Answered step by step

Verified Expert Solution

Question

1 Approved Answer

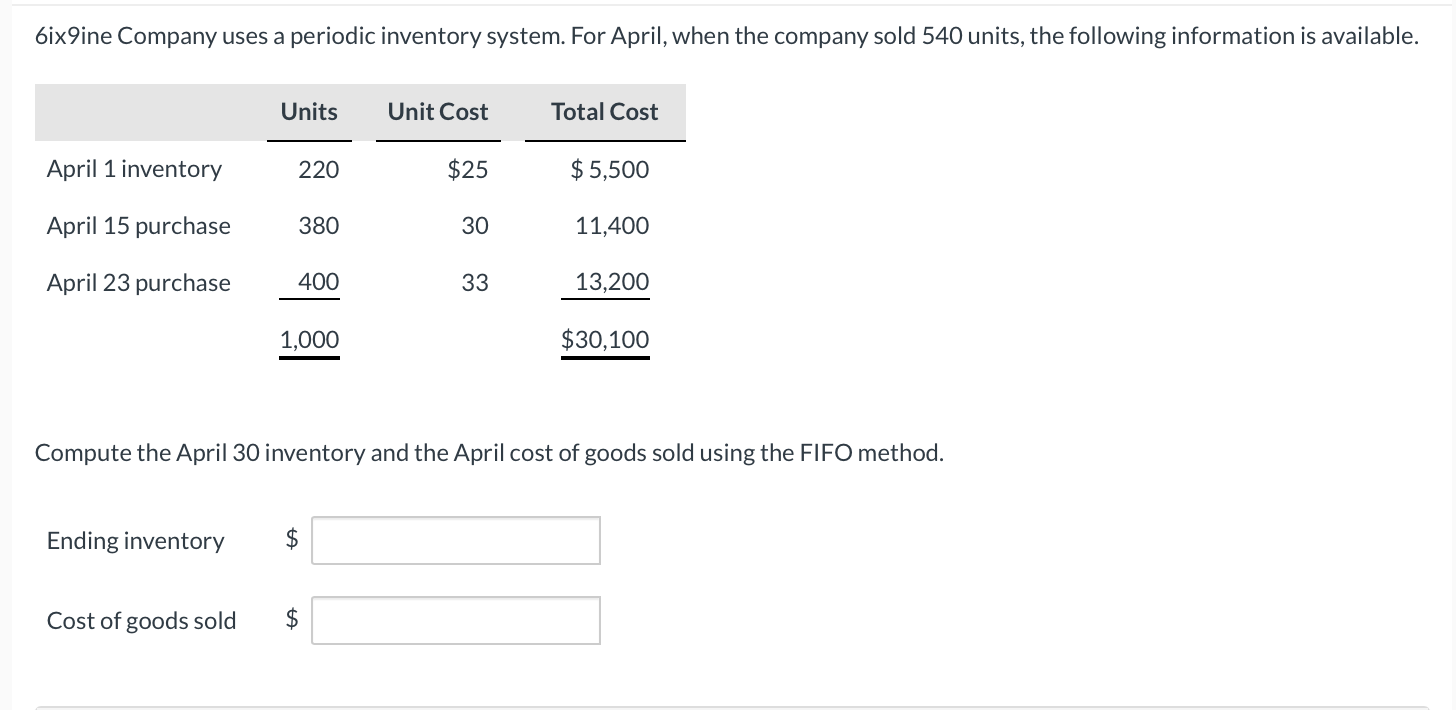

6ix9ine Company uses a periodic inventory system. For April, when the company sold 540 units, the following information is available. Units Unit Cost Total

