Question

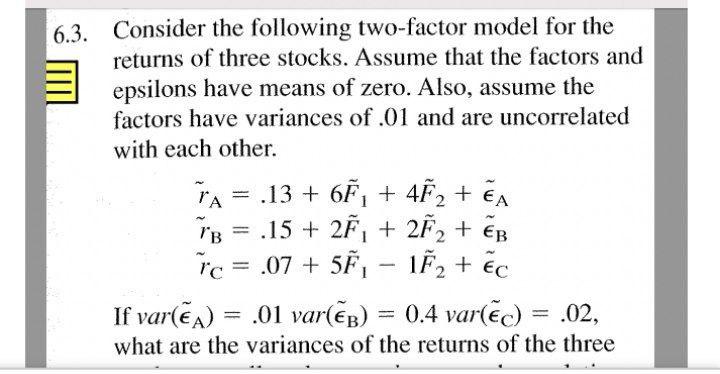

6.3. Consider the following two-factor model for the returns of three stocks. Assume that the factors and epsilons have means of zero. Also, assume

6.3. Consider the following two-factor model for the returns of three stocks. Assume that the factors and epsilons have means of zero. Also, assume the factors have variances of .01 and are uncorrelated with each other. EA TA = .13 + 6F + 4 + A TB = .15 + 2F + 2F + B rc = .07 + 5F - 1F + Ec If var(A) = .01 var(EB) = 0.4 var(ec) = .02, what are the variances of the returns of the three

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To find the variances of the returns for the three stocks we can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Probability

Authors: Mark Daniel Ward, Ellen Gundlach

1st edition

716771098, 978-1319060893, 1319060897, 978-0716771098

Students also viewed these Electrical Engineering questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App