Answered step by step

Verified Expert Solution

Question

1 Approved Answer

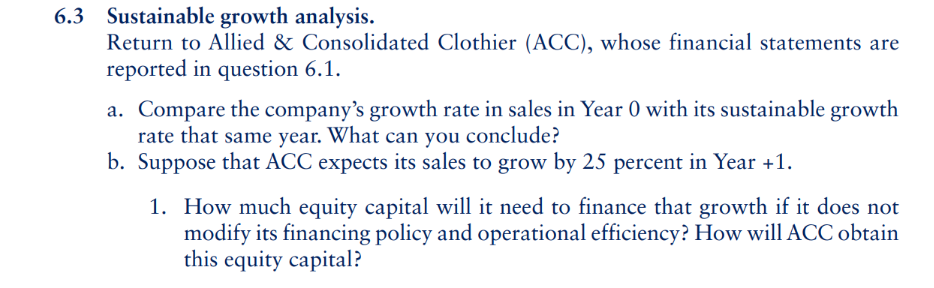

6.3 Sustainable growth analysis. Return to Allied & Consolidated Clothier (ACC), whose financial statements are reported in question 6.1 . a. Compare the company's growth

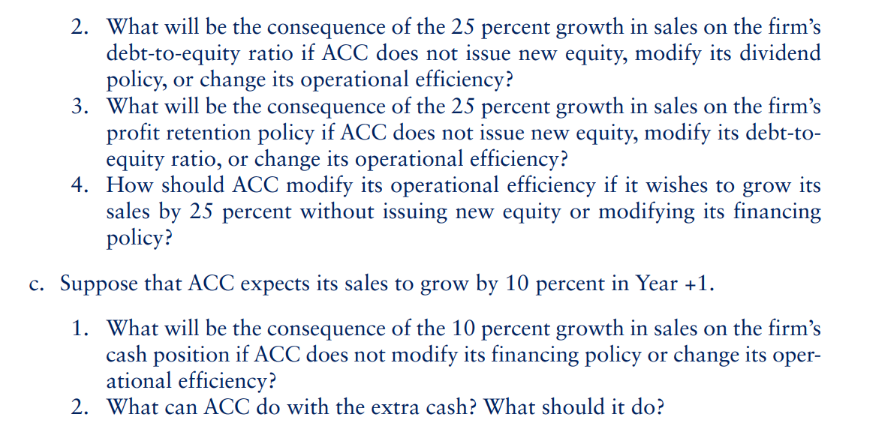

6.3 Sustainable growth analysis. Return to Allied \& Consolidated Clothier (ACC), whose financial statements are reported in question 6.1 . a. Compare the company's growth rate in sales in Year 0 with its sustainable growth rate that same year. What can you conclude? b. Suppose that ACC expects its sales to grow by 25 percent in Year +1 . 1. How much equity capital will it need to finance that growth if it does not modify its financing policy and operational efficiency? How will ACC obtain this equity capital? 2. What will be the consequence of the 25 percent growth in sales on the firm's debt-to-equity ratio if ACC does not issue new equity, modify its dividend policy, or change its operational efficiency? 3. What will be the consequence of the 25 percent growth in sales on the firm's profit retention policy if ACC does not issue new equity, modify its debt-toequity ratio, or change its operational efficiency? 4. How should ACC modify its operational efficiency if it wishes to grow its sales by 25 percent without issuing new equity or modifying its financing policy? c. Suppose that ACC expects its sales to grow by 10 percent in Year +1 . 1. What will be the consequence of the 10 percent growth in sales on the firm's cash position if ACC does not modify its financing policy or change its operational efficiency? 2. What can ACC do with the extra cash? What should it do

6.3 Sustainable growth analysis. Return to Allied \& Consolidated Clothier (ACC), whose financial statements are reported in question 6.1 . a. Compare the company's growth rate in sales in Year 0 with its sustainable growth rate that same year. What can you conclude? b. Suppose that ACC expects its sales to grow by 25 percent in Year +1 . 1. How much equity capital will it need to finance that growth if it does not modify its financing policy and operational efficiency? How will ACC obtain this equity capital? 2. What will be the consequence of the 25 percent growth in sales on the firm's debt-to-equity ratio if ACC does not issue new equity, modify its dividend policy, or change its operational efficiency? 3. What will be the consequence of the 25 percent growth in sales on the firm's profit retention policy if ACC does not issue new equity, modify its debt-toequity ratio, or change its operational efficiency? 4. How should ACC modify its operational efficiency if it wishes to grow its sales by 25 percent without issuing new equity or modifying its financing policy? c. Suppose that ACC expects its sales to grow by 10 percent in Year +1 . 1. What will be the consequence of the 10 percent growth in sales on the firm's cash position if ACC does not modify its financing policy or change its operational efficiency? 2. What can ACC do with the extra cash? What should it do Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started