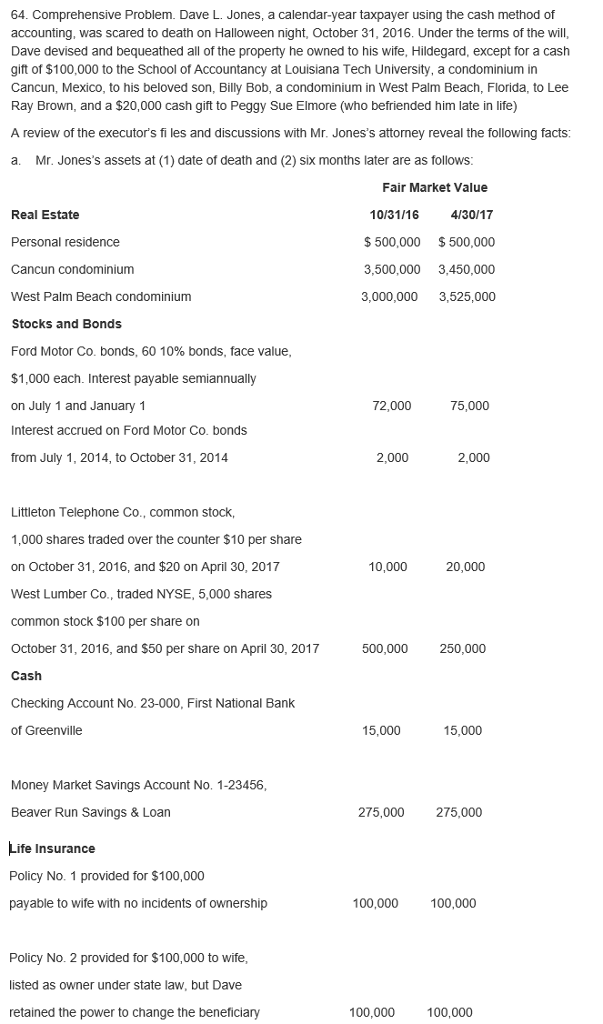

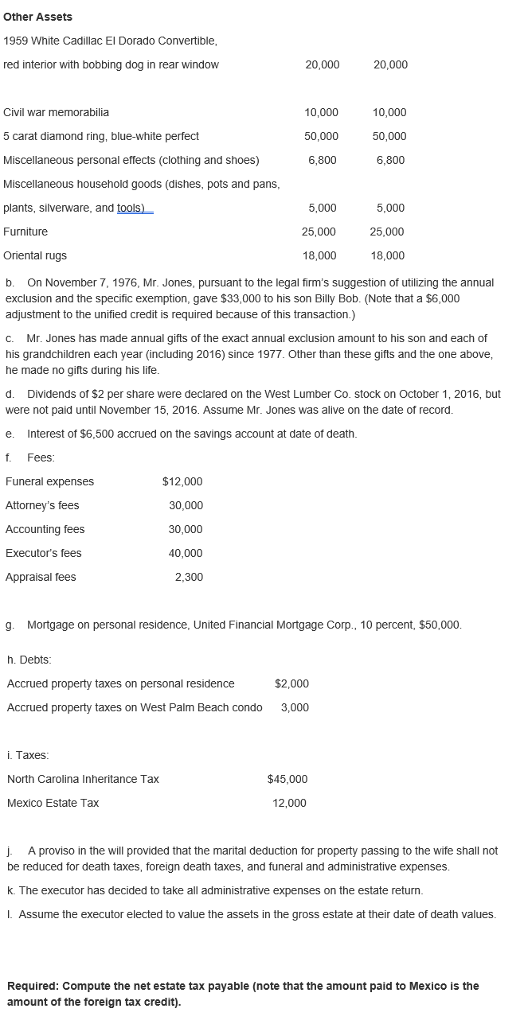

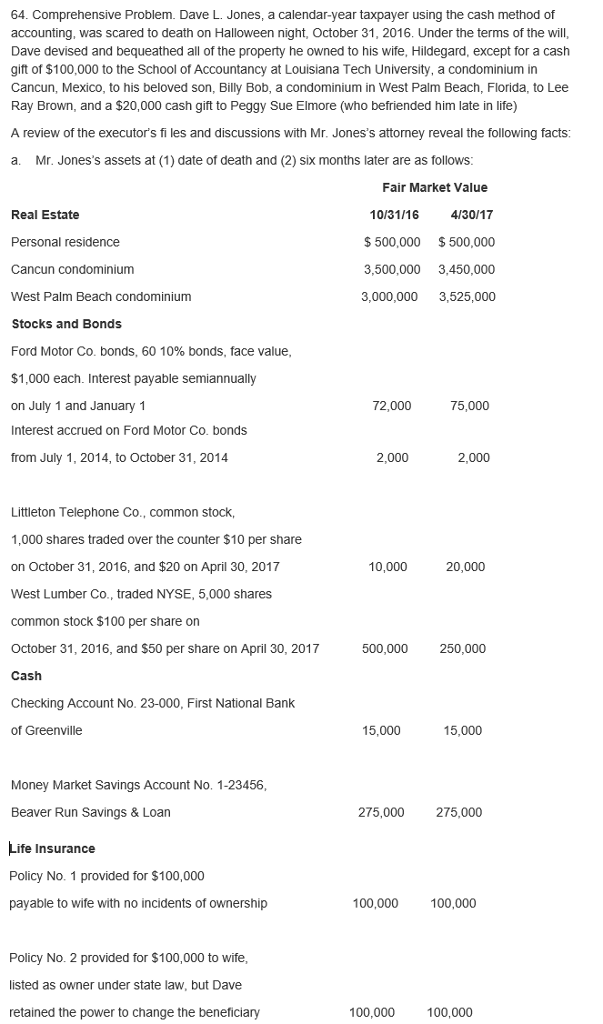

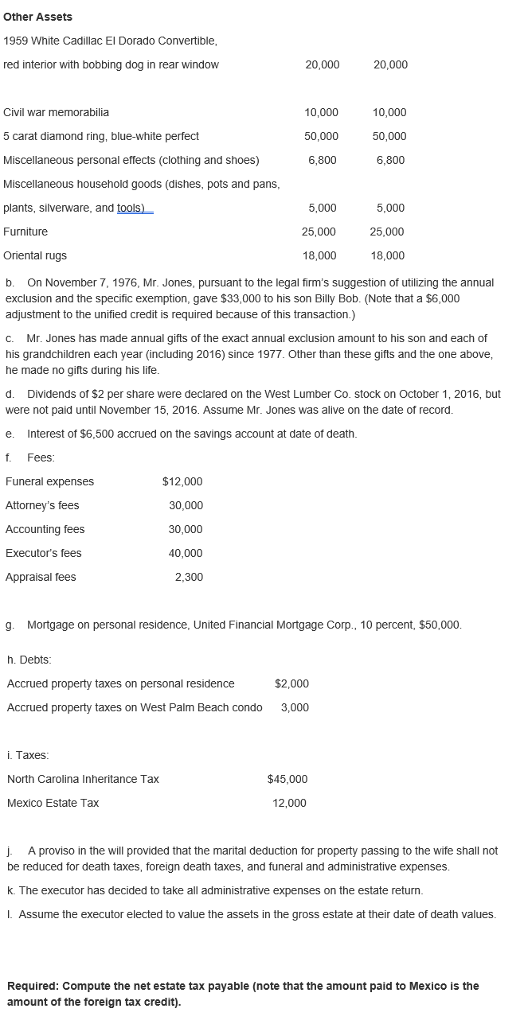

64. Comprehensive Problem. Dave L. Jones, a calendar-year taxpayer using the cash method of accounting, was scared to death on Halloween night, October 31, 2016. Under the terms of the will, Dave devised and bequeathed all of the property he owned to his wife, Hildegard, except for a cash gift of $100,000 to the School of Accountancy at Louisiana Tech University, a condominium in Cancun, Mexico, to his beloved son, Billy Bob, a condominium in West Palm Beach, Florida, to Lee Ray Brown, and a $20,000 cash gift to Peggy Sue Elmore (who befriended him late in life) A review of the executor's fi les and discussions with Mr. Jones's attorney reveal the following facts: a. Mr. Jones's assets at (1) date of death and (2) six months later are as follows Fair Market Value Real Estate Personal residence Cancun condominium West Palm Beach condominium Stocks and Bonds Ford Motor Co. bonds, 60 10% bonds, face value $1,000 each. Interest payable semiannually on July 1 and January 1 Interest accrued on Ford Motor Co. bonds from July 1, 2014, to October 31, 2014 10/31/16 4/30/17 $500,000 $500,000 3,500,000 3,450,000 3,000,000 3,525,000 72,000 75,000 2,000 2,000 Littleton Telephone Co., common stock 1,000 shares traded over the counter $10 per share on October 31, 2016, and $20 on April 30, 2017 West Lumber Co., traded NYSE, 5,000 shares common stock $100 per share on October 31, 2016, and $50 per share on April 30, 2017 Cash Checking Account No. 23-000, First National Bank of Greenville 10,000 20,000 500,000 250,000 15,000 15,000 Money Market Savings Account No. 1-23456 Beaver Run Savings & Loan Life Insurance Policy No. 1 provided for $100,000 payable to wife with no incidents of ownership 275,000 275,000 100,000 0,00 Policy No. 2 provided for $100,000 to wife listed as owner