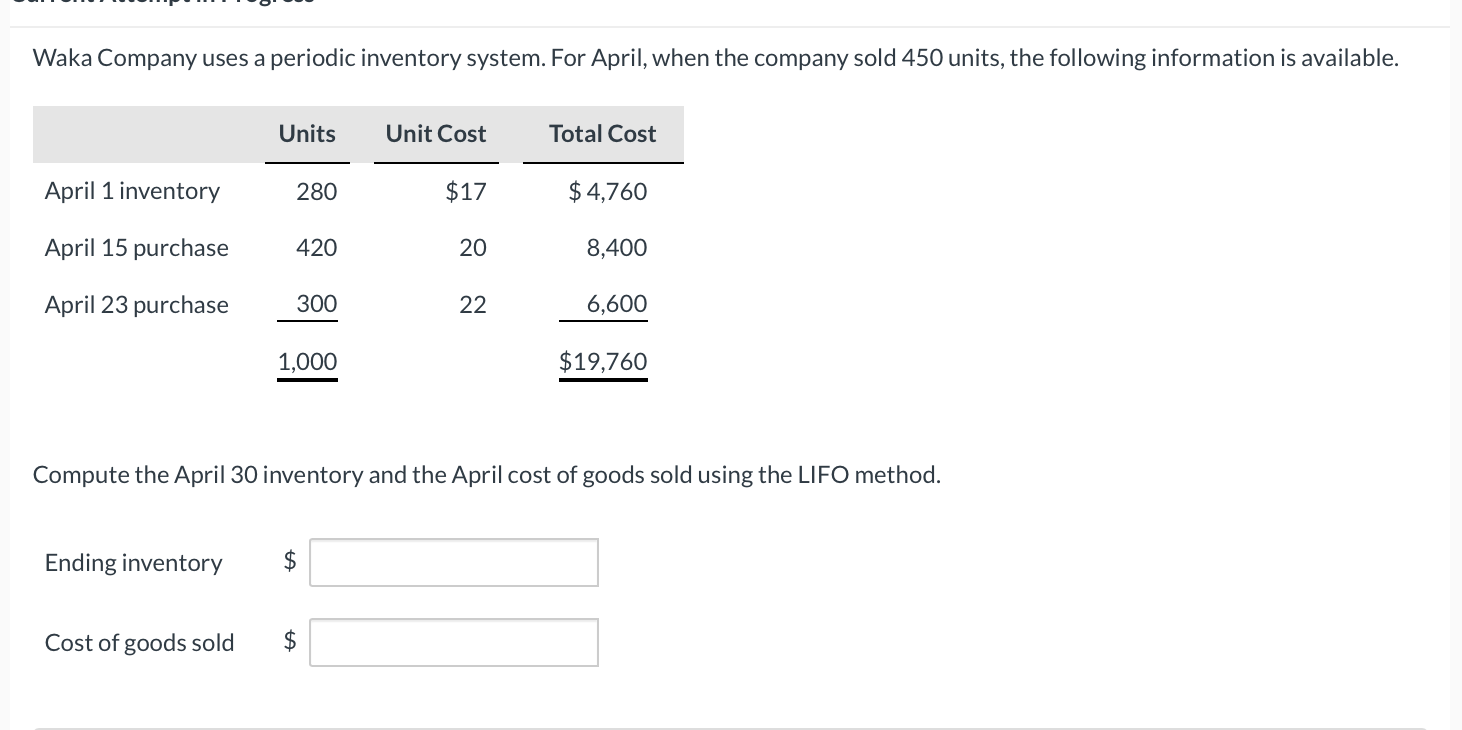

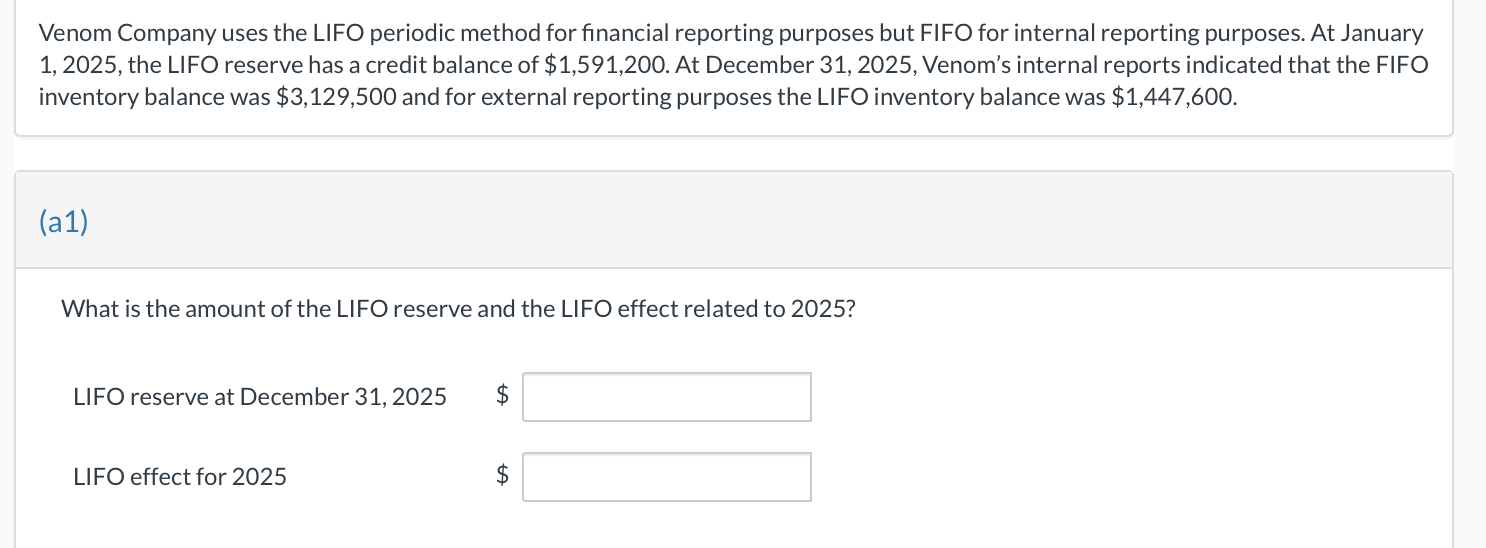

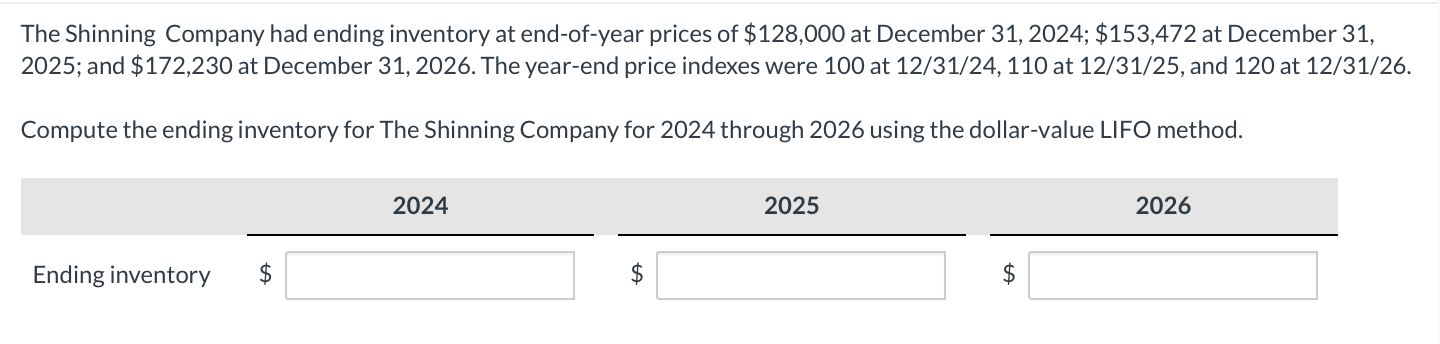

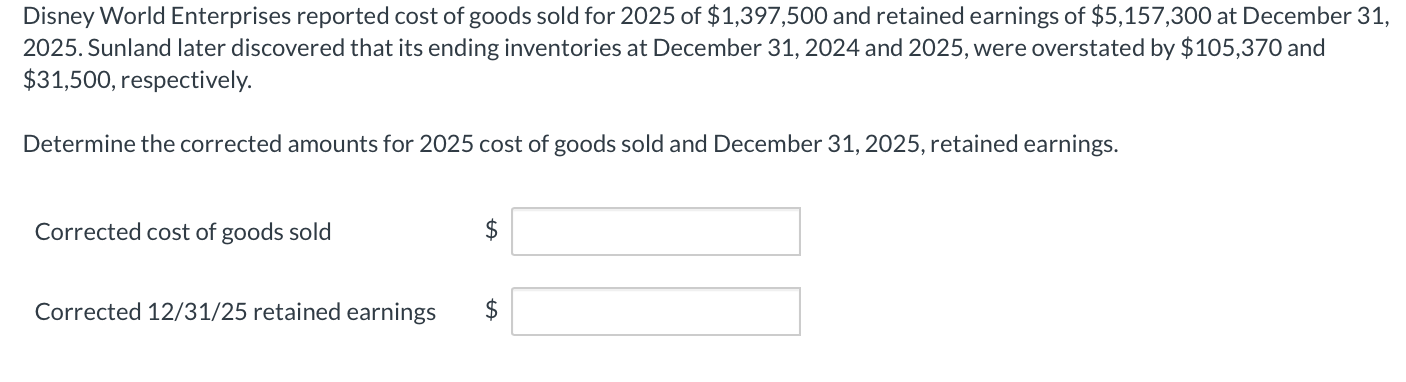

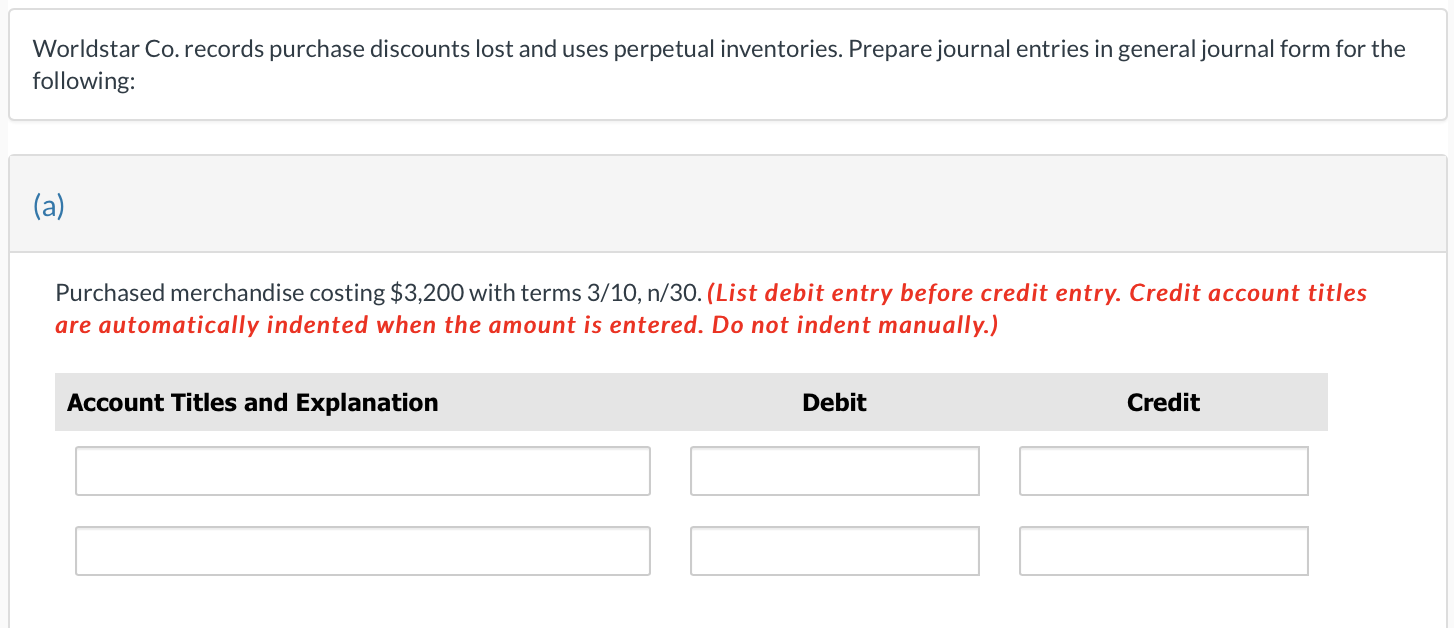

6ix9ine Company uses a periodic inventory system. For April, when the company sold 540 units, the following information is available. Units Unit Cost Total Cost April 1 inventory 220 $25 $5,500 April 15 purchase 380 30 11,400 April 23 purchase 400 33 13,200 1,000 $30,100 Compute the April 30 inventory and the April cost of goods sold using the FIFO method. Ending inventory GA $ Cost of goods sold $ Waka Company uses a periodic inventory system. For April, when the company sold 450 units, the following information is available. Units Unit Cost Total Cost April 1 inventory 280 $17 $4,760 April 15 purchase 420 20 8,400 April 23 purchase 300 22 6,600 1,000 $19,760 Compute the April 30 inventory and the April cost of goods sold using the LIFO