Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6-6 Problem 6-6A (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable

6-6

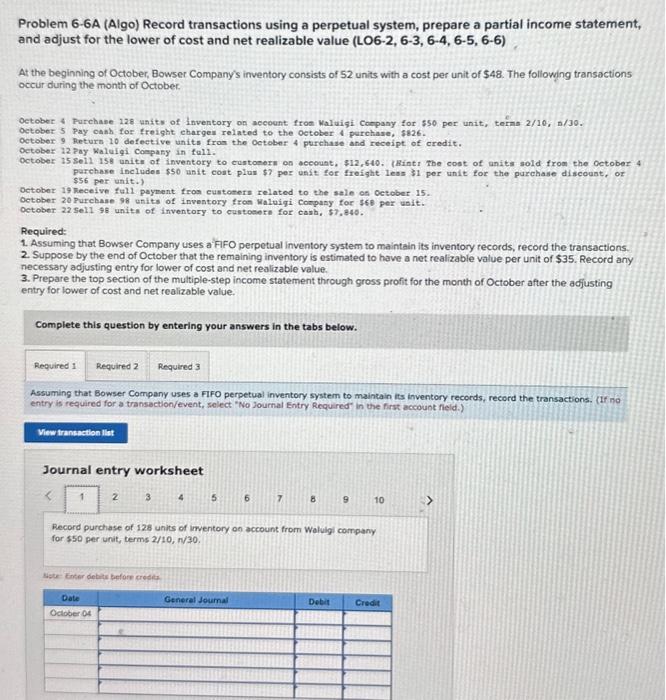

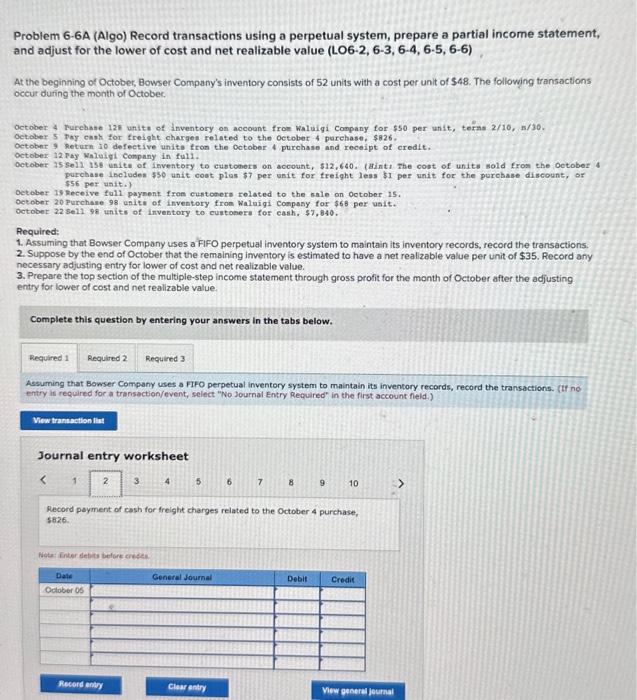

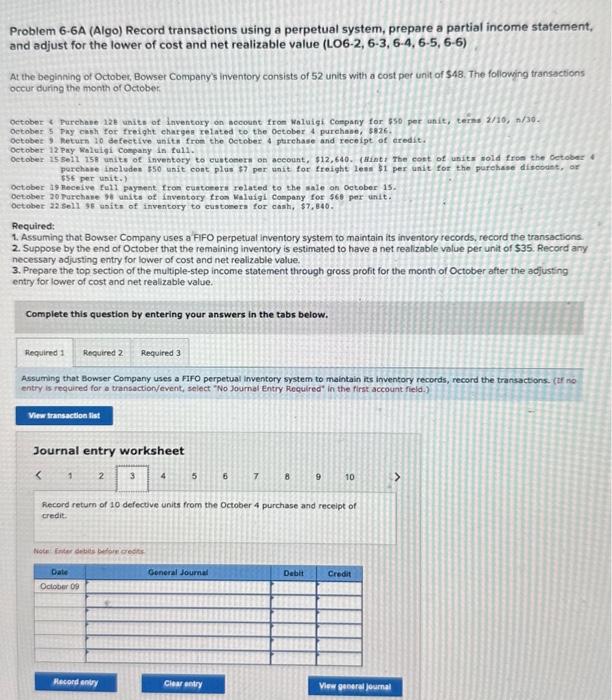

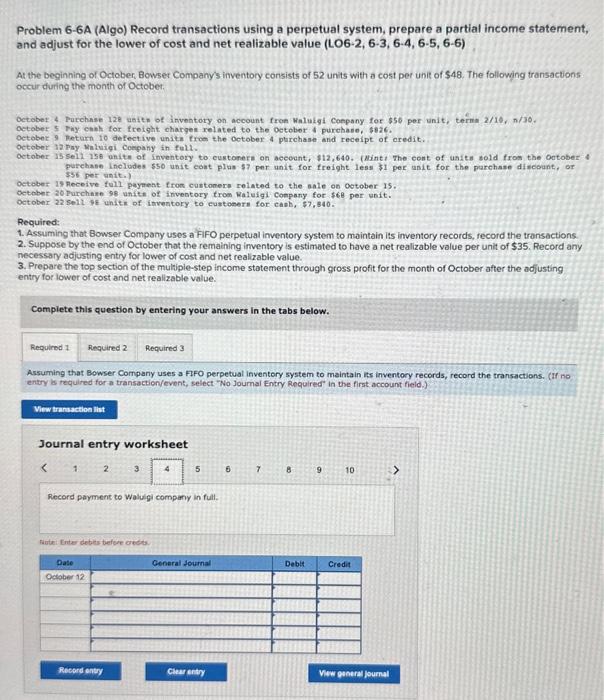

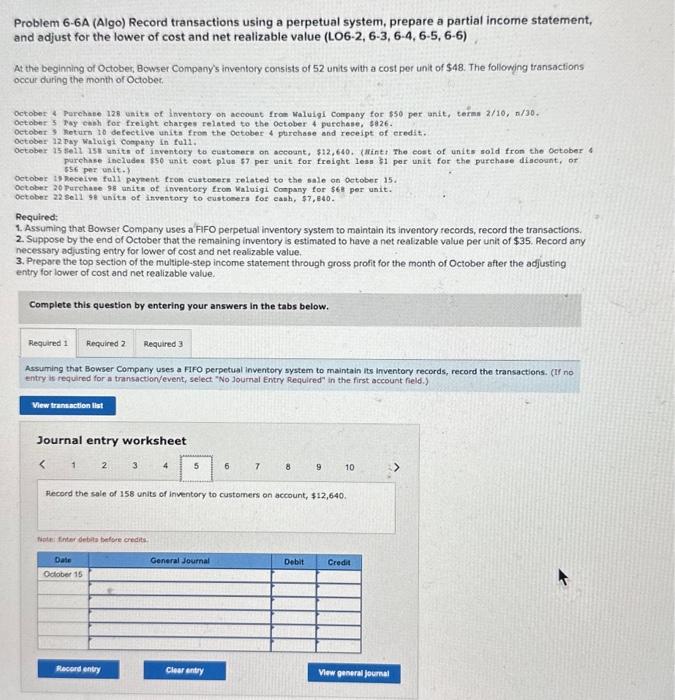

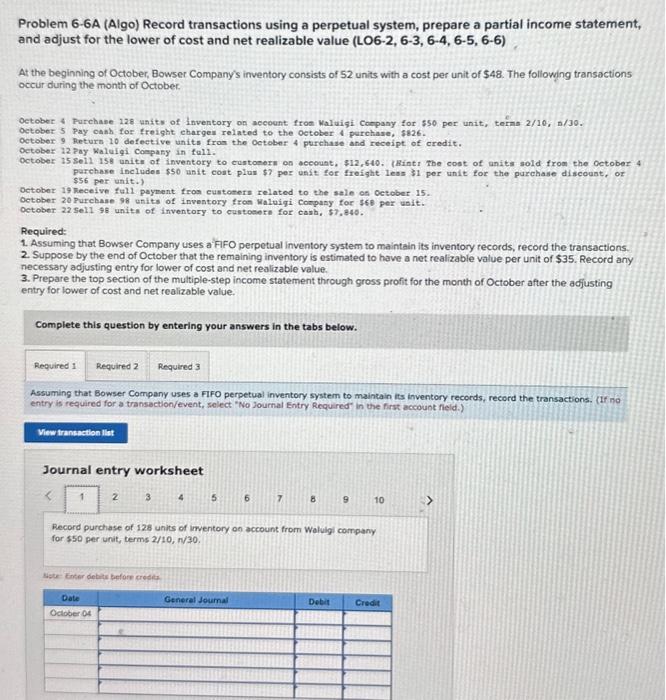

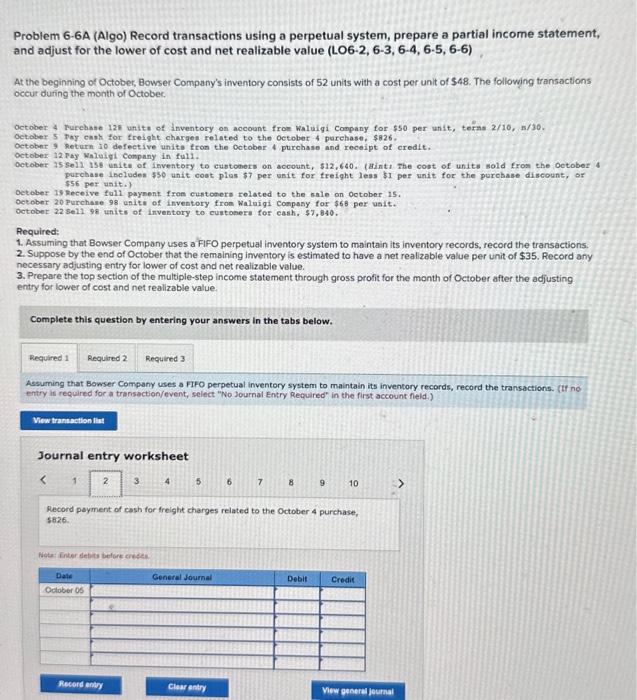

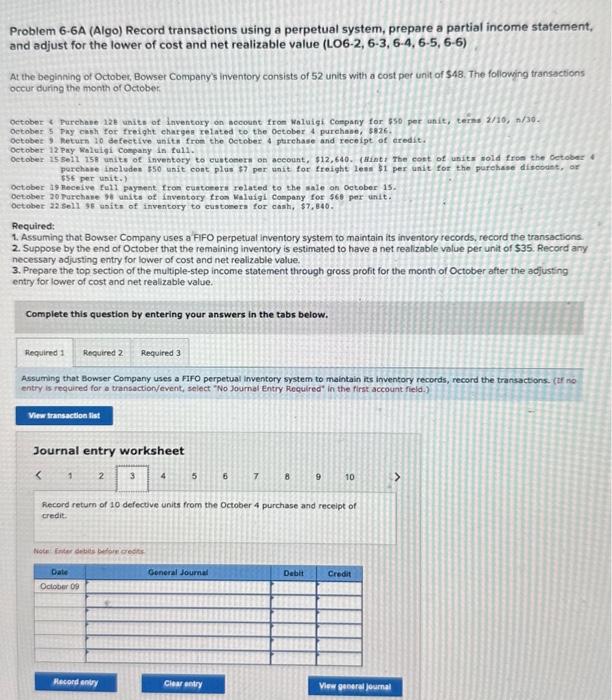

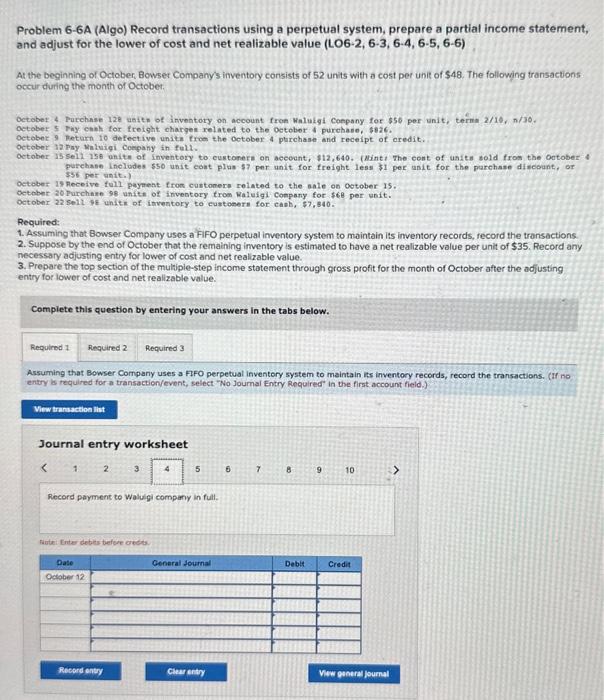

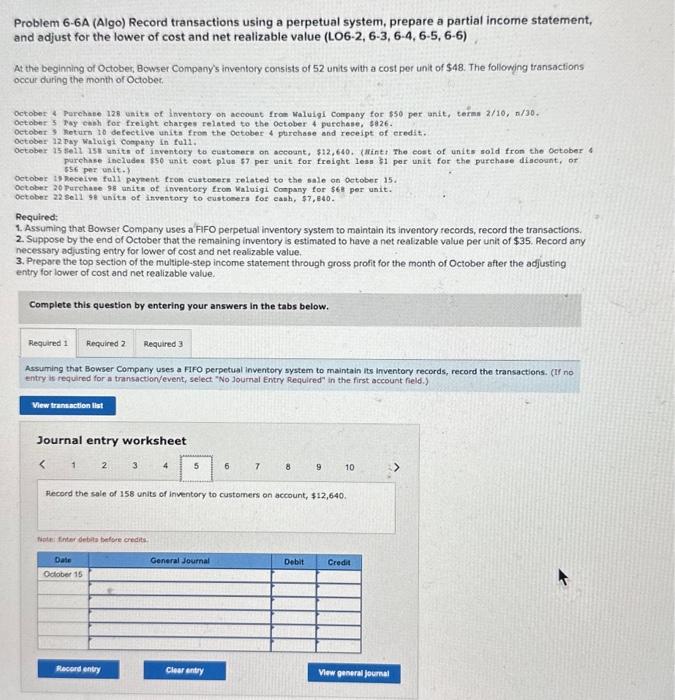

Problem 6-6A (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) At the beginning of October, Bowser Company's inventory consists of 52 units with a cost per unit of $48. The following transactions occur during the month of October. Oetober 4 Punchase 228 units of Inventory on account fron Maluigi Cenpany for 550 per unit, terms 2/10; n/30. Octobet 5 Pay oanh for Irelight ehargen related to the october 4 parchase, 5826 . October 9 Aeturn 10 defeetive units fron the Oetober 4 pturchase and receipt of credit. Getober 12 Pay Waluigi Conpany in full. October 15sel115B unit of inventory to customern on acoount, $12,540. (Bint r The cost of anits sold fron the October 4 parchase includen $50 anit cost plun $ ? per undt for frelight leas $1 per unit for the purchase discount, or $56 per unit + ) Detober 19 Teceive full payment fron customers related to the sale on oetober 15. Oetober 20 Purchase 98 units of inventory Iran Maluigi Company for $60 per usit. Oetober 22 sell 9g units of inventory to custoent for cash, 57 , 546 . Required: 1. Assuming that Bowser Company uses a FFO perpetual inventory system to maintain its inventory records, record the transactions. 