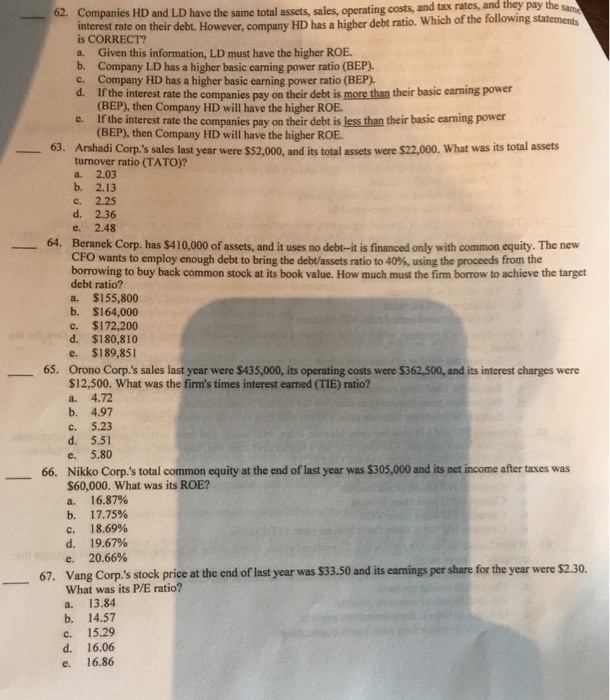

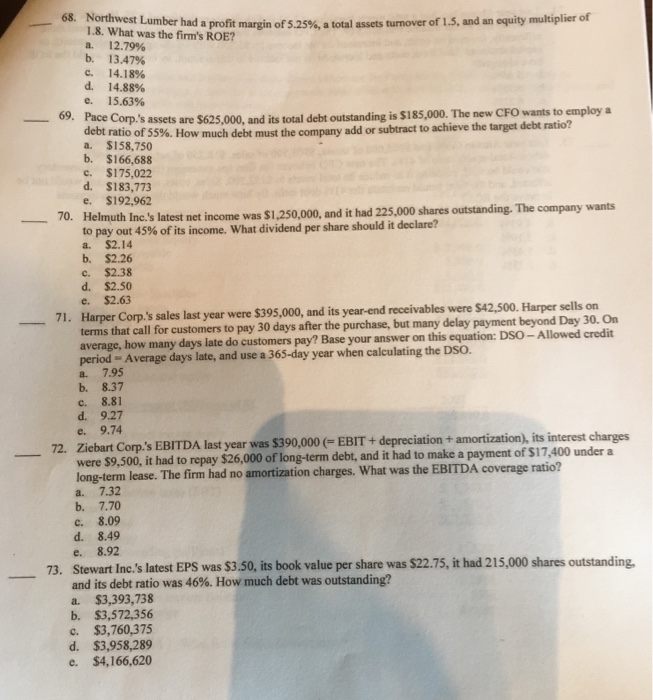

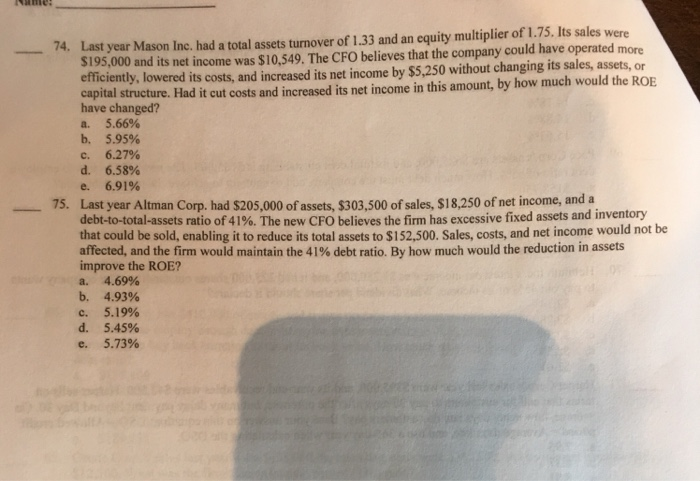

62. Companies HD and LD have the same total assets, sales, operating costs, and tax rates and they pay the sam on their debt. However, company HD has a higher debt ratio. Which of the following statement is CORRECT? Given this information, LD must have the higher ROE. b. Company LD has a higher basic earning power ratio (BEP) c. a. Company HD has a higher basic earning power ratio (BEP). d. If the interest rate the companies pay on their debt is more than their basic earning power (BEP), then Company HD will have the higher ROE. e. If the interest rate the companies pay on their debt is less than their basic earning power (BEP), then Company HD will have the higher ROE. 63. Arshadi Corp.'s sales last year were $52,000, and its total assets were $22,000. What was its total assets turnover ratio (TATO)? a. 2.03 b. 2.13 c. 2.25 d. 2.36 e. 2.48 Beranek Corp. has $410,000 of assets, and it uses no debt-it is financed only with common equity. The new CFO wants to employ enough debt to bring the debt/assets ratio to 40% using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio? a. $155,800 b. $164,000 c. $172,200 d. $180,810 e. $189,851 64. 65. Orono Corp.'s sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. What was the firm's times interest earned (TIE) ratio? a. 4.72 b. 4.97 c. 5.23 d. 5.51 e. 5.80 Nikko Corp.'s total common equity at the end of last year was $305,000 and its net income after taxes was $60,000. What was its ROE? a. 16.87% b. 17.75% 66. d. e. 18.69% 19.67% 20.66% 67. Vang Corp.'s stock price at the end of last year was $33.50 and its eamings per share for the year were $2.30. What was its P/E ratio? a. 13.84 b. 14.57 c. 15.29 d. 16.06 e. 16.86 68. 18. what wasthe firan's profit margin of 5.25%, a total assets turnover of 15, and an equity multiplier of a. b. c. d. 12.79% 13.47% 14.18% 14.88% 15.63% 69. Pace Corp's s assets are $625,000, and its total debt outstanding is S$185,000. The new CFO wants to employ a are dett ratio of 55%. How much debt must the company add or subtract to achieve the target debt ratio? a. $158,750 b. $166,688 c. $175,022 d. $183,773 e. $192,962 Helmuth Inc.'s latest net income was $1,250,000, and it had 225,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? a. $2.14 b. $2.26 C. $2.38 d. $2.50 e. $2.63 70. 