Answered step by step

Verified Expert Solution

Question

1 Approved Answer

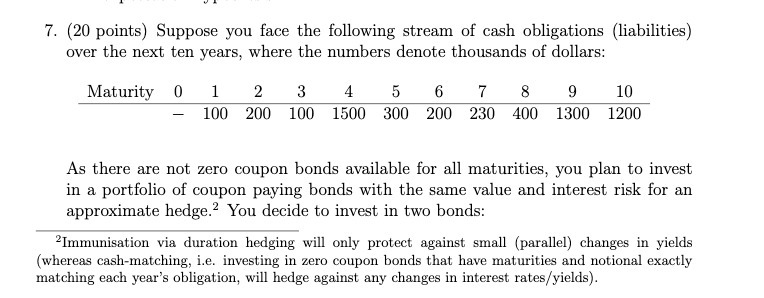

7. (20 points) Suppose you face the following stream of cash obligations (liabilities) over the next ten years, where the numbers denote thousands of

7. (20 points) Suppose you face the following stream of cash obligations (liabilities) over the next ten years, where the numbers denote thousands of dollars: Maturity 0 1 3 4 5 6 7 8 9 10 2 - 100 200 100 1500 300 200 230 400 1300 1200 As there are not zero coupon bonds available for all maturities, you plan to invest in a portfolio of coupon paying bonds with the same value and interest risk for an approximate hedge.2 You decide to invest in two bonds: 2Immunisation via duration hedging will only protect against small (parallel) changes in yields (whereas cash-matching, i.e. investing in zero coupon bonds that have maturities and notional exactly matching each year's obligation, will hedge against any changes in interest rates/yields).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets solve this using immunization through duration hedging Step 1 Calculate the portfolio d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started