under state law, but Dave retained the power to change the beneficiary 100,000 100,000 64. Comprehensive Problem. Dave L. Jones, a calendar-year taxpayer using the cash method of accounting, was scared to death on Halloween night, October 31, 2016. Under the terms of the will, Dave devised and bequeathed all of the property he owned to his wife, Hildegard, except for a cash gift of $100,000 to the School of Accountancy at Louisiana Tech University, a condominium in Cancun, Mexico, to his beloved son, Billy Bob, a condominium in West Palm Beach, Florida, to Lee Ray Brown, and a $20,000 cash gift to Peggy Sue Elmore (who befriended him late in life) A review of the executor's fi les and discussions with Mr. Jones's attorney reveal the following facts: a. Mr. Jones's assets at (1) date of death and (2) six months later are as follows Fair Market Value Real Estate Personal residence Cancun condominium West Palm Beach condominium Stocks and Bonds Ford Motor Co. bonds, 60 10% bonds, face value $1,000 each. Interest payable semiannually on July 1 and January 1 Interest accrued on Ford Motor Co. bonds from July 1, 2014, to October 31, 2014 10/31/16 4/30/17 $500,000 $500,000 3,500,000 3,450,000 3,000,000 3,525,000 72,000 75,000 2,000 2,000 Littleton Telephone Co., common stock 1,000 shares traded over the counter $10 per share on October 31, 2016, and $20 on April 30, 2017 West Lumber Co., traded NYSE, 5,000 shares common stock $100 per share on October 31, 2016, and $50 per share on April 30, 2017 Cash Checking Account No. 23-000, First National Bank of Greenville 10,000 20,000 500,000 250,000 15,000 15,000 Money Market Savings Account No. 1-23456 Beaver Run Savings & Loan Life Insurance Policy No. 1 provided for $100,000 payable to wife with no incidents of ownership 275,000 275,000 100,000 0,00 Policy No. 2 provided for $100,000 to wife listed as owner under state law, but Dave retained the power to change the beneficiary 100,000 100,000