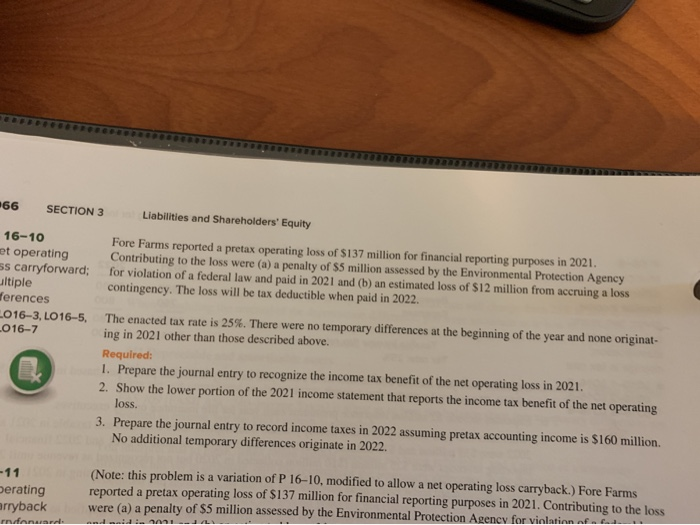

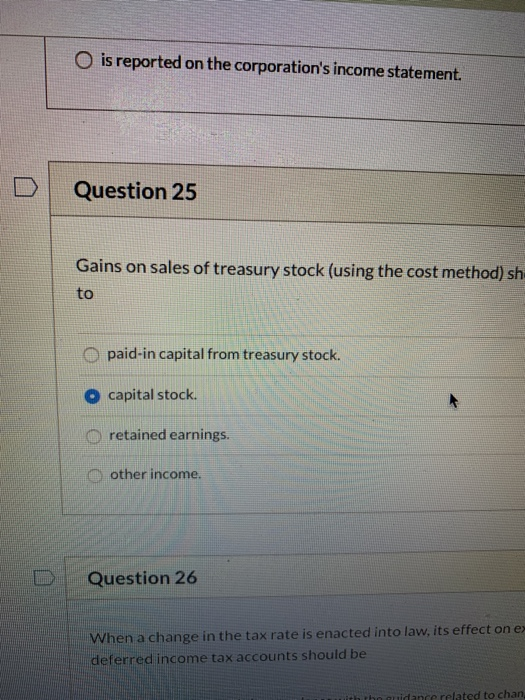

66 SECTION 3 Liabilities and Shareholders' Equity 16-10 et operating is carryforward; altiple ferences 016-3, LO16-5. 016-7 Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental Protection Agency for violation of a federal law and paid in 2021 and (b) an estimated loss of $12 million from accruing a loss contingency. The loss will be tax deductible when paid in 2022. The enacted tax rate is 25%. There were no temporary differences at the beginning of the year and none originat ing in 2021 other than those described above. Required: 1. Prepare the journal entry to recognize the income tax benefit of the net operating loss in 2021 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. 3. Prepare the journal entry to record income taxes in 2022 assuming pretax accounting income is $160 million. No additional temporary differences originate in 2022. Derating ryback (Note: this problem is a variation of P 16-10, modified to allow a net operating loss carryback.) Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental Protection Agency for violation . O is reported on the corporation's income statement. Question 25 Gains on sales of treasury stock (using the cost method) sh to paid-in capital from treasury stock. capital stock. retained earnings. other income. Question 26 When a change in the tax rate is enacted into law, its effect on deferred income tax accounts should be 66 SECTION 3 Liabilities and Shareholders' Equity 16-10 et operating is carryforward; altiple ferences 016-3, LO16-5. 016-7 Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental Protection Agency for violation of a federal law and paid in 2021 and (b) an estimated loss of $12 million from accruing a loss contingency. The loss will be tax deductible when paid in 2022. The enacted tax rate is 25%. There were no temporary differences at the beginning of the year and none originat ing in 2021 other than those described above. Required: 1. Prepare the journal entry to recognize the income tax benefit of the net operating loss in 2021 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. 3. Prepare the journal entry to record income taxes in 2022 assuming pretax accounting income is $160 million. No additional temporary differences originate in 2022. Derating ryback (Note: this problem is a variation of P 16-10, modified to allow a net operating loss carryback.) Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental Protection Agency for violation . O is reported on the corporation's income statement. Question 25 Gains on sales of treasury stock (using the cost method) sh to paid-in capital from treasury stock. capital stock. retained earnings. other income. Question 26 When a change in the tax rate is enacted into law, its effect on deferred income tax accounts should be