Answered step by step

Verified Expert Solution

Question

1 Approved Answer

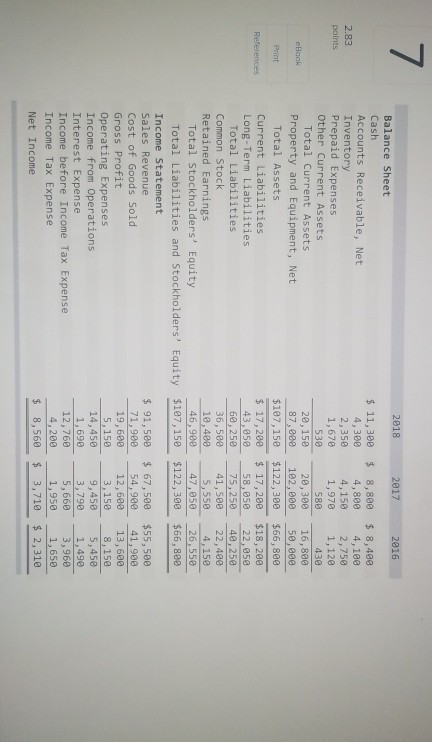

7 2818 2017 2016 Balance Sheet Cash Accounts Receivable, Net Inventory Prepaid Expenses Other Current Assets s 11,300 $8,800 8,400 4,800 4,100 2,35 4,15 2,750