2. Suppose by the end of October that the remaining inventory is estimated to have a net realizable value per unit of $35. Record any necessary adjusting entry for lower of cost and net realizable value. 3. Prepare the top section of the multiple-step income statement through gross profit for the month of October after the adjusting entry for lower of cost and net realizable value. Complete this question by entering your answers in the tabs below. Assuming that Bowser Company uses a FIFO perpetual inventory system to maintain its inventory records, record the transactions. (If no entry is required for a transaction/event, select "No Joumal Entry Required" in the first account field.) Journal entry worksheet 234567 b 9 10 Record purchase of 128 units of irventory on account from Waluigi company for $50 per unit, terms 2/10,n/30. Siste Enter debici before crostes Problem 6-6A (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) At the beginning of October, Bowser Company's inventory consists of 52 units with a cost per unit of $48. The following transactions occur dufing the month of October. Octobet 4 Turchase 121 units of inventory on account from waluigi conpany for 550 per unit, teras 2/10, B/30. Oeteber 5 Tay ensh for freight chargen related to the oetober 4 purehase, $ s.2. Octobnt 9 heturn 10 defective units fron the October 4 purchass and receipt of oredit. october 12 Thy Mnluigi conpany in ful1. october 25 seld 15 . unite of inventory to custoners on socount, 512,640 . (Aintt rhe cost of units sold fros the oetober 4 purchase Ineludes $50 unit coet plas $7 per unit for treight less $1 per unit for the purcbase diseount, or $56 per wait.) oetober 15 Receive foll payment fren custonera rolsted to the alle on