Answered step by step

Verified Expert Solution

Question

1 Approved Answer

66.7% (which have little or no value if not used as a farm) Planting seedling 80,000 Assets acquired or constructed during the year ended 31

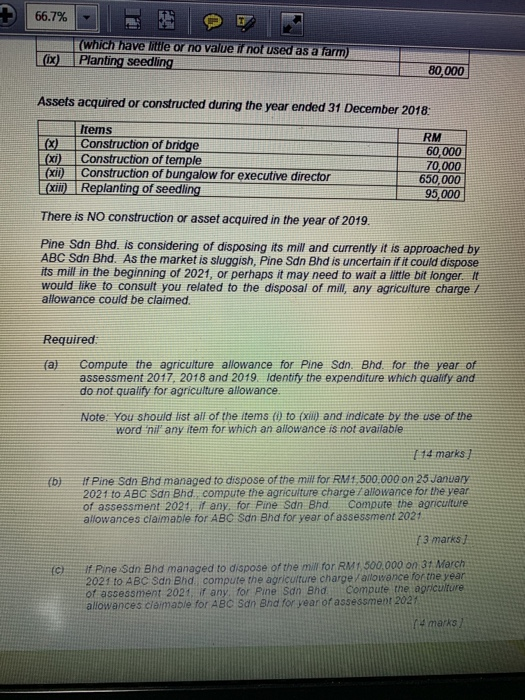

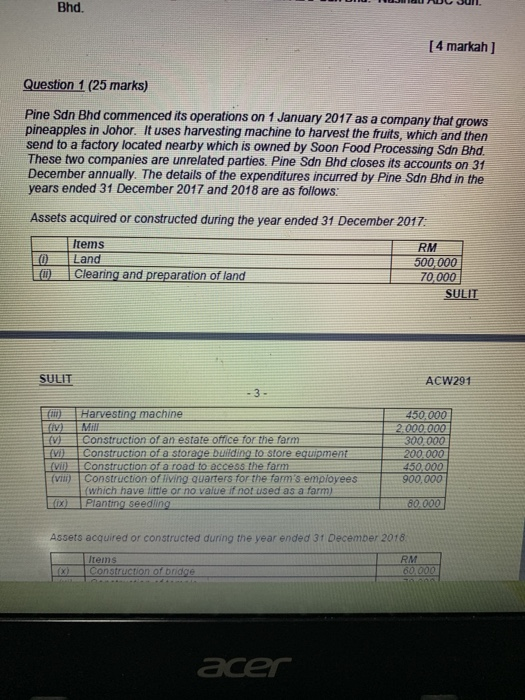

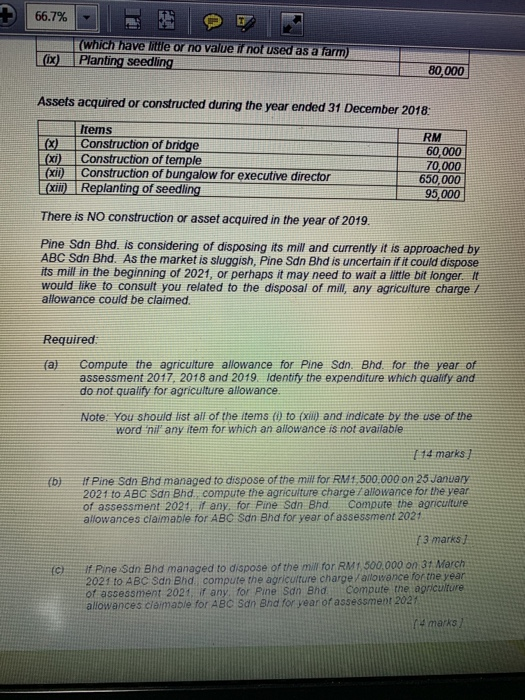

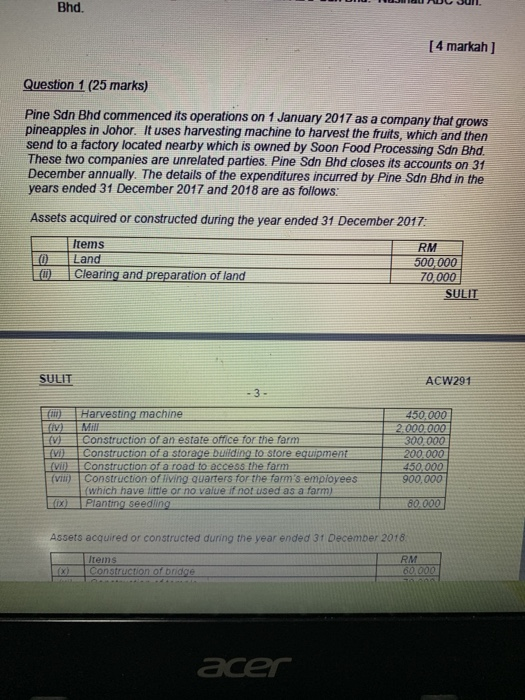

66.7% (which have little or no value if not used as a farm) Planting seedling 80,000 Assets acquired or constructed during the year ended 31 December 2018: Items Construction of bridge (xi) Construction of temple (xii) Construction of bungalow for executive director (xii) Replanting of seedling RM 60,000 70,000 650,000 95,000 There is NO construction or asset acquired in the year of 2019. Pine Sdn Bhd. is considering of disposing its mill and currently it is approached by ABC Sdn Bhd. As the market is sluggish, Pine Sdn Bhd is uncertain if it could dispose its mill in the beginning of 2021, or perhaps it may need to wait a little bit longer. It would like to consult you related to the disposal of mill, any agriculture charge / allowance could be claimed. Required: fa) Compute the agriculture allowance for Pine Sdn. Bhd. for the year of assessment 2017, 2018 and 2019. Identify the expenditure which quality and do not qualify for agriculture allowance. Note. You should list all of the items (i) to (i) and indicate by the use of the word 'nil' any item for which an allowance is not available ( 14 marks fb) If Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 25 January 2021 to ABC Sdn Bhd. compute the agriculture charge / allowance for the year of assessment 2021 / any for Pine Sdn Bhd Compute the agriculture allowances claimable for ABC Sdn Bhd for year of assessment 2021 [3 marks c) of Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 31 March 2021 to ABC Sdn Bhd, compute the agriculture charge / allowance for the year of assessment 2021, if any, for Pine Sdn Bhd Compute the agriculture allowances clamable for ABC Sdn Bhd for year of assessment 2024 (4 marks Bhd. [4 markah] Question 1 (25 marks) Pine Sdn Bhd commenced its operations on 1 January 2017 as a company that grows pineapples in Johor. It uses harvesting machine to harvest the fruits, which and then send to a factory located nearby which is owned by Soon Food Processing Sdn Bhd. These two companies are unrelated parties. Pine Sdn Bhd closes its accounts on 31 December annually. The details of the expenditures incurred by Pine Sdn Bhd in the years ended 31 December 2017 and 2018 are as follows: Assets acquired or constructed during the year ended 31 December 2017: Items Land Clearing and preparation of land RM 500,000 70,000 SULIT SULIT ACW291 3- Harvesting machine (V) Construction of an estate office for the farm Construction of a storage building to store equipment Construction of a road to access the farm (viii) Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) (ix) Planting