Pit Co. purchased 90% ownership interest of Soe Co. in 2030 at underlying book value. On that date, the fair value of non- controlling

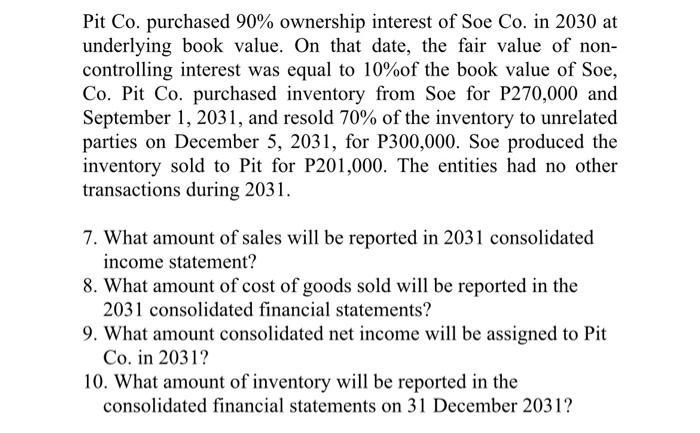

Pit Co. purchased 90% ownership interest of Soe Co. in 2030 at underlying book value. On that date, the fair value of non- controlling interest was equal to 10% of the book value of Soe, Co. Pit Co. purchased inventory from Soe for P270,000 and September 1, 2031, and resold 70% of the inventory to unrelated parties on December 5, 2031, for P300,000. Soe produced the inventory sold to Pit for P201,000. The entities had no other transactions during 2031. 7. What amount of sales will be reported in 2031 consolidated income statement? 8. What amount of cost of goods sold will be reported in the 2031 consolidated financial statements? 9. What amount consolidated net income will be assigned to Pit Co. in 2031? 10. What amount of inventory will be reported in the consolidated financial statements on 31 December 2031?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets work through the questions step by step focusing on the relevant details from the problem Given Pit Co purchased 90 of Soe Co in 2030 The noncont...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started