ootober 15 . oetober 20 Purchase 98 unite of inventory fron Waluigi Conpany for $6b per usit. octobet 22 sel1 98 units of inventory to custonera for eash. 57,840 , Required: 1. Assuming that Bowser Company uses a FIFO perpetual inventory system to maintain its inventory records, record the transactions: 2. Suppose by the end of Cctober that the remaining imventory is estimated to have a net realizabie value per unit of $35. Record any necessary adjusting entry for lower of cost and net realizable value. 3. Prepare the top section of the multiple-step income statement through gross profit for the month of October after the adjusting entry for lower of cost and net realizable value. Complete this question by entering your answers in the tabs below. Assuming that Bowser Company uses a FIFO perpetual inventory system to maintain its inventory records, record the transactions. (If no entry is reguined for a transection/event, select "No Journal Entry Reculred" in the first account field.) Journal entry worksheet 4 5. 6 7 8 9 10 Record poyment of cash for freight charges related to the October 4 purchase, sti6. Note: Enter debly beflurk creses Problem 6.6A (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) At the beginning of Octobet, Bowser Compeny's inventory consists of 52 units with a cost per unit of $48. The foliowing transactions occur during the month of Octeber. Getober 4 Purebabe 12k units of inventory on socount from koluigi Cempany for 550 per uhit, terts 2/10, n/30. Oetober 5 Fay cash for freight ebatgeg related to the october 4 purchase, 5926 . oetobet 9 peturn 10 defective phits from the oetober 4 ptrehase and receipt of eredit. octobet 12 Pay Walulai company in full. Getober 15 Bel1 158 units of