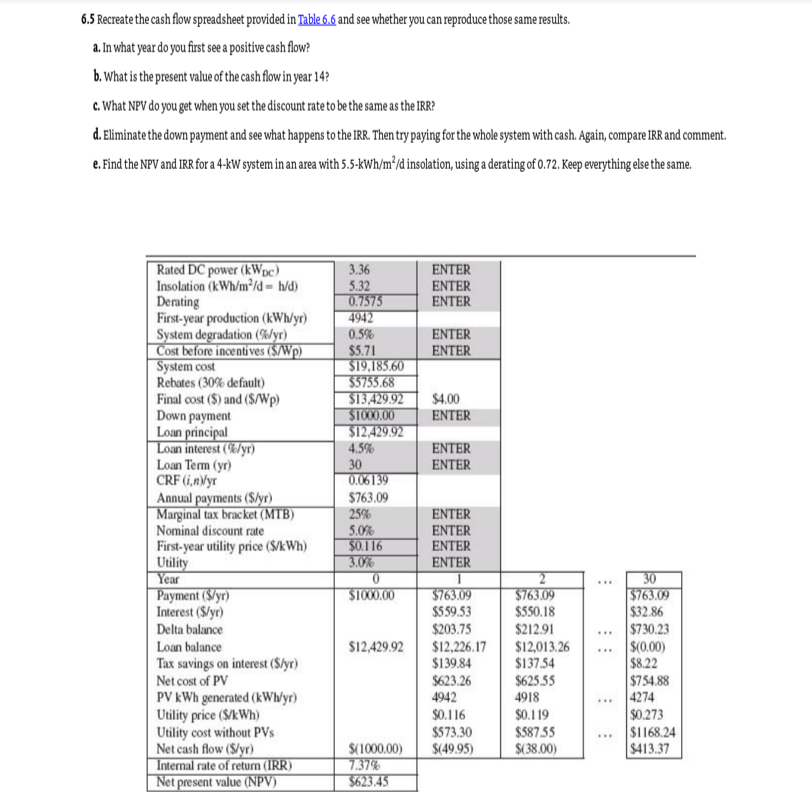

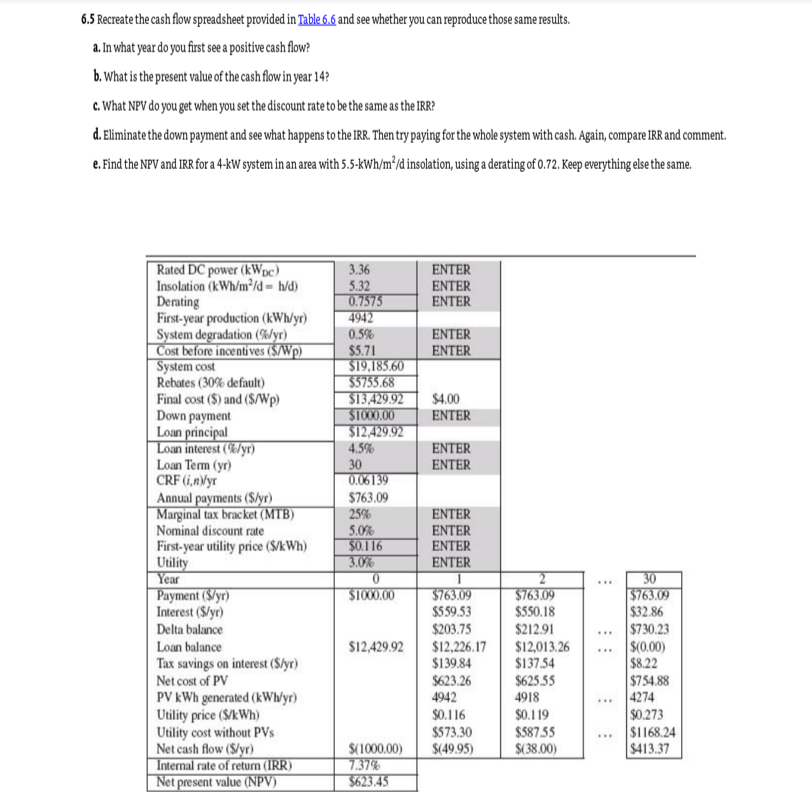

6.5 Recreate the cash flow spreadsheet provided in Table6.6 and see whether you can reproduce those same results. a.In what year do you first see a positive cash flow? b. What is the present value of the cash flow in year14 CWhat NPV do you get when you set the discount rate to be the same as the IRR? d. Eliminate the down payment and see what happens to the IRR. Then try paying for the whole system with cash.Again, compare IRR and comment. Find the NPV and IRR for a 4-kW system in an area with 5.5-kWh/m2/d insolation, using a derating of 0.72. Keep everything elsethe same. 3.36 5.32 Rated DC power (kWc) Insolation (k Wh/m2ld- h/d) Derating First-year production (kWh/yr) System ENTER 49 0.5% $5.71 tion (vr) ENTER ost before incentives ystem cost Rebates ( 30% default) Final cost (S) and (S/Wp) Down payment 4.00 45% 30 interest (Telyr ENTER Loan Term (yr) CRF i,nyr Annual 06 $763.09 25% 50% tax bracket Nominal discount rate First-year utility price (S/kWh) Utili ENTER ENTER ENTER ear yment (Syr) Interest (S/yr) Delta balance Loan balance Tax savings on interest (S/yr) Net cost of PV PV kWh generated (kWhyr) Utility price (S/kWh) Utility cost without PVs Net cash flow(S/yr) 559.53 203.75 550.18 $212.91 32.86 $730.23 12,42992 $12,226.17 $12,013.26$(0.00) 139.84 623.26 4942 0.116 573.30 8.22 754.88 $137.54 625.55 4918 0.119 587.55 $(38.00) .. 4274 0.273 $1168.24 413.37 (1000.00) $(49.95 rate of return (IRR) t present value( 6.5 Recreate the cash flow spreadsheet provided in Table6.6 and see whether you can reproduce those same results. a.In what year do you first see a positive cash flow? b. What is the present value of the cash flow in year14 CWhat NPV do you get when you set the discount rate to be the same as the IRR? d. Eliminate the down payment and see what happens to the IRR. Then try paying for the whole system with cash.Again, compare IRR and comment. Find the NPV and IRR for a 4-kW system in an area with 5.5-kWh/m2/d insolation, using a derating of 0.72. Keep everything elsethe same. 3.36 5.32 Rated DC power (kWc) Insolation (k Wh/m2ld- h/d) Derating First-year production (kWh/yr) System ENTER 49 0.5% $5.71 tion (vr) ENTER ost before incentives ystem cost Rebates ( 30% default) Final cost (S) and (S/Wp) Down payment 4.00 45% 30 interest (Telyr ENTER Loan Term (yr) CRF i,nyr Annual 06 $763.09 25% 50% tax bracket Nominal discount rate First-year utility price (S/kWh) Utili ENTER ENTER ENTER ear yment (Syr) Interest (S/yr) Delta balance Loan balance Tax savings on interest (S/yr) Net cost of PV PV kWh generated (kWhyr) Utility price (S/kWh) Utility cost without PVs Net cash flow(S/yr) 559.53 203.75 550.18 $212.91 32.86 $730.23 12,42992 $12,226.17 $12,013.26$(0.00) 139.84 623.26 4942 0.116 573.30 8.22 754.88 $137.54 625.55 4918 0.119 587.55 $(38.00) .. 4274 0.273 $1168.24 413.37 (1000.00) $(49.95 rate of return (IRR) t present value(