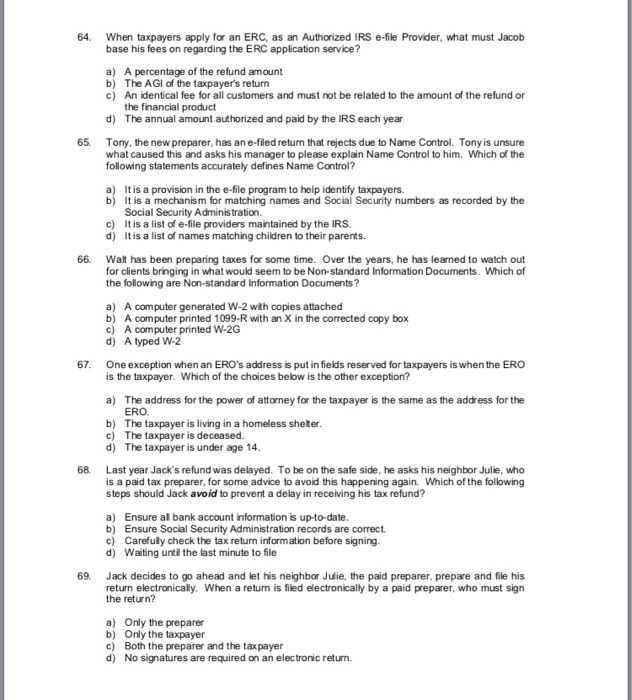

64. When taxpayers apply for an ERC, as an Authorized IRS e-file Provider, what must Jacob base his fees on regarding the ERC application service? a) A percentage of the refund amount b) The AGI of the taxpayers return c) An identical fee for all customers and must not be related to the amount of the refund or the financial product d) The annual amount authorized and paid by the IRS each year 65. Tony, the new preparer, has an e-filed return that rejects due to Name Control. Tony is unsure what caused this and asks his manager to please explain Name Control to him. Which of the following statements accurately defines Name Control? It is a provision in the e-file program to help identify taxpayers. b) a) It is a mechanism for matching names and Social Security numbers as recorded by the Social Security Adminis tration. c) tis a list of e-file providers maintained by the IRS d) tis a list of names matching children to their parents. 66. Walt has been preparing taxes for some time. Over the years, he has learned to watch out for clients bringing in what would seem to be Non-standard Information Documents. Which of the following are Non-standard Information Documents? a) A computer generated W-2 with copies attached b) A computer printed 1099-R with an X in the corrected copy box c) A computer printed W-2G d) A typed W-2 67. One exception when an ERO's address is put in fields reserved for taxpayers is when the ERCo is the taxpayer. Which of the choices below is the other exception? a) The address for the power of attorney for the taxpayer is the same as the address for the ERO. b) The taxpayer is living in a homeless sheter c) The taxpayer is deceased. d) The taxpayer is under age 14 68 Last year Jack's refund was delayed. To be on the safe side, he asks his neighbor Julie, who is a paid tax preparer, for some advice to avoid this happening again. Which of the following steps should Jack avoid to prevent a delay in receiving his tax refund? a) Ensure al bank account information is up-to-date b) Ensure Social Security Administration records are correct. c) Carefuly check the tax return information before signing d) Waiting until the last minute to file 69 Jack decides to go ahead and let his neighbor Julie, the paid preparer, prepare and file his return electronically. When a return is filed electronically by a paid preparer, who must sign the return? a) b) c) d) Only the preparer Only the taxpayer Both the preparer and the tax payer No signatures are required on an electronic return