inventory to eustomern on becount, $12,640. (aint The cost of units wold fron ehe cetobet 4 percheie ineluden $50 unit cont plus $7 per woit for frolght lest $1 per unit for the purehase discoust, of 6se per unit.) October is Beceive ful1 payenct fron cuatcers related to the sale on October 15. oetober 20 Purebase 96 unite of inventory fron Waluigi conpany for 568 per unit. oetober 22 sell 58 asita of inventory to eustomers for cash, $7,840. Required: 1. Assuming that Bowser Company uses a FIFO perpetual inventory system to maintain its inventory records, record the transactions: 2. Suppose by the end of October that the remaining inventory is estimated to have a net realizable value per unit of 535 . Record any necessary adjusting entry for lower of cost and net realizable value. 3. Prepare the top section of the multiple-step income statement through gross profit for the month of October after the adjusting entry for lower of cost and net realizable value. Complete this question by entering your answers in the tabs below. Assuming that Bowser Company uses a FIFO perpetual inventory system to maintain its imventory records, record the transactions. (tI ino entry is required for a transactiondevent, select "No Joumel Entry Reculred" in the first account field.) Journal entry worksheet Problem 6-6A (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) At the beginning of October, Bowser Company's inventory consists of 52 units with a cost per unit of $48. The following transactions occur during the month of Octobet. Getobef 4 Purchnse 128 antte of inventoty on account fron Waluigi Conpany for $56 per unit, terma 2/10, n/30. actober 5 Thy enth for freight chargen related to the october 4 purchase, 5826 . october 