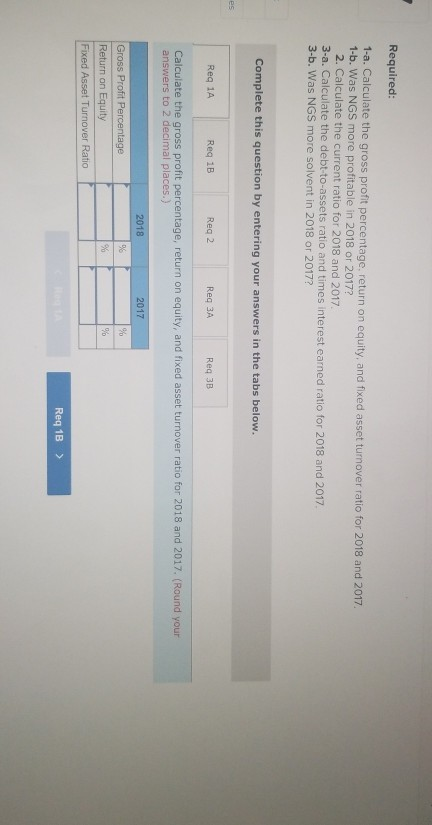

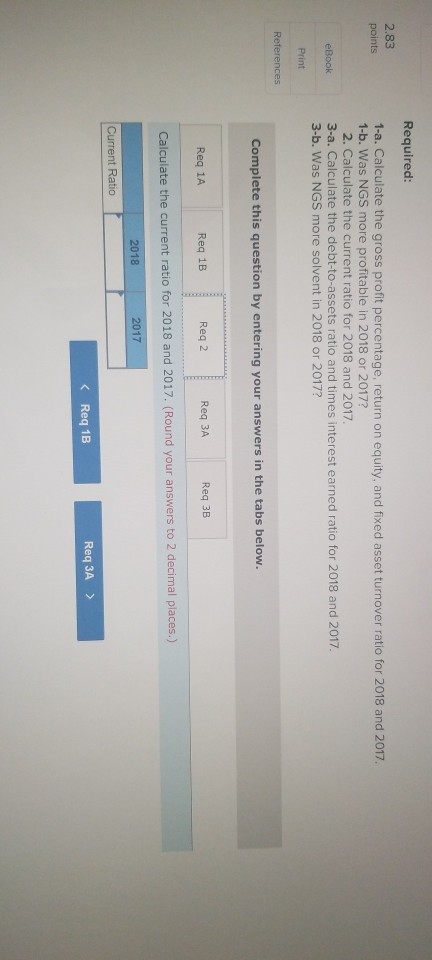

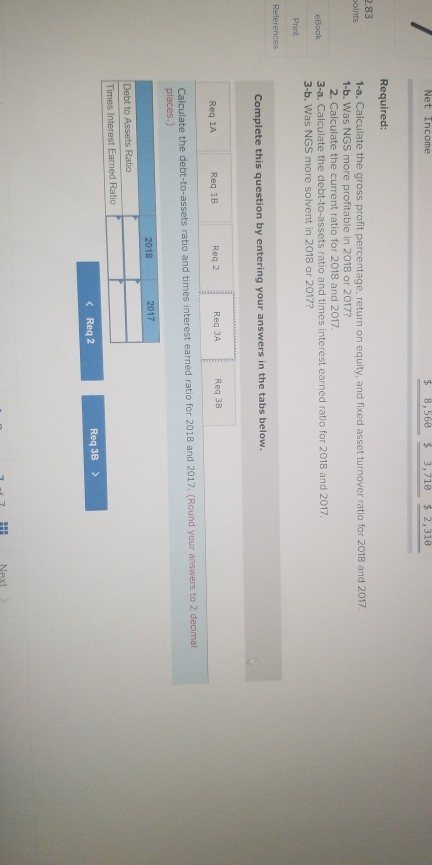

7 2818 2017 2016 Balance Sheet Cash Accounts Receivable, Net Inventory Prepaid Expenses Other Current Assets s 11,300 $8,800 8,400 4,800 4,100 2,35 4,15 2,750 1,978 1,128 430 1,670 580 Total Current Assets Property and Equipment, Net 20,158 20,300 16,880 87,880 102,90 50,800 $107,15e $122,300 $66,800 Total Assets Current Liabilities Long-Term Liabilities 17,280 17,200 $18,200 58,050 22,050 60,25e 75,250 4,250 41,500 22,400 4,150 43,850 Total Liabilities Common Stock Retained Earnings 36,580 10,480 5,550 Total Stockholders' Equity 46,900 47,850 26,550 Total Liabilities and Stockholders' Equity $107,150 $122,300 $66,80e Income Statement Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Interest Expense Income before Income Tax Expense Income Tax Expense Net Income $ 91,500 $ 67,500 $55,500 54,900 41,900 12.600 13,600 71,900 19,600 14,1503,150 5,150 9,450 5,450 1,690 12,760 4, 200 5,660 3,960 1,650 1,950 $ 8,560 $3,710 2,310 Required: 1-a. Calculate the gross profit percentage, return on equity, and fixed asset turnover ratio for 2018 and 2017. 1-b. Was NGS more profitable in 2018 or 2017? 2. Calculate the current ratio for 2018 and 2017 3-a. Calculate the debt-to-assets ratio and times interest earned ratio for 2018 and 2017. 3-b. Was NGS more solvent in 2018 or 2017? Complete this question by entering your answers in the tabs belovw Req 1A Req 1B Req 2 Req 3AReq 3B Calculate the gross profit percentage, return on equity, and fixed asset turnover ratio for 2018 and 2017. (Round your answers to 2 decimal places.) 2018 2017 Gross Profit Percentage Return on Equity Fixed Asset Turnover Ratio Req 1B Required 2.83 1-a. Calculate the gross profit percentage, return on equity, and fixed asset turnover ratio for 2018 and 2017. 1-b. Was NGS more profitable in 2018 or 2017? 2. Calculate the current ratio for 2018 and 2017 3-a. Calculate the debt-to-assets ratio and times interest earned ratio for 2018 and 2017. 3-b. Was NGS more solvent in 2018 or 2017? Print Complete this question by entering your answers in the tabs below Req 1A Req 1B Req 2 Req 3A Req 3B Calculate the current ratio for 2018 and 2017. (Round your answers to 2 decimal places.) 2018 2017 K Req 1E Req 3A > $ 8,560 3,718 $2,318 Required: .83 oints 1-a. Calculate the gross profit percentage, return on equity, and fixed asset turnover ratio for 2018 and 2017 1-b. Was NGS more profitable in 2018 or 2017? 2. Calculate the current ratio for 2018 and 2017 3-a. Calculate the debt-to-assets ratio and times interest earned ratio for 2018 and 2017 3-b. Was NGS more solvent in 2018 or 2017? eBook Complete this question by entering your answers in the tabs below Req 1B Req 3A Req 3B Calculate the debt-to-assets ratio and times interest ea rned ratio for 2018 and 2017. (Round your answers to 2 decimal 2018 2017 Req 2 Req 3B Ne

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started