Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6-27. The Stengel Company has outstanding an issue of common stock, an issue of preferred stock, and an issue of mortgage bonds. The company's

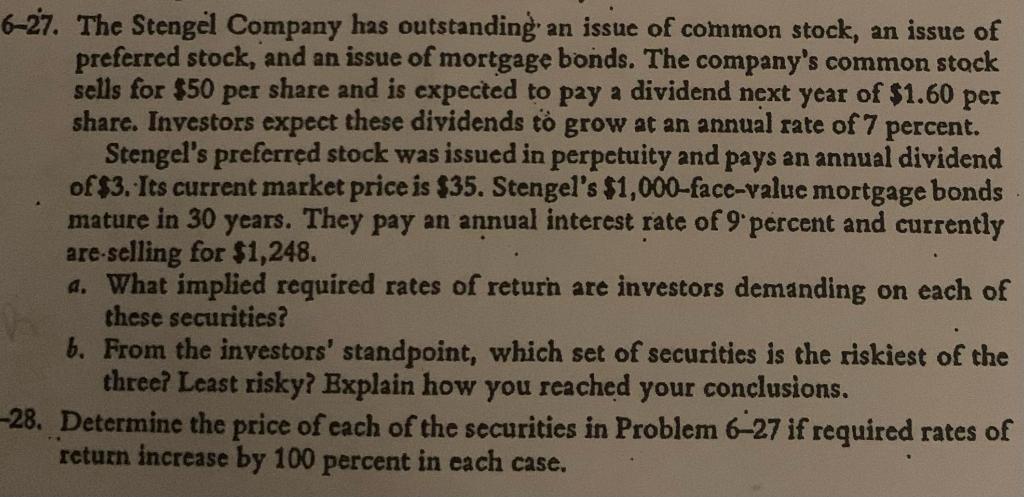

6-27. The Stengel Company has outstanding an issue of common stock, an issue of preferred stock, and an issue of mortgage bonds. The company's common stock sells for $50 per share and is expected to pay a dividend next year of $1.60 per share. Investors expect these dividends to grow at an annual rate of 7 percent. Stengel's preferred stock was issued in perpetuity and pays an annual dividend of $3. Its current market price is $35. Stengel's $1,000-face-value mortgage bonds mature in 30 years. They pay an annual interest rate of 9 percent and currently are-selling for $1,248. a. What implied required rates of return are investors demanding on each of these securities? b. From the investors' standpoint, which set of securities is the riskiest of the three? Least risky? Explain how you reached your conclusions. -28. Determine the price of each of the securities in Problem 6-27 if required rates of return increase by 100 percent in each case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started