9 peturn 10 defective unita troe the Dotober 4 ptrchase and receipt of oredit. octobet 12. Pry Maluigi Coespany in full. october 15sel2.15s units of inventory to eustoners en aececnt, $12,640, (Nint, The eent of usits sold from the Ootober 4 purchase ineludes 550 unit cobt plas 57 per unit for freight less $1 per anit for the parehsat discount, or Ss6 per pait.) Oetober is Meceive full paytent from custoners related to the anle on oetober 15. Detober 20 Turchnme 98 unita of inventory trom Kaluigi conpany for $68 per unit. october 225012 sf uniti of inventory te eustomern for cabl, $7,340. Required: 1. Assuming that Bowser Company uses a FiFO perpetual inventory system to maintain its inventory records, record the transactions. 2. Suppose by the end of October that the remaining imventory is estimated to have a net realizable value per unit of $35. Record any necessary adjusting entry for lower of cost and net realizable value. 3. Prepare the top section of the multiple-step income statement through gross profit for the month of October after the adjusting entry for lower of cost and net realizable value. Complete this question by entering your answers in the tabs below. Assuming that Bowser Company uses a HIFO perpetual inventory system to maintain its inventory records, record the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Roquired" in the first account field.) Journal entry worksheet Problem 6-6A (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) At the beginning of October, Bowser Company's inventory consists of 52 units with a cost per unit of $48. The following transactions occur during the month of Octobec. October 4 Purehate 128 unitm of inventory on account from waluigi company for 550 per anit, terma 2/10, n/30. oetober 5 Tay ewih for freight charges related to the oetober 4 purchase, 3926 . october 3 Jeturs 10 defective unit. fron the oetober 4 purehase and receipt of eredit. october 12 pwy Waluigi conpany in full. october 35 tel2 ISt wnits of isventory to eustomers on accoant, $12,640, (arint the eost of units sold fron the oetober 4 parchise included $50 unit cost plus $7 per unit for freight less $1 per unit for the purehase discount, or isf per unit. October 11 Receive ful1 payment from custeeere related to the sale on oetober 15. Octeber 20 Purchase 98 unite of investory fron Malvigi Conpany for $6g per unit. oetobet 22 sell 98 with of investory to customers for cash, $7,840. Required; 1. Assuming that Bowser Company uses a FFO perpetual inventory system to maintain its inventory fecords, record the transactions. 2. Suppose by the end of October that the remaining inventory is estimated to have a net realzable value per unit of $35, Record any necessery adjusting entry for lower of cost and net realizable value, 3. Prepore the top section of the multiple-step income statement through gross profit for the month of October after the adjusting entry for lower of cost and net realizable value. Complete this question by entering your answers in the tabs below. Assuming that Bowser Company uses a FIFO perpetual inventory system to maintain Its inventory records, record the transactions. (If no entry is required for a transactiondevent, seiect, "No Joumal Entry Required" in the first account field.) Journal entry worksheet 123 678910 Hecord the soie of 158 units of inventory to customers on account, $12,640. Fupini finter debila before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started