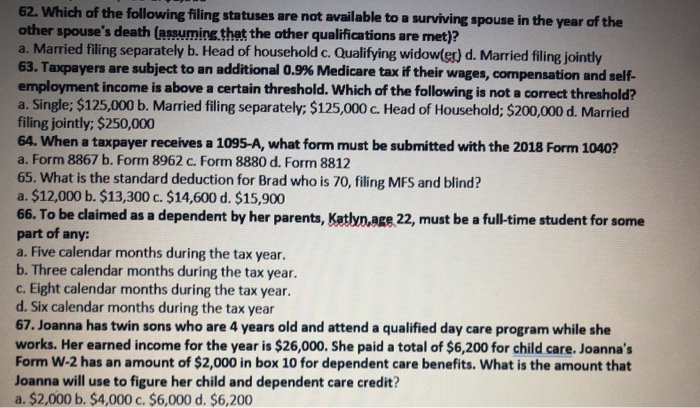

62. Which of the following filing statuses are not available to a surviving spouse in the year of the other spouse's death (assuming that the other qualifications are met)? a. Married filing separately b. Head of household c. Qualifying widow(er) d. Married filing jointly 63. Taxpayers are subject to an additional 0.9% Medicare tax if their wages, compensation and self- employment income is above a certain threshold. Which of the following is not a correct threshold? a. Single; $125,000 b. Married filing separately: $125,000 c. Head of Household; $200,000 d. Married filing jointly: $250,000 64. When a taxpayer receives a 1095-A, what form must be submitted with the 2018 Form 1040? a. Form 8867 b. Form 8962 c. Form 8880 d. Form 8812 65. What is the standard deduction for Brad who is 70, filing MFS and blind? a. $12,000 b. $13,300 c. $14,600 d. $15,900 66. To be claimed as a dependent by her parents, Katlyn,age 22, must be a full-time student for some part of any: a. Five calendar months during the tax year. b. Three calendar months during the tax year. c. Eight calendar months during the tax year. d. Six calendar months during the tax year 67. Joanna has twin sons who are 4 years old and attend a qualified day care program while she works. Her earned income for the year is $26,000. She paid a total of $6,200 for child care. Joanna's Form W-2 has an amount of $2,000 in box 10 for dependent care benefits. What is the amount that Joanna will use to figure her child and dependent care credit? a. $2,000 b. $4,000 c. $6,000 d. $6,200 62. Which of the following filing statuses are not available to a surviving spouse in the year of the other spouse's death (assuming that the other qualifications are met)? a. Married filing separately b. Head of household c. Qualifying widow(er) d. Married filing jointly 63. Taxpayers are subject to an additional 0.9% Medicare tax if their wages, compensation and self- employment income is above a certain threshold. Which of the following is not a correct threshold? a. Single; $125,000 b. Married filing separately: $125,000 c. Head of Household; $200,000 d. Married filing jointly: $250,000 64. When a taxpayer receives a 1095-A, what form must be submitted with the 2018 Form 1040? a. Form 8867 b. Form 8962 c. Form 8880 d. Form 8812 65. What is the standard deduction for Brad who is 70, filing MFS and blind? a. $12,000 b. $13,300 c. $14,600 d. $15,900 66. To be claimed as a dependent by her parents, Katlyn,age 22, must be a full-time student for some part of any: a. Five calendar months during the tax year. b. Three calendar months during the tax year. c. Eight calendar months during the tax year. d. Six calendar months during the tax year 67. Joanna has twin sons who are 4 years old and attend a qualified day care program while she works. Her earned income for the year is $26,000. She paid a total of $6,200 for child care. Joanna's Form W-2 has an amount of $2,000 in box 10 for dependent care benefits. What is the amount that Joanna will use to figure her child and dependent care credit? a. $2,000 b. $4,000 c. $6,000 d. $6,200