71. Harper Corp's sales last year were $395,000, and its year-end receivables were $42,500. Harper sells on terms that call for customers to pay 30 days after the purchase, but many delay payment beyond Day 30. On average, how many days late do customers pay? Base your answer on this equation: DSO- Allowed credit period Average days late, and use a 365-day year when calculating the DSO. a. 7.95 b. 8.37 c. 8.81 d. 9.27 e. 9.74 72. Ziebart Corp.'s EBITDA last year was $390,000 EBIT+ depreciation + amortization), its were $9,500, it had to repay $26,000 of long-term debt, and it had to make a payment of $17,400 under long-term lease. The firm h a. 7.32 b. 7.70 ad no amortization charges. What was the EBITDA coverage ratio? c. 8.09 d. 8.49 e. 8.92 73. Stewart Inc.'s latest EPS was $3.50, its book value per share was $22.75, it had 215,000 shares outstanding, and its debt ratio was 46%. How much debt was outstanding? a. $3,393,738 b. $3,572,356 c. $3,760,375 d. $3,958,289 e. $4,166,620 Last year Mason Inc. had a total assets turnover of 1.33 and an equity multiplier of 1.75. Its sales were $195,000 74, fficiently, lowered its costs, and increased its net income by $5,250 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income in this amount, by how much would the ROE have changed? a. 5.66% b. 5.95% and its net income was $10,549. The CFO believes that the company could have operated more 6.27% 6.58% . d. e. 6.91% Last year Altman Corp. had $205,000 of assets, $303,500 of sales, $18,250 of net income, and a debt-to-total-assets ratio of 41%. The new CFO believes the firm has excessive fixed assets and inventory that could be sold, enabling it to reduce its total assets to $152,500. Sales, costs, and net income would not be affected, and he firm would maintain the 41% debt ratio. By how much would the reduction in assets improve the ROE? a. 4.69% b. 4.93% c. 5.19% d. 5.45% e. 5.73% 75