seedling 450.000 2.000.000 300.000 200.000 450,000 900.000 80.000 Assets acquired or constructed during the year ended 31 December 2018 Items Construction of bridge RM 80.000 acer 66.7% (which have little or no value if not used as a farm) Planting seedling 80,000 Assets acquired or constructed during the year ended 31 December 2018: Items Construction of bridge (xi) Construction of temple (xii) Construction of bungalow for executive director (xii) Replanting of seedling RM 60,000 70,000 650,000 95,000 There is NO construction or asset acquired in the year of 2019. Pine Sdn Bhd. is considering of disposing its mill and currently it is approached by ABC Sdn Bhd. As the market is sluggish, Pine Sdn Bhd is uncertain if it could dispose its mill in the beginning of 2021, or perhaps it may need to wait a little bit longer. It would like to consult you related to the disposal of mill, any agriculture charge / allowance could be claimed. Required: fa) Compute the agriculture allowance for Pine Sdn. Bhd. for the year of assessment 2017, 2018 and 2019. Identify the expenditure which quality and do not qualify for agriculture allowance. Note. You should list all of the items (i) to (i) and indicate by the use of the word 'nil' any item for which an allowance is not available ( 14 marks fb) If Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 25 January 2021 to ABC Sdn Bhd. compute the agriculture charge / allowance for the year of assessment 2021 / any for Pine Sdn Bhd Compute the agriculture allowances claimable for ABC Sdn Bhd for year of assessment 2021 [3 marks c) of Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 31 March 2021 to ABC Sdn Bhd, compute the agriculture charge / allowance for the year of assessment 2021, if any, for Pine Sdn Bhd Compute the agriculture allowances clamable for ABC Sdn Bhd for year of assessment 2024 (4 marks Bhd. [4 markah] Question 1 (25 marks) Pine Sdn Bhd commenced its operations on 1 January 2017 as a company that grows pineapples in Johor. It uses harvesting machine to harvest the fruits, which and then send to a factory located nearby which is owned by Soon Food Processing Sdn Bhd. These two companies are unrelated parties. Pine Sdn Bhd closes its accounts on 31 December annually. The details of the expenditures incurred by Pine Sdn Bhd in the years ended 31 December 2017 and 2018 are as follows: Assets acquired or constructed during the year ended 31 December 2017: Items Land Clearing and preparation of land RM 500,000 70,000 SULIT SULIT ACW291 3- Harvesting machine (V) Construction of an estate office for the farm Construction of a storage building to store equipment Construction of a road to access the farm (viii) Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) (ix) Planting seedling 450.000 2.000.000 300.000 200.000 450,000 900.000 80.000 Assets acquired or constructed during the year ended 31 December 2018 Items Construction of bridge RM 80.000 acer

