Answered step by step

Verified Expert Solution

Question

1 Approved Answer

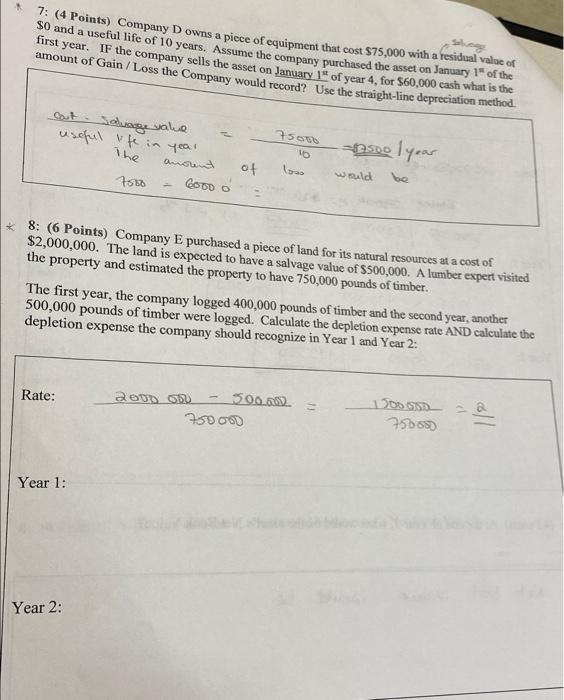

7: (4 Points) Company D owns a piece of equipment that cost $75,000 with a residual value of $0 and a useful life of

7: (4 Points) Company D owns a piece of equipment that cost $75,000 with a residual value of $0 and a useful life of 10 years. Assume the company purchased the asset on January 1 of the first year. If the company sells the asset on January 1 of year 4, for $60,000 cash what is the amount of Gain/Loss the Company would record? Use the straight-line depreciation method. Cout Salvage value useful life in year. V The amount Rate: 7080 Year 1: GOOD O Year 2: 8: (6 Points) Company E purchased a piece of land for its natural resources at a cost of $2,000,000. The land is expected to have a salvage value of $500,000. A lumber expert visited the property and estimated the property to have 750,000 pounds of timber. of The first year, the company logged 400,000 pounds of timber and the second year, another 500,000 pounds of timber were logged. Calculate the depletion expense rate AND calculate the depletion expense the company should recognize in Year 1 and Year 2: 2000 OBU 75000 10. loas -=17500 1 year would be 500.00 750000 1500050 = 750550

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

7 Gain or loss the company would record sale value Cost depreciation till January 1 ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started