Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6/8 are false. please provide explaination witb the answer. thank you! (a) Question 4 [16 points] Are the following statements true or false? If the

6/8 are false. please provide explaination witb the answer. thank you!

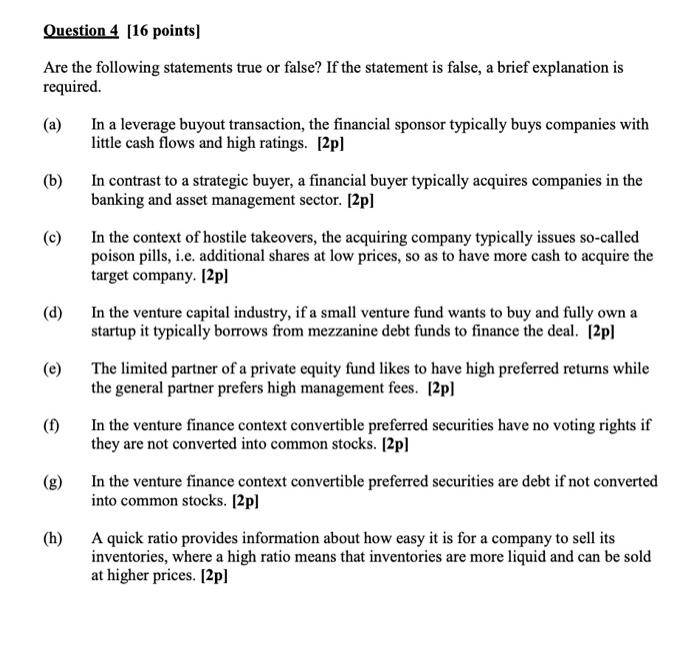

(a) Question 4 [16 points] Are the following statements true or false? If the statement is false, a brief explanation is required. In a leverage buyout transaction, the financial sponsor typically buys companies with little cash flows and high ratings. [2] (b) In contrast to a strategic buyer, a financial buyer typically acquires companies in the banking and asset management sector. [2p] (c) In the context of hostile takeovers, the acquiring company typically issues so-called poison pills, i.e. additional shares at low prices, so as to have more cash to acquire the target company. [2p] (d) In the venture capital industry, if a small venture fund wants to buy and fully own a startup it typically borrows from mezzanine debt funds to finance the deal. [2pl (e) The limited partner of a private equity fund likes to have high preferred returns while the general partner prefers high management fees. (2p) In the venture finance context convertible preferred securities have no voting rights if they are not converted into common stocks. [2] In the venture finance context convertible preferred securities are debt if not converted into common stocks. [2p] (h) A quick ratio provides information about how easy it is for a company to sell its inventories, where a high ratio means that inventories are more liquid and can be sold at higher prices. [2p] ()

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started