66.7% (which have little or no value if not used as a farm) Planting seedling 80,000 Assets acquired or constructed during the year ended 31 December 2018: Items Construction of bridge (xi) Construction of temple (xii) Construction of bungalow for executive director (xii) Replanting of seedling RM 60,000 70,000 650,000 95,000 There is NO construction or asset acquired in the year of 2019. Pine Sdn Bhd. is considering of disposing its mill and currently it is approached by ABC Sdn Bhd. As the market is sluggish, Pine Sdn Bhd is uncertain if it could dispose its mill in the beginning of 2021, or perhaps it may need to wait a little bit longer. It would like to consult you related to the disposal of mill, any agriculture charge / allowance could be claimed. Required: fa) Compute the agriculture allowance for Pine Sdn. Bhd. for the year of assessment 2017, 2018 and 2019. Identify the expenditure which quality and do not qualify for agriculture allowance. Note. You should list all of the items (i) to (i) and indicate by the use of the word 'nil' any item for which an allowance is not available ( 14 marks fb) If Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 25 January 2021 to ABC Sdn Bhd. compute the agriculture charge / allowance for the year of assessment 2021 / any for Pine Sdn Bhd Compute the agriculture allowances claimable for ABC Sdn Bhd for year of assessment 2021 [3 marks c) of Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 31 March 2021 to ABC Sdn Bhd, compute the agriculture charge / allowance for the year of assessment 2021, if any, for Pine Sdn Bhd Compute the agriculture allowances clamable for ABC Sdn Bhd for year of assessment 2024 (4 marks Bhd. [4 markah] Question 1 (25 marks) Pine Sdn Bhd commenced its operations on 1 January 2017 as a company that grows pineapples in Johor. It uses harvesting machine to harvest the fruits, which and then send to a factory located nearby which is owned by Soon Food Processing Sdn Bhd. These two companies are unrelated parties. Pine Sdn Bhd closes its accounts on 31 December annually. The details of the expenditures incurred by Pine Sdn Bhd in the years ended 31 December 2017 and 2018 are as follows: Assets acquired or constructed during the year ended 31 December 2017: Items Land Clearing and preparation of land RM 500,000 70,000 SULIT SULIT ACW291 3- Harvesting machine (V) Construction of an estate office for the farm Construction of a storage building to store equipment Construction of a road to access the farm (viii) Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) (ix) Planting seedling 450.000 2.000.000 300.000 200.000 450,000 900.000 80.000 Assets acquired or constructed during the year ended 31 December 2018 Items Construction of bridge RM 80.000 acer 66.7% (which have little or no value if not used as a farm) Planting seedling 80,000 Assets acquired or constructed during the year ended 31 December 2018: Items Construction of bridge (xi) Construction of temple (xii) Construction of bungalow for executive director (xii) Replanting of seedling RM 60,000 70,000 650,000 95,000 There is NO construction or asset acquired in the year of 2019. Pine Sdn Bhd. is considering of disposing its mill and currently it is approached by ABC Sdn Bhd. As the market is sluggish, Pine Sdn Bhd is uncertain if it could dispose its mill in the beginning of 2021, or perhaps it may need to wait a little bit longer. It would like to consult you related to the disposal of mill, any agriculture charge / allowance could be claimed. Required: fa) Compute the agriculture allowance for Pine Sdn. Bhd. for the year of assessment 2017, 2018 and 2019. Identify the expenditure which quality and do not qualify for agriculture allowance. Note. You should list all of the items (i) to (i) and indicate by the use of the word 'nil' any item for which an allowance is not available ( 14 marks fb) If Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 25 January 2021 to ABC Sdn Bhd. compute the agriculture charge / allowance for the year of assessment 2021 / any for Pine Sdn Bhd Compute the agriculture allowances claimable for ABC Sdn Bhd for year of assessment 2021 [3 marks c) of Pine Sdn Bhd managed to dispose of the mill for RM1,500,000 on 31 March 2021 to ABC Sdn Bhd, compute the agriculture charge / allowance for the year of assessment 2021, if any, for Pine Sdn Bhd Compute the agriculture allowances clamable for ABC Sdn Bhd for year of assessment 2024 (4 marks Bhd. [4 markah] Question 1 (25 marks) Pine Sdn Bhd commenced its operations on 1 January 2017 as a company that grows pineapples in Johor. It uses harvesting machine to harvest the fruits, which and then send to a factory located nearby which is owned by Soon Food Processing Sdn Bhd. These two companies are unrelated parties. Pine Sdn Bhd closes its accounts on 31 December annually. The details of the expenditures incurred by Pine Sdn Bhd in the years ended 31 December 2017 and 2018 are as follows: Assets acquired or constructed during the year ended 31 December 2017: Items Land Clearing and preparation of land RM 500,000 70,000 SULIT SULIT ACW291 3- Harvesting machine (V) Construction of an estate office for the farm Construction of a storage building to store equipment Construction of a road to access the farm (viii) Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) (ix) Planting seedling 450.000 2.000.000 300.000 200.000 450,000 900.000 80.000 Assets acquired or constructed during the year ended 31 December 2018 Items Construction of bridge RM 80.000 acer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started