments to the ini- tial forecast represent the final forecast for 2019. (Hint: Total assets do not change from the initial forecast.) Calculate NWC's forecasted ratios based on its final forecast and compare them with the company's 2018 historical ratios, the 2019 initial forecast ratios, and the industry averages. How does NWC compare with the average firm in its industry, and is the company's financial position expected to improve during the coming year? Explain. d. Based on the final forecast, calculate NWC's free cash flow for 2019. How does this FCF differ from the FCF forecasted by NWC's initial "business as usual" forecast? Initially, some NWC managers questioned whether the new facility expansion was necessary, espe- cially as it results in increasing i However, after extensive discussions about NWC needing to position itself for future growth and being flexible and competitive in today's marketplace, NWC's top managers agreed that the expan- sion was necessary. Among the issues raised by opponents was that NWC's fixed assets were being operated at only 85% of capacity. Assuming that its fixed assets were operating at only 85% of capac- ity, by how much could sales have increased, both in dollar terms and in percentage terms, before NWC reached full capacity? net fixed assets from $500 million to $700 million (a 40% increase) . How would changes in the following items affect the AFN: (1) the dividend payout ratio, (2) the profit f margin, (3) the capital intensity ratio, and (4) NWC beginning to buy from its suppliers on terms that permit it to pay after 60 other things constant.) (Consider each item separately and hold all rather than after 30 days Part 6 Working Capital Management aru Financial Statements and Other Data on NWC (Millions of Dollars) $ 2019E 2018 TABLE IC 17.1 20 A. Balance Sheets 300 240 Cash and equivalents 300 240 Accounts receivable 625 $ 500 Inventories 50 625 Total current assets $1,250 $1,000 Net fixed assets $ 125 100 Total assets 190 100 Accounts payable and accrued liabilities $ 315 S 200 Notes payable 190 100 Total current liabilities 500 500 Long-term debt Common stock 245 200 Retained earnings $1,250 $1,000 Total liabilities and equity 2019E 2018 B. Income Statements $2,500.00 $2,000.00 Sales 1,500.00 1,200.CC Variable costs 700.0 875.00 Fixed costs $1000 Earnings before interest and taxes (EBIT) 16 CC 16.00 Interest $ 109.00 84.00 Earnings before taxes (EBT) 33.60 43.60 Taxes (40 % ) $ 50.40 $ 65.40 Net income Dividends (30%%) $ 15.12 19.62 Addition to retained earnings 35.28 S 45.78 C. Key Ratios NWC (2018) NWC (2019E) Industry Comment Basic earning power 10.00% 10.00% 20.00% Profit margin 2.52 2.62 4.00 Return on equity 7.20 8.77 15.60 Days sales outstanding (365 days) 43.80 days 43.80 days 32.00 days Inventory turnover 8.33x 8.33X 11,00X Fixed assets turnover 4.00 4,00 Total assets turnover 5.00 2.00 2.00 Total liabilities/assets 2.50 30,00% 40.40% Times interest earned 36.00% 6.25X Current ratio 7.81X 9.40X 2.50 Payout ratio 1.99 3.00 30.00% 30.00% 30.00% 25