Answered step by step

Verified Expert Solution

Question

1 Approved Answer

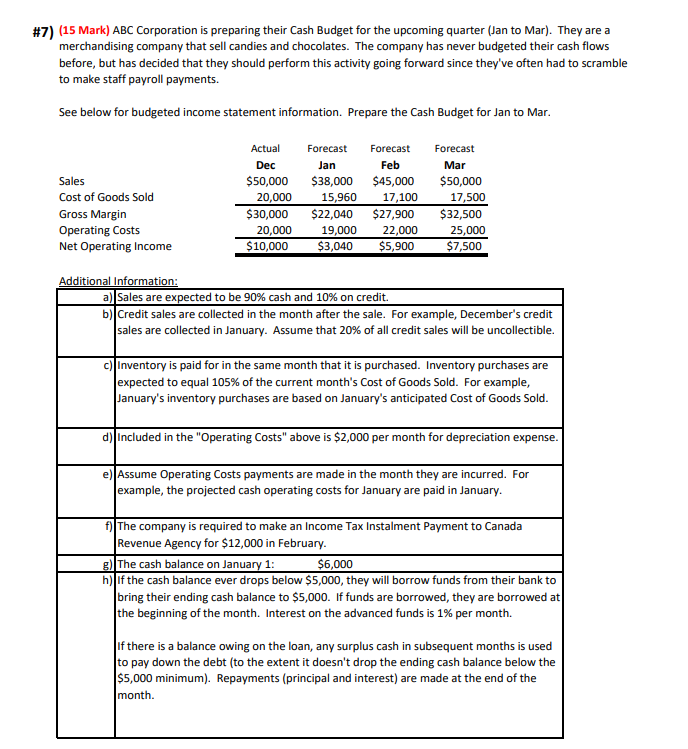

#7) (15 Mark) ABC Corporation is preparing their Cash Budget for the upcoming quarter (Jan to Mar). They are a merchandising company that sell

#7) (15 Mark) ABC Corporation is preparing their Cash Budget for the upcoming quarter (Jan to Mar). They are a merchandising company that sell candies and chocolates. The company has never budgeted their cash flows before, but has decided that they should perform this activity going forward since they've often had to scramble to make staff payroll payments. See below for budgeted income statement information. Prepare the Cash Budget for Jan to Mar. Actual Forecast Forecast Forecast Dec Jan Feb Mar Sales $50,000 $38,000 $45,000 $50,000 Cost of Goods Sold 20,000 15,960 17,100 17,500 Gross Margin $30,000 $22,040 $27,900 $32,500 Operating Costs 20,000 19,000 22,000 25,000 Net Operating Income $10,000 $3,040 $5,900 $7,500 Additional Information: a) Sales are expected to be 90% cash and 10% on credit. b) Credit sales are collected in the month after the sale. For example, December's credit sales are collected in January. Assume that 20% of all credit sales will be uncollectible. c) Inventory is paid for in the same month that it is purchased. Inventory purchases are expected to equal 105% of the current month's Cost of Goods Sold. For example, January's inventory purchases are based on January's anticipated Cost of Goods Sold. d) Included in the "Operating Costs" above is $2,000 per month for depreciation expense. e) Assume Operating Costs payments are made in the month they are incurred. For example, the projected cash operating costs for January are paid in January. f) The company is required to make an Income Tax Instalment Payment to Canada Revenue Agency for $12,000 in February. g) The cash balance on January 1: $6,000 h) If the cash balance ever drops below $5,000, they will borrow funds from their bank to bring their ending cash balance to $5,000. If funds are borrowed, they are borrowed at the beginning of the month. Interest on the advanced funds is 1% per month. If there is a balance owing on the loan, any surplus cash in subsequent months is used to pay down the debt (to the extent it doesn't drop the ending cash balance below the $5,000 minimum). Repayments (principal and interest) are made at the end of the month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started