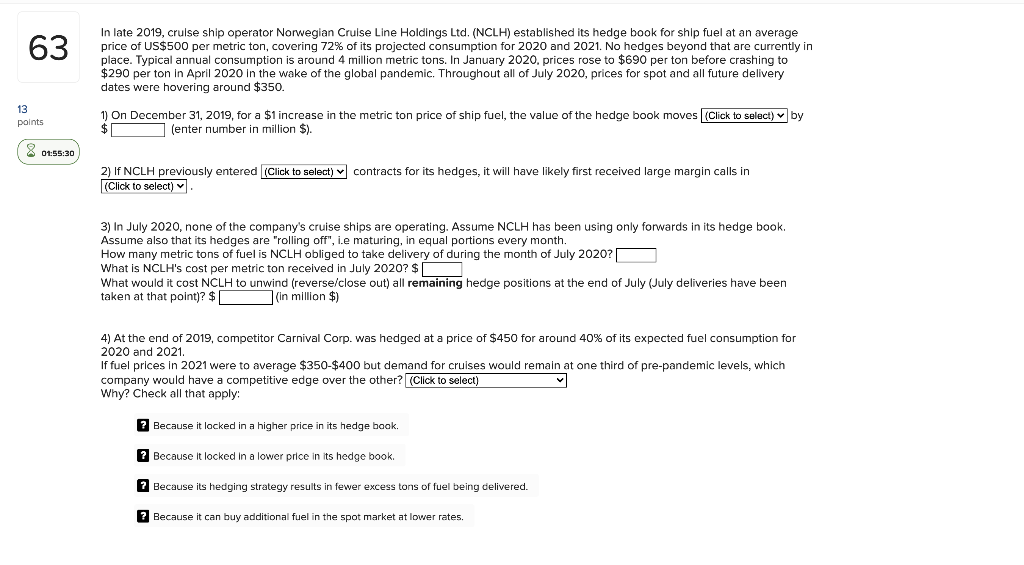

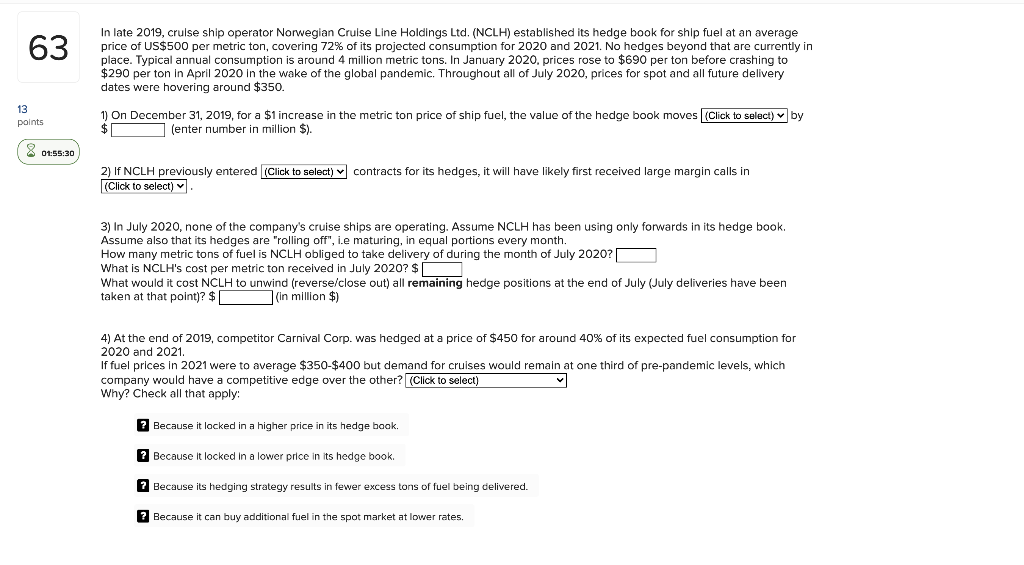

63 In late 2019, crulse ship operator Norwegian Cruise Line Holdings Ltd. (NCLH) established its hedge book for ship fuel at an average price of US$500 per metric ton, covering 72% of its projected consumption for 2020 and 2021. No hedges beyond that are currently in place. Typical annual consumption is around 4 million metric tons. In January 2020. prices rose to $690 per ton before crashing to $290 per ton in April 2020 in the wake of the global pandemic. Throughout all of July 2020, prices for spot and all future delivery dates were hovering around $350. 13 points 1) On December 31, 2019, for a $1 increase in the metric ton price of ship fuel, the value of the hedge book moves (Click to select) by (enter number in million $). 8 01:55:30 2) If NCLH previously entered (Click to select) contracts for its hedges, it will have likely first received large margin calls in (Click to select) 3) In July 2020, none of the company's cruise ships are operating. Assume NCLH has been using only forwards in its hedge book. Assume also that its hedges are "rolling off", i.e maturing, in equal portions every month. How many metric tons of fuel is NCLH obliged to take delivery of during the month of July 2020? What is NCLH's cost per metric ton received in July 2020?$| What would it cost NCLH to unwind (reverse/close out) all remaining hedge positions at the end of July (July deliveries have been taken at that point)? $(in Million $) 4) At the end of 2019, competitor Carnival Corp. was hedged at a price of $450 for around 40% of its expected fuel consumption for 2020 and 2021. If fuel prices in 2021 were to average $350-$400 but demand for cruises would remain at one third of pre-pandemic levels, which company would have a competitive edge over the other? (Click to select) Why? Check all that apply: ? Because it lacked in a higher price in its hedge book. 2 Because it locked in a lower price in its hedge book. 2 Because its hedging strategy results in fewer excess tons of fuel being delivered. Because it can buy additional fuel in the spot market at lower rates. 63 In late 2019, crulse ship operator Norwegian Cruise Line Holdings Ltd. (NCLH) established its hedge book for ship fuel at an average price of US$500 per metric ton, covering 72% of its projected consumption for 2020 and 2021. No hedges beyond that are currently in place. Typical annual consumption is around 4 million metric tons. In January 2020. prices rose to $690 per ton before crashing to $290 per ton in April 2020 in the wake of the global pandemic. Throughout all of July 2020, prices for spot and all future delivery dates were hovering around $350. 13 points 1) On December 31, 2019, for a $1 increase in the metric ton price of ship fuel, the value of the hedge book moves (Click to select) by (enter number in million $). 8 01:55:30 2) If NCLH previously entered (Click to select) contracts for its hedges, it will have likely first received large margin calls in (Click to select) 3) In July 2020, none of the company's cruise ships are operating. Assume NCLH has been using only forwards in its hedge book. Assume also that its hedges are "rolling off", i.e maturing, in equal portions every month. How many metric tons of fuel is NCLH obliged to take delivery of during the month of July 2020? What is NCLH's cost per metric ton received in July 2020?$| What would it cost NCLH to unwind (reverse/close out) all remaining hedge positions at the end of July (July deliveries have been taken at that point)? $(in Million $) 4) At the end of 2019, competitor Carnival Corp. was hedged at a price of $450 for around 40% of its expected fuel consumption for 2020 and 2021. If fuel prices in 2021 were to average $350-$400 but demand for cruises would remain at one third of pre-pandemic levels, which company would have a competitive edge over the other? (Click to select) Why? Check all that apply: ? Because it lacked in a higher price in its hedge book. 2 Because it locked in a lower price in its hedge book. 2 Because its hedging strategy results in fewer excess tons of fuel being delivered. Because it can buy additional fuel in the spot market at lower rates