method. Ending inventory $ Cost of goods sold $ Venom Company uses the LIFO periodic method for financial reporting purposes but FIFO for internal reporting purposes. At January 1, 2025, the LIFO reserve has a credit balance of $1,591,200. At December 31, 2025, Venom's internal reports indicated that the FIFO inventory balance was $3,129,500 and for external reporting purposes the LIFO inventory balance was $1,447,600. (a1) What is the amount of the LIFO reserve and the LIFO effect related to 2025? LIFO reserve at December 31, 2025 $ LIFO effect for 2025 A The Shinning Company had ending inventory at end-of-year prices of $128,000 at December 31, 2024; $153,472 at December 31, 2025; and $172,230 at December 31, 2026. The year-end price indexes were 100 at 12/31/24, 110 at 12/31/25, and 120 at 12/31/26. Compute the ending inventory for The Shinning Company for 2024 through 2026 using the dollar-value LIFO method. Ending inventory $ 2024 $ 2025 $ 2026 Disney World Enterprises reported cost of goods sold for 2025 of $1,397,500 and retained earnings of $5,157,300 at December 31, 2025. Sunland later discovered that its ending inventories at December 31, 2024 and 2025, were overstated by $105,370 and $31,500, respectively. Determine the corrected amounts for 2025 cost of goods sold and December 31, 2025, retained earnings. Corrected cost of goods sold $ Corrected 12/31/25 retained earnings $ Worldstar Co. records purchase discounts lost and uses perpetual inventories. Prepare journal entries in general journal form for the following: (a) Purchased merchandise costing $3,200 with terms 3/10, n/30. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the April 30 inventory and the April cost of goods sold using the FIFO method we follow the order in which the units were purchased 1 Calculate the cost of goods sold From April 1 inven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started