7 8 9 10 11

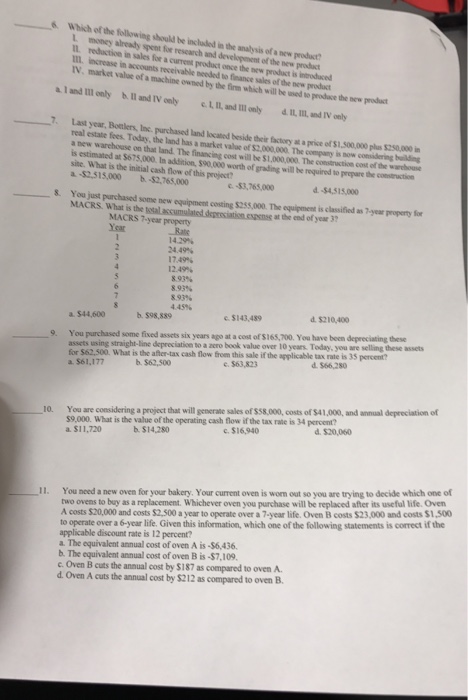

Which of the following should be included in the analysis of a new product? I. money already spent for research and development of the new product II. reduction in sales for a current product once the new product is introduced III. increase in accounts receivable needed to sales of the new product IV market value of a machine owned by the firm which will be need to produce the new product a. I and II only b. II and IV only c. I, II, and III only d. II, III, and IV only Last year, Bottlers, Inc., purchased land located beside their factory at a price of $1, 500,000 plus $250,000 in real estate fees. Today, the land has a market value of $2,000,000. The company is now considering building a new warehouse on the land. The financing cost will be $1,000,000. The construction cost of the warehouse is estimated at $675,000. In addition, $90,000 worth of grading will be required to prepare the construction site. What is the initial each flow of this project? a.-$2, 515,000 b.-$2, 765,000 c.-$3, 765,000 d.-$4, 515,000 You just purchased some new equipment costing $255,000. The equipment is classified as 7-year property for MACRS. What is the total accumulated depreciation expense at the end of year 3? MACRS 7-year property a. $44, 600 b. $98, 889 c. $143, 489 d. $210, 400 You purchased some fixed assets six years age a cost $165, 700. You have been depreciating these assets using straight-line depreciation to a zero book value over 10 years. Today, you are selling these assets for $62, 500. What is the after-tax cash flow from this sale if the applicable tax rate is 35 percent? a. $61, 117 b. 62, 500 c. $63, 823 d. $66, 280 You are considering a project that will generate sales of $58,000, costs of $41,000, and annual depreciation of $9,000. What is the value of the operating cash flow if the rate is 34 percent? a. $11, 720 b. $14, 280 c. $16, 940 d. $20, 060 You need a new oven for your bakery. Your current oven is out so you are trying to decide which one of two ovens to buy as a replacement. Whichever you purchase will be replace after its useful life. Oven A costs $20,000 and costs $2, 500 a year to operate over a 7 - years life. Oven B costs $23,000 and costs $1, 500 to operate over a 6 - years life. Given this information, which one of the following statements is correct if the applicable discount rate is 12 percent? a. The equivalent annual cost of oven A is -$6, 436. b The equivalent annual cost of oven B is -$7, 109. c. Oven B cuts the annual cost by $187 as compared to oven A. d Oven A cuts the annual cost by $212 as compared to oven B

7 8 9 10 11